Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

I. Foreword

Switzerland is a landlocked country situated in Central Europe, spanning an area of 41,000 km2, where the Alps occupy 60% of the territory, while it owns little cultivated land and poor natural resources. In 2011, its population was about 7,950,000 persons[1]. Since the Swiss Federal was founded, it has been adhering to a diplomatic policy claiming neutrality and peace, and therefore, it is one of the safest and most stable countries in the world. Switzerland is famous for its high-quality education and high-level technological development and is very competitive in biomedicine, chemical engineering, electronics and metal industries in the international market. As a small country with poor resources, the Swiss have learnt to drive their economic and social development through education, R&D and innovation a very long time ago. Some renowned enterprises, including Nestle, Novartis and Roche, are all based in Switzerland. Meanwhile, a lot of creative small-sized and medium-sized enterprises based in Switzerland are dedicated to supporting the export-orientation economy in Switzerland.

Switzerland has the strongest economic strength and plentiful innovation energy. Its patent applications, publication of essay, frequencies of quotation and private enterprises’ innovation performance are remarkable all over the world. According to the Global Competitiveness Report released by the World Economic Forum (WEF), Switzerland has ranked first among the most competitive countries in the world for four years consecutively since 2009[2]. Meanwhile, according to the Global Innovation Index (GII) released by INSEAD and the World Intellectual Property Organization (WIPO) jointly, Switzerland has also ranked first in 2011 and 2012 consecutively[3]. Obviously, Switzerland has led the other countries in the world in innovation development and economic strength. Therefore, when studying the R&D incentives and boosting the industrial innovation, we might benefit from the experience of Switzerland to help boost the relevant mechanism in Taiwan.

Taiwan’s government organization reform has been launched officially and boosted step by step since 2012. In the future, the National Science Council will be reformed into the “Ministry of Science and Technology”, and the Ministry of Economic Affairs into the “Ministry of Economy and Energy”, and the Department of Industrial Development into the “Department of Industry and Technology”. Therefore, Taiwan’s technology administrative system will be changed materially. Under the new government organizational framework, how Taiwan’s technology R&D and industrial innovation system divide work and coordinate operations to boost the continuous economic growth in Taiwan will be the first priority without doubt. Support of innovation policies is critical to promotion of continuous economic growth. The Swiss Government supports technological research and innovation via various organizations and institutions effectively. In recent years, it has achieved outstanding performance in economy, education and innovation. Therefore, we herein study the functions and orientation of the competent authorities dedicated to boosting research and innovation in Switzerland, and observe its policies and legal system applied to boost the national R&D in order to provide the reference for the functions and orientation of the competent authorities dedicated to boosting R&D and industrial innovation in Taiwan.

II. Overview of Swiss Federal Technology Laws and Technology Administrative System

Swiss national administrative organization is subject to the council system. The Swiss Federal Council is the national supreme administrative authority, consisting of 7 members elected from the Federal Assembly and dedicated to governing a Federal Government department respectively. Switzerland is a federal country consisting of various cantons that have their own constitutions, councils and governments, respectively, entitled to a high degree of independence.

Article 64 of the Swiss Federal Constitution[4] requires that the federal government support research and innovation. The “Research and Innovation Promotion Act” (RIPA)[5] is dedicated to fulfilling the requirements provided in Article 64 of the Constitution. Article 1 of the RIPA[6] expressly states that the Act is enacted for the following three purposes: 1. Promoting the scientific research and science-based innovation and supporting evaluation, promotion and utilization of research results; 2. Overseeing the cooperation between research institutions, and intervening when necessary; 3. Ensuring that the government funding in research and innovation is utilized effectively. Article 4 of the RIPA provides that the Act shall apply to the research institutions dedicated to innovation R&D and higher education institutions which accept the government funding, and may serve to be the merit for establishment of various institutions dedicated to boosting scientific research, e.g., the National Science Foundation and Commission of Technology & Innovation (CTI). Meanwhile, the Act also provides detailed requirements about the method, mode and restriction of the government funding.

According to the RIPA amended in 2011, the Swiss Federal Government’s responsibility for promoting innovation policies has been extended from “promotion of technology R&D” to “unification of education, research and innovation management”, making the Swiss national industrial innovation framework more well-founded and consistent[8] . Therefore, upon the government organization reform of Switzerland in 2013, most of the competent authorities dedicated to technology in Swiss have been consolidated into the Federal Department of Economic Affairs, Education and Research.

Under the framework, the Swiss Federal Government assigned higher education, job training, basic scientific research and innovation to the State Secretariat for Education, Research and Innovation (SERI), while the Commission of Technology & Innovation (CTI) was responsible for boosting the R&D of application scientific technology and industrial technology and cooperation between the industries and academy. The two authorities are directly subordinate to the Federal Department of Economic Affairs, Education and Research (EAER). The Swiss Science and Technology Council (SSTC), subordinate to the SERