Finland’s Technology Innovation System

I. Introduction

When, Finland, this country comes to our minds, it is quite easy for us to associate with the prestigious cell-phone company “NOKIA”, and its unbeatable high technology communication industry. However, following the change of entire cell-phone industry, the rise of smart phone not only has an influence upon people’s communication and interaction, but also makes Finland, once monopolized the whole cell-phone industry, feel the threat and challenge coming from other new competitors in the smart phone industry. However, even though Finland’s cell-phone industry has encountered frustrations in recent years in global markets, the Finland government still poured many funds into the area of technology and innovation, and brought up the birth of “Angry Birds”, one of the most popular smart phone games in the world. The Finland government still keeps the tradition to encourage R&D, and wishes Finland’s industries could re-gain new energy and power on technology innovation, and indirectly reach another new competitive level.

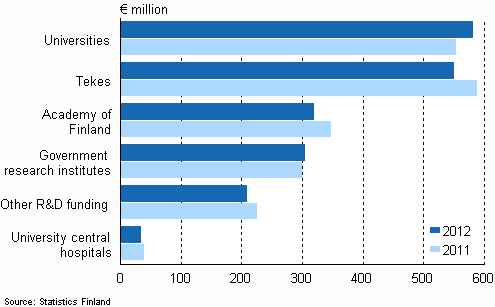

According to the Statistics Finland, 46% Finland’s enterprises took innovative actions upon product manufacturing and the process of R&D during 2008-2010; also, the promotion of those actions not merely existed in enterprises, but directly continued to the aspect of marketing and manufacturing. No matter on product manufacturing, the process of R&D, the pattern of organization or product marketing, we can observe that enterprises or organizations make contributions upon innovative activities in different levels or procedures. In the assignment of Finland’s R&D budgets in 2012, which amounted to 200 million Euros, universities were assigned by 58 million Euros and occupied 29% R&D budgets. The Finland Tekes was assigned by 55 million Euros, and roughly occupied 27.5% R&D budgets. The Academy of Finland (AOF) was assigned by 32 million Euros, and occupied 16% R&D budges. The government’s sectors were assigned by 3 million Euros, and occupied 15.2% R&D budgets. Other technology R&D expenses were 2.1 million Euros, and roughly occupied 10.5% R&D. The affiliated teaching hospitals in universities were assigned by 0.36 million Euros, and occupied 1.8% R&D budgets. In this way, observing the information above, concerning the promotion of technology, the Finland government not only puts more focus upon R&D innovation, but also pays much attention on education quality of universities, and subsidizes various R&D activities. As to the Finland government’s assignment of budges, it can be referred to the chart below.

As a result of the fact that Finland promotes industries’ innovative activities, it not only made Finland win the first position in “Growth Competitiveness Index” published by the World Economic Forum (WEF) during 2000-2006, but also located the fourth position in 142 national economy in “The Global Competitiveness Report” published by WEF, preceded only by Swiss, Singapore and Sweden, even though facing unstable global economic situations and the European debt crisis. Hence, observing the reasons why Finland’s industries have so strong innovative power, it seems to be related to the Finland’s national technology administrative system, and is worthy to be researched.

II. The Recent Situation of Finland’s Technology Administrative System

A. Preface

Finland’s administrative system is semi-presidentialism, and its executive power is shared by the president and the Prime Minister; as to its legislative power, is shared by the Congress and the president. The president is the Finland’s leader, and he/she is elected by the Electoral College, and the Prime Minister is elected by the Congress members, and then appointed by the president. To sum up, comparing to the power owned by the Prime Minister and the president in the Finland’s administrative system, the Prime Minister has more power upon executive power. So, actually, Finland can be said that it is a semi-predisnetialism country, but trends to a cabinet system.

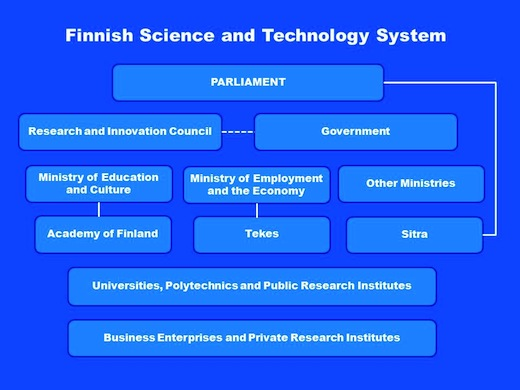

Finland technology administrative system can be divided into four parts, and the main agency in each part, based upon its authority, coordinates and cooperates with making, subsidizing, executing of Finland’s technology policies. The first part is the policy-making, and it is composed of the Congress, the Cabinet and the Research and Innovation Council; the second part is policy management and supervision, and it is leaded by the Ministry of Education and Culture, the Ministry of Employment and the Economy, and other Ministries; the third part is science program management and subsidy, and it is composed of the Academy of Finland (AOF), the National Technology Agency (Tekes), and the Finnish National Fund Research and Development (SITRA); the fourth part is policy-executing, and it is composed of universities, polytechnics, public-owned research institutions, private enterprises, and private research institutions. Concerning the framework of Finland’s technology administrative, it can be referred to below.

B. The Agency of Finland’s Technology Policy Making and Management

(A) The Agency of Finland’s Technology Policy Making

Finland’s technology policies are mainly made by the cabinet, and it means that the cabinet has responsibilities for the master plan, coordinated operation and fund-assignment of national technology policies. The cabinet has two councils, and those are the Economic Council and the Research and Innovation Council, and both of them are chaired by the Prime Minister. The Research and Innovation Council is reshuffled by the Science and Technology Policy Council (STPC) in 1978, and it changed name to the Research and Innovation Council in Jan. 2009. The major duties of the Research and Innovation Council include the assessment of country’s development, deals with the affairs regarding science, technology, innovative policy, human resource, and provides the government with aforementioned schedules and plans, deals with fund-assignment concerning public research development and innovative research, coordinates with all government’s activities upon the area of science, technology, and innovative policy, and executes the government’s other missions.

The Research and Innovation Council is an integration unit for Finland’s national technology policies, and it originally is a consulting agency between the cabinet and Ministries. However, in the actual operation, its scope of authority has already covered coordination function, and turns to direct to make all kinds of policies related to national science technology development. In addition, the consulting suggestions related to national scientific development policies made by the Research and Innovation Council for the cabinet and the heads of Ministries, the conclusion has to be made as a “Key Policy Report” in every three year. The Report has included “Science, Technology, Innovation” in 2006, “Review 2008” in 2008, and the newest “Research and Innovation Policy Guidelines for 2011-2015” in 2010.

Regarding the formation and duration of the Research and Innovation Council, its duration follows the government term. As for its formation, the Prime Minister is a chairman of the Research and Innovation Council, and the membership consists of the Minister of Education and Science, the Minister of Economy, the Minister of Finance and a maximum of six other ministers appointed by the Government. In addition to the Ministerial members, the Council shall comprise ten other members appointed by the Government for the parliamentary term. The Members must comprehensively represent expertise in research and innovation. The structure of Council includes the Council Secretariat, the Administrative Assistant, the Science and Education Subcommittee, and the Technology and Innovation Subcommittee. The Council has the Science and Education Subcommittee and the Technology and Innovation Subcommittee with preparatory tasks. There are chaired by the Ministry of Education and Science and by the Minister of Economy, respectively. The Council’s Secretariat consists of one full-time Secretary General and two full-time Chief Planning Officers. The clerical tasks are taken care of at the Ministry of Education and Culture.

(B) The Agency of Finland’s Technology Policy Management

The Ministries mainly take the responsibility for Finland’s technology policy management, which includes the Ministry of Education and Culture, the Ministry of Employment and Economy, the Ministry of Social Affairs and Health, the Ministry of Agriculture and Forestry, the Ministry of Defense, the Ministry of Transport and Communication, the Ministry of Environment, the Ministry of Financial, and the Ministry of Justice. In the aforementioned Ministries, the Ministry of Education and Culture and the Ministry of Employment and Economy are mainly responsible for Finland national scientific technology development, and take charge of national scientific policy and national technical policy, respectively. The goal of national scientific policy is to promote fundamental scientific research and to build up related scientific infrastructures; at the same time, the authority of the Ministry of Education and Culture covers education and training, research infrastructures, fundamental research, applied research, technology development, and commercialization. The main direction of Finland’s national scientific policy is to make sure that scientific technology and innovative activities can be motivated aggressively in universities, and its objects are, first, to raise research funds and maintain research development in a specific ratio; second, to make sure that no matter on R&D institutions or R&D training, it will reach fundamental level upon funding or environment; third, to provide a research network for Finland, European Union and global research; fourth, to support the research related to industries or services based upon knowledge-innovation; fifth, to strengthen the cooperation between research initiators and users, and spread R&D results to find out the values of commercialization, and then create a new technology industry; sixth, to analyze the performance of national R&D system.

As for the Ministry of Employment and Economy, its major duties not only include labor, energy, regional development, marketing and consumer policy, but also takes responsibilities for Finland’s industry and technical policies, and provides industries and enterprises with a well development environment upon technology R&D. The business scope of the Ministry of Employment and Economy puts more focus on actual application of R&D results, it covers applied research of scientific technology, technology development, commercialization, and so on. The direction of Finland’s national technology policy is to strengthen the ability and creativity of industries’ technology development, and its objects are, first, to develop the new horizons of knowledge with national innovation system, and to provide knowledge-oriented products and services; second, to promote the efficiency of the government R&D funds; third, to provide cross-country R&D research networks, and support the priorities of technology policy by strengthening bilateral or multilateral cooperation; fourth, to raise and to broaden the efficiency of research discovery; fifth, to promote the regional development by technology; sixth, to evaluate the performance of technology policy; seventh, to increase the influence of R&D on technological change, innovation and society; eighth, to make sure that technology fundamental structure, national quality policy and technology safety system will be up to international standards.

(C) The Agency of Finland’s Technology Policy Management and Subsidy

As to the agency of Finland’s technology policy management and subsidy, it is composed of the Academy of Finland (AOF), the National Technology Agency (Tekes), and the Finnish National Fund Research and Development (SITRA). The fund of AOF comes from the Ministry of Education and Culture; the fund of Tekes comes from the Ministry of Employment and Economy, and the fund of SITRA comes from independent public fund supervised by the Finland’s Congress.

(D) The Agency of Finland’s Technology Plan Execution

As to the agency of Finland’s technology plan execution, it mainly belongs to the universities under Ministries, polytechnics, national technology research institutions, and other related research institutions. Under the Ministry of Education and Culture, the technology plans are executed by 16 universities, 25 polytechnics, and the Research Institute for the Language of Finland; under the Ministry of Employment and Economy, the technology plans are executed by the Technical Research Centre of Finland (VTT), the Geological Survey of Finnish, the National Consumer Research Centre; under the Ministry of Social Affairs and Health, the technology plans are executed by the National Institute for Health and Welfare, the Finnish Institute of Occupational Health, and University Central Hospitals; under the Ministry of Agriculture and Forestry, the technology plans are executed by the Finnish Forest Research Institute (Metla), the Finnish Geodetic Institute, and the Finnish Game and Fisheries Research Institute (RKTL); under the Ministry of Defense, the technology plans are executed by the Finnish Defense Forces’ Technical Research Centre (Pvtt); under the Ministry of Transport and Communications, the technology plans are executed by the Finnish Meteorological Institute; under the Ministry of Environment, the technology plans are executed by the Finnish Environment Institute (SYKE); under the Ministry of Financial, the technology plans are executed by the Government Institute for Economic Research (VATT). At last, under the Ministry of Justice, the technology plans are executed by the National Research Institute of Legal Policy.

The opening and sharing of scientific data- The Data Policy of the U.S. National Institutes of Health Li-Ting Tsai Scientific research improves the well-being of all mankind, the data sharing on medical and health promote the overall amount of energy in research field. For promoting the access of scientific data and research findings which was supported by the government, the U.S. government affirmed in principle that the development of science was related to the retention and accesses of data. The disclosure of information should comply with legal restrictions, and the limitation by time as well. For government-sponsored research, the data produced was based on the principle of free access, and government policies should also consider the actual situation of international cooperation[1]Furthermore, the access of scientific research data would help to promote scientific development, therefore while formulating a sharing policy, the government should also consider the situation of international cooperation, and discuss the strategy of data disclosure based on the principle of free access. In order to increase the effectiveness of scientific data, the U.S. National Institutes of Health (NIH) set up the Office of Science Policy (OSP) to formulate a policy which included a wide range of issues, such as biosafety (biosecurity), genetic testing, genomic data sharing, human subjects protections, the organization and management of the NIH, and the outputs and value of NIH-funded research. Through extensive analysis and reports, proposed emerging policy recommendations.[2] At the level of scientific data sharing, NIH focused on "genes and health" and "scientific data management". The progress of biomedical research depended on the access of scientific data; sharing scientific data was helpful to verify research results. Researchers integrated data to strengthen analysis, promoted the reuse of difficult-generated data, and accelerated research progress.[3] NIH promoted the use of scientific data through data management to verify and share research results. For assisting data sharing, NIH had issued a data management and sharing policy (DMS Policy), which aimed to promote the sharing of scientific data funded or conducted by NIH.[4] DMS Policy defines “scientific data.” as “The recorded factual material commonly accepted in the scientific community as of sufficient quality to validate and replicate research findings, regardless of whether the data are used to support scholarly publications. Scientific data do not include laboratory notebooks, preliminary analyses, completed case report forms, drafts of scientific papers, plans for future research, peer reviews, communications with colleagues, or physical objects, such as laboratory specimens.”[5] In other words, for determining scientific data, it is not only based on whether the data can support academic publications, but also based on whether the scientific data is a record of facts and whether the research results can be repeatedly verified. In addition, NIH, NIH research institutes, centers, and offices have had expected sharing of data, such as: scientific data sharing, related standards, database selection, time limitation, applicable and presented in the plan; if not applicable, the researcher should propose the data sharing and management methods in the plan. NIH also recommended that the management and sharing of data should implement the FAIR (Findable, Accessible, Interoperable and Reusable) principles. The types of data to be shared should first in general descriptions and estimates, the second was to list meta-data and other documents that would help to explain scientific data. NIH encouraged the sharing of scientific data as soon as possible, no later than the publication or implementation period.[6] It was said that even each research project was not suitable for the existing sharing strategy, when planning a proposal, the research team should still develop a suitable method for sharing and management, and follow the FAIR principles. The scientific research data which was provided by the research team would be stored in a database which was designated by the policy or funder. NIH proposed a list of recommended databases lists[7], and described the characteristics of ideal storage databases as “have unique and persistent identifiers, a long-term and sustainable data management plan, set up metadata, organizing data and quality assurance, free and easy access, broad and measured reuse, clear use guidance, security and integrity, confidentiality, common format, provenance and data retention policy”[8]. That is to say, the design of the database should be easy to search scientific data, and should maintain the security, integrity and confidentiality and so on of the data while accessing them. In the practical application of NIH shared data, in order to share genetic research data, NIH proposed a Genomic Data Sharing (GDS) Policy in 2014, including NIH funding guidelines and contracts; NIH’s GDS policy applied to all NIHs Funded research, the generated large-scale human or non-human genetic data would be used in subsequent research. [9] This can effectively promote genetic research forward. The GDS policy obliged researchers to provide genomic data; researchers who access genomic data should also abide by the terms that they used the Controlled-Access Data for research.[10] After NIH approved, researchers could use the NIH Controlled-Access Data for secondary research.[11] Reviewed by NIH Data Access Committee, while researchers accessed data must follow the terms which was using Controlled-Access Data for research reason.[12] The Genomic Summary Results (GSR) was belong to NIH policy,[13] and according to the purpose of GDS policy, GSR was defined as summary statistics which was provided by researchers, and non-sensitive data was included to the database that was designated by NIH.[14] Namely. NIH used the application and approval of control access data to strike a balance between the data of limitation access and scientific development. For responding the COVID-19 and accelerating the development of treatments and vaccines, NIH's data sharing and management policy alleviated the global scientific community’s need for opening and sharing scientific data. This policy established data sharing as a basic component in the research process.[15] In conclusion, internalizing data sharing in the research process will help to update the research process globally and face the scientific challenges of all mankind together. [1]NATIONAL SCIENCE AND TECHNOLOGY COUNCIL, COMMITTEE ON SCIENCE, SUBCOMMITEE ON INTERNATIONAL ISSUES, INTERAGENCY WORKING GROUP ON OPEN DATA SHARING POLICY, Principles For Promoting Access To Federal Government-Supported Scientific Data And Research Findings Through International Scientific Cooperation (2016), 1, organized from Principles, at 5-8, https://obamawhitehouse.archives.gov/sites/default/files/microsites/ostp/NSTC/iwgodsp_principles_0.pdf (last visited December 14, 2020). [2]About Us, Welcome to NIH Office of Science Policy, NIH National Institutes of Health Office of Science Policy, https://osp.od.nih.gov/about-us/ (last visited December 7, 2020). [3]NIH Data Management and Sharing Activities Related to Public Access and Open Science, NIH National Institutes of Health Office of Science Policy, https://osp.od.nih.gov/scientific-sharing/nih-data-management-and-sharing-activities-related-to-public-access-and-open-science/ (last visited December 10, 2020). [4]Final NIH Policy for Data Management and Sharing, NIH National Institutes of Health Office of Extramural Research, Office of The Director, National Institutes of Health (OD), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-21-013.html (last visited December 11, 2020). [5]Final NIH Policy for Data Management and Sharing, NIH National Institutes of Health Office of Extramural Research, Office of The Director, National Institutes of Health (OD), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-21-013.html (last visited December 12, 2020). [6]Supplemental Information to the NIH Policy for Data Management and Sharing: Elements of an NIH Data Management and Sharing Plan, Office of The Director, National Institutes of Health (OD), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-21-014.html (last visited December 13, 2020). [7]The list of databases in details please see:Open Domain-Specific Data Sharing Repositories, NIH National Library of Medicine, https://www.nlm.nih.gov/NIHbmic/domain_specific_repositories.html (last visited December 24, 2020). [8]Supplemental Information to the NIH Policy for Data Management and Sharing: Selecting a Repository for Data Resulting from NIH-Supported Research, Office of The Director, National Institutes of Health (OD), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-21-016.html (last visited December 13, 2020). [9]NIH Genomic Data Sharing, National Institutes of Health Office of Science Policy, https://osp.od.nih.gov/scientific-sharing/genomic-data-sharing/ (last visited December 15, 2020). [10]NIH Genomic Data Sharing Policy, National Institutes of Health (NIH), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-14-124.html (last visited December 17, 2020). [11]NIH Genomic Data Sharing Policy, National Institutes of Health (NIH), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-14-124.html (last visited December 17, 2020). [12]id. [13]NIH National Institutes of Health Turning Discovery into Health, Responsible Use of Human Genomic Data An Informational Resource, 1, at 6, https://osp.od.nih.gov/wp-content/uploads/Responsible_Use_of_Human_Genomic_Data_Informational_Resource.pdf (last visited December 17, 2020). [14]Update to NIH Management of Genomic Summary Results Access, National Institutes of Health (NIH), https://grants.nih.gov/grants/guide/notice-files/NOT-OD-19-023.html (last visited December 17, 2020). [15]Francis S. Collins, Statement on Final NIH Policy for Data Management and Sharing, National Institutes of Health Turning Discovery Into Health, https://www.nih.gov/about-nih/who-we-are/nih-director/statements/statement-final-nih-policy-data-management-sharing (last visited December 14, 2020).

Analyzing the Framwork of the Regulation「Act For The Development of Biotech And New Pharmaceuticals Industry」in TaiwanTaiwan Government passed The「Act for the Development of Biotech and New Pharmaceuticals Industry」for supporting the biopharmaceutical industry. The purpose of the Act is solely for biopharmaceutical industry, and building the leading economic force in Taiwan. To fulfill this goal, the Act has enacted regulations concerning funding, taxation and recruitment especially for the biopharmaceutical industry. The Act has been seen as the recent important law in the arena of upgrading industry regulation on the island. It is also a rare case where single legislation took place for particular industry. After the Act came into force, the government has promulgated further regulations to supplement the Act, including Guidance for MOEA-Approved Biotech and New Pharmaceuticals Company Issuing Stock Certificate, Deductions on Investments in R&D and Personnel Training of Biotech and New Pharmaceuticals Company, Guidance for Deduction Applicable to Shareholders of Profit-Seeking Enterprises -Biotech and New Pharmaceuticals Company etc. The following discussions are going to introduce the Act along with related incentive measures from an integrated standpoint. 1 、 Scope of Application According to Article 3 of the Act, 「Biotech and New Pharmaceuticals Industry」 refers to the industry that deals in New Rugs and High-risk Medical devices used by human beings, animals, and plants; 「Biotech and New Pharmaceuticals Company」 refers to a company in the Biotech and New Pharmaceuticals Industry that is organized and incorporated in accordance with the Company Act and engages in the research, development, and manufacture of new drugs and high-risk medical devices. Thus, the Act applies to company that conducts research and manufacture product in new drug or high-risk medical devices for human and animal use. Furthermore, to become a Biotech and New Pharmaceuticals Company stipulated in the Act, the Company must receive letter of approval to establish as a Biotech and New Pharmaceuticals Company valid for five years. Consequently, company must submit application to the authority for approval by meeting the following requirements: (1) Companies that conduct any R&D activities or clinical trials must receive permission, product registration, or proof of manufacture for such activities from a competent authority. However, for those conducted these activities outside the country will not apply. (2) When applied for funding for the previous year or in the same year, the expense on R&D in the previous year exceeds 5% of the total net revenue within the same year; or the expenses exceeds 10% of the total capital of the company. (3) Hired at least five R&D personnel majored in biotechnology. For New Drug and High-Risk Medical Device are confined in specific areas. New Drug provided in the Act refers to a drug that has a new ingredient, a new therapeutic effect or a new administration method as verified by the central competent authorities. And High-Risk Medical Device refers to a type of Class III medical devices implanted into human bodies as verified by the central competent authorities. Therefore, generic drug, raw materials, unimplanted medical device, and medical device are not qualified as type III, are all not within the scope of the Act and are not the subject matter the Act intends to reward. 2 、 Tax Benefits Article 5, 6 and 7 provided in the Act has followed the footsteps of Article 6 and 8 stipulated of the Statute, amending the rules tailored to the biopharmaceutical industry, and provided tax benefits to various entities as 「Biotech and New Pharmaceuticals Company」, 「Investors of Biotech and New Pharmaceuticals Industry」, 「Professionals and Technology Investors」. (1) Biotech and New Pharmaceuticals Company In an effort to advance the biopharmaceutical industry, alleviate financial burden of the companies and strengthen their R&D capacity. The Act has provided favorable incentive measures in the sector of R&D and personnel training. According to Article 5: 「For the purpose of promoting the Biotech and New Pharmaceuticals Industry, a Biotech and New Pharmaceuticals Company may, for a period of five years from the time it is subject to profit-seeking enterprise income tax payable, enjoy a reduction in its corporate income tax payable, for up to 35% of the total funds invested in research and development (R&D) and personnel training each year.」 Consequently, company could benefit through tax deduction and relieve from the stress of business operation. Moreover, in supporting Biotech and New Pharmaceutical Company to proceed in R&D and personnel training activities, the Act has set out rewards for those participate in ongoing R&D and training activities. As Article 5 provided that」 If the R&D expenditure of a particular year exceeds the average R&D expenditure of the previous two years, or if the personnel training expenditure of a particular year exceeds the average personnel training expenditure of the pervious two years, 50% of the exceed amount in excess of the average may be used to credit against the amount of profit-seeking enterprise income tax payable. 「However, the total amount of investment credited against by the payable corporate income tax in each year shall not exceed 50% of the amount of profit-seeking enterprise income tax payable by a Biotech and New Pharmaceuticals Company in a year, yet this restriction shall not apply to the amount to be offset in the last year of the aforementioned five-year period. Lastly, Article 5 of the Act shall not apply to Biotech and New Pharmaceutical Company that set up headquarters or branches outside of Taiwan. Therefore, to be qualified for tax deduction on R&D and personnel training, the headquarters or branches of the company must be located in Taiwan. (2) Investors of Biotech and New Pharmaceuticals Company To raise funding, expand business development, and attract investor continuing making investments, Article 6 of the Act has stated that 「In order to encourage the establishment or expansion of Biotech and New Pharmaceuticals Companies, a profit-seeking enterprise that subscribes for the stock issued by a Biotech and New Pharmaceuticals Company at the time of the latter's establishment or subsequent expansion; and has been a registered shareholder of the Biotech and New Pharmaceuticals Company for a period of 3 years or more, may, for a period of five years from the time it is subject to corporate income tax, enjoy a reduction in its profit-seeking enterprise income tax payable for up to 20% of the total amount of the price paid for the subscription of shares in such Biotech and New Pharmaceuticals Company.」 Yet 「If the afore-mentioned profit-seeking enterprise is a venture capital company (「VC」), such VC corporate shareholders may, for a period of five years from the fourth anniversary year of the date on which the VC becomes a registered shareholder of the subject Biotech and New Pharmaceuticals Company, enjoy a reduction in their profit-seeking enterprise income tax payable based on the total deductible amount enjoyed by the VC under Paragraph 1 hereof and the shareholders' respective shareholdings in the VC.」 The government enacted this regulation to encourage corporations and VC to invest in biotech and new pharmaceutical company, and thus provide corporate shareholders with 20% of profit-seeking enterprise income tax payable deduction, and provide VC corporate shareholders tax deduction that proportion to its shareholdings in the VC. (3) Top Executives and Technology Investors Top Executives refer to those with biotechnology background, and has experience in serving as officer of chief executive (CEO) or manager; Technology Investors refer to those acquire shares through exchange of technology. As biopharmaceutical industry possesses a unique business model that demands intensive technology, whether top executives and technology investors are willing to participate in a high risk business and satisfy the needs of industry becomes a critical issue. Consequently, Article 7 of the Act stated that 「In order to encourage top executives and technology investors to participate in the operation of Biotech and New Pharmaceuticals Companies and R&D activities, and to share their achievements, new shares issued by a Biotech and New Pharmaceuticals Company to top executives and technology investors (in return of their knowledge and technology) shall be excluded from the amount of their consolidated income or corporate income of the then current year for taxation purposes; provided, however, that if the title to the aforesaid shares is transferred with or without consideration, or distributed as estate, the total purchase price or the market value of the shares at the time of transfer as a gift or distribution as estate shall be deemed income generated in that tax year and such income less the acquisition cost shall be reported in the relevant income tax return.」 Additionally, 「For the title transfer of shares under the preceding paragraph, the Biotech and New Pharmaceuticals Company concerned shall file a report with the local tax authorities within thirty 30 days from the following day of the title transfer.」 Purpose of this regulation is to attract top executives and technology personnel for the company in long-term through defer taxation. Moreover, the Biotech and New Pharmaceutical Company usually caught in a prolong period of losses, and has trouble financing through issuing new shares, as stipulated par value of each share cannot be less than NTD $10.Thus, in order to offer top executive and technology investors incentives and benefits under such circumstances, Article 8 has further provided that」Biotech and New Pharmaceutical Companies may issue subscription warrants to its top executives and technology investors, provided that the proposal for the issuance of the aforesaid subscription warrants shall pass resolution adopted by a majority votes of directors attended by at least two-thirds (2/3) of all the directors of the company; and be approved by the competent authorities. Holders of the subscription warrants may subscribe a specific number of shares at the stipulated price. The amount of stipulated price shall not be subject to the minimum requirement, i.e. par value of the shares, as prescribed under Article 140 of the Company Act. Subscription of the shares by exercising the subscription warrant shall be subject to income tax in accordance with Article 7 hereof. if a Biotech and New Pharmaceutical Company issue new shares pursuant to Article 7 hereof, Article 267 of the Company Act shall not apply. The top executives and technology investors shall not transfer the subscription warrant acquired to pursuant to this Article.」 These three types of tax benefits are detailed incentive measures tailor to the biopharmaceutical industry. However, what is noteworthy is the start date of the benefits provided in the Act. Different from the Statue, the Act allows company to enjoy these benefits when it begins to generate profits, while the Statute provides company tax benefits once the authority approved its application in the current year. Thus, Biotech and New Pharmaceuticals Company enjoys tax benefits as the company starts to make profit. Such approach reflects the actual business operation of the industry, and resolves the issue of tax benefits provided in the Statue is inapplicable to the biopharmaceutical industry. 3 、 Technical Assistance and Capital Investment Due to the R&D capacity and research personnel largely remains in the academic circle, in order to encourage these researchers to convert R&D efforts into commercial practice, the government intends to enhance the collaboration among industrial players, public institutions, and the research and academic sectors, to bolster the development of Biotech and New Pharmaceuticals Company. However, Article 13 of Civil Servants Service Act prohibits officials from engaging in business operation, the Act lifts the restriction on civil servants. According to Article 10 of the Act provided that」For a newly established Biotech and New Pharmaceuticals Company, if the person providing a major technology is a research member of the government research organization, such person may, with the consent of the government research organization, acquired 10% or more of the shares in the Biotech and New Pharmaceuticals Company at the time of its establishment, and act as founder, director, or technical adviser thereof. In such case, Article 13 of the Civil Servants Service Act shall not apply. And the research organization and research member referred to thereof shall be defined and identified by the Executive Yuan, in consultation with the Examination Yuan.」 This regulation was enacted because of the Civil Servants Services Act provided that public officials are not allowed to be corporate shareholders. However, under certain regulations, civil servants are allowed to be corporate shareholders in the sector of agriculture, mining, transportation or publication, as value of the shares cannot exceed 10% of the total value of the company, and the civil servant does not served in the institution. In Taiwan, official and unofficial research institution encompasses most of the biotechnology R&D capacity and research personnel. If a researcher is working for a government research institution, he would be qualified as a public servant and shall be governed by the Civil Servants Service Act. As a result of such restriction, the Act has lifted the restriction and encouraged these researchers to infuse new technologies into the industry. At last, for advancing the development of the industry, Article 11 also provided that 」R&D personnel of the academic and research sectors may, subject to the consent of their employers, served as advisors or consultants for a Biotech and New Pharmaceuticals Company.」 4 、 Other Regulations For introducing and transferring advanced technology in support of the biopharmaceutical industry, Article 9 stated that 「Organization formed with government funds to provide technical assistance shall provide appropriate technical assistance as may be necessary.」 Besides technical assistance, government streamlines the review process taken by various regulatory authorities, in order to achieve an improved product launch process result in faster time-to-market and time-to profit. As Article 12 provided that 「the review and approval of field test, clinical trials, product registration, and others, the central competent authorities shall establish an open and transparent procedure that unifies the review system.」

The Research on ownership of cell therapy productsThe Research on ownership of cell therapy products 1. Issues concerning ownership of cell therapy products Regarding the issue of ownership interests, American Medical Association(AMA)has pointed out in 2016 that using human tissues to develop commercially available products raises question about who holds property rights in human biological materials[1]. In United States, there have been several disputes concern the issue of the whether the donor of the cell therapy can claim ownership of the product, including Moore v. Regents of University of California(1990)[2], Greenberg v. Miami Children's Hospital Research Institute(2003)[3], and Washington University v. Catalona(2007)[4]. The courts tend to hold that since cells and tissues were donated voluntarily, the donors had already lost their property rights of their cells and tissues at the time of the donation. In Moore case, even if the researchers used Moore’s cells to obtain commercial benefits in an involuntary situation, the court still held that the property rights of removed cells were not suitable to be claimed by their donor, so as to avoid the burden for researcher to clarify whether the use of cells violates the wishes of the donors and therefore decrease the legal risk for R&D activities. United Kingdom Medical Research Council(MRC)also noted in 2019 that the donated human material is usually described as ‘gifts’, and donors of samples are not usually regarded as having ownership or property rights in these[5]. Accordingly, both USA and UK tends to believe that it is not suitable for cell donors to claim ownership. 2. The ownership of cell therapy products in the lens of Taiwan’s Civil Code In Taiwan, Article 766 of Civil Code stipulated: “Unless otherwise provided by the Act, the component parts of a thing and the natural profits thereof, belong, even after their separation from the thing, to the owner of the thing.” Accordingly, many scholars believe that the ownership of separated body parts of the human body belong to the person whom the parts were separated from. Therefore, it should be considered that the ownership of the cells obtained from the donor still belongs to the donor. In addition, since it is stipulated in Article 406 of Civil Code that “A gift is a contract whereby the parties agree that one of the parties delivers his property gratuitously to another party and the latter agrees to accept it.”, if the act of donation can be considered as a gift relationship, then the ownership of the cells has been delivered from donor to other party who accept it accordingly. However, in the different versions of Regenerative Medicine Biologics Regulation (draft) proposed by Taiwan legislators, some of which replace the term “donor” with “provider”. Therefore, for cell providers, instead of cell donors, after providing cells, whether they can claim ownership of cell therapy product still needs further discussion. According to Article 69 of the Civil Code, it is stipulated that “Natural profits are products of the earth, animals, and other products which are produced from another thing without diminution of its substance.” In addition, Article 766 of the Civil Code stipulated that “Unless otherwise provided by the Act, the component parts of a thing and the natural profits thereof, belong, even after their separation from the thing, to the owner of the thing.” Thus, many scholars believe that when the product is organic, original substance and the natural profits thereof are all belong to the owner of the original substance. For example, when proteins are produced from isolated cells, the proteins can be deemed as natural profits and the ownership of proteins and isolated cells all belong to the owner of the cells[6]. Nevertheless, according to Article 814 of the Civil Code, it is stipulated that “When a person has contributed work to a personal property belonging to another, the ownership of the personal property upon which the work is done belongs to the owner of the material thereof. However, if the value of the contributing work obviously exceeds the value of the material, the ownership of the personal property upon which the work is done belongs to the contributing person.” Thus, scholar believes that since regenerative medical technology, which induces cell differentiation, involves quite complex biotechnology technology, and should be deemed as contributing work. Therefore, the ownership of cell products after contributing work should belongs to the contributing person[7]. Thus, if the provider provides the cells to the researcher, after complex biotechnology contributing work, the original ownership of the cells should be deemed to have been eliminated, and there is no basis for providers to claim ownership. However, since the development of cell therapy products involves a series of R&D activities, it still need to be clarified that who is entitled to the ownership of the final cell therapy products. According to Taiwan’s Civil Code, the ownership of product after contributing work should belongs to the contributing person. However, when there are numerous contributing persons, which person should the ownership belong to, might be determined on a case-by-case basis. 3. Conclusion The biggest difference between cell therapy products and all other small molecule drugs or biologics is that original cell materials are provided by donors or providers, and the whole development process involves numerous contributing persons. Hence, ownership disputes are prone to arise. In addition to the above-discussed disputes, United Kingdom Co-ordinating Committee on Cancer Research(UKCCCR)also noted that there is a long list of people and organizations who might lay claim to the ownership of specimens and their derivatives, including the donor and relatives, the surgeon and pathologist, the hospital authority where the sample was taken, the scientists engaged in the research, the institution where the research work was carried out, the funding organization supporting the research and any collaborating commercial company. Thus, the ultimate control of subsequent ownership and patent rights will need to be negotiated[8]. Since the same issues might also occur in Taiwan, while developing cell therapy products, carefully clarifying the ownership between stakeholders is necessary for avoiding possible dispute. [1]American Medical Association [AMA], Commercial Use of Human Biological Materials, Code of Medical Ethics Opinion 7.3.9, Nov. 14, 2016, https://www.ama-assn.org/delivering-care/ethics/commercial-use-human-biological-materials (last visited Jan. 3, 2021). [2]Moore v. Regents of University of California, 793 P.2d 479 (Cal. 1990) [3]Greenberg v. Miami Children's Hospital Research Institute, 264 F. Suppl. 2d, 1064 (SD Fl. 2003) [4]Washington University v. Catalona, 490 F 3d 667 (8th Cir. 2007) [5]Medical Research Council [MRC], Human Tissue and Biological Samples for Use in Research: Operational and Ethical Guidelines, 2019, https://mrc.ukri.org/publications/browse/human-tissue-and-biological-samples-for-use-in-research/ (last visited Jan. 3, 2021). [6]Wen-Hui Chiu, The legal entitlement of human body, tissue and derivatives in civil law, Angle Publishing, 2016, at 327. [7]id, at 341. [8]Okano, M., Takebayashi, S., Okumura, K., Li, E., Gaudray, P., Carle, G. F., & Bliek, J. UKCCCR guidelines for the use of cell lines in cancer research.Cytogenetic and Genome Research,86(3-4), 1999, https://europepmc.org/backend/ptpmcrender.fcgi?accid=PMC2363383&blobtype=pdf (last visited Jan. 3, 2021).

Legal Opinion Led to Science and Technology Law: By the Mechanism of Policy Assessment of Industry and Social NeedsWith the coming of the Innovation-based economy era, technology research has become the tool of advancing competitive competence for enterprises and academic institutions. Each country not only has begun to develop and strengthen their competitiveness of industrial technology but also has started to establish related mechanism for important technology areas selected or legal analysis. By doing so, they hope to promote collaboration of university-industry research, completely bring out the economic benefits of the R & D. and select the right technology topics. To improve the depth of research cooperation and collect strategic advice, we have to use legislation system, but also social communication mechanism to explore the values and practical recommendations that need to be concerned in policy-making. This article in our research begins with establishing a mechanism for collecting diverse views on the subject, and shaping more efficient dialogue space. Finally, through the process of practicing, this study effectively collects important suggestions of practical experts.

- Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

- The Demand of Intellectual Property Management for Taiwanese Enterprises

- Blockchain in Intellectual Property Protection

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

- Recent Federal Decisions and Emerging Trends in U.S. Defend Trade Secrets Act Litigation

- The effective and innovative way to use the spectrum: focus on the development of the "interleaved/white space"

- Copyright Ownership for Outputs by Artificial Intelligence

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System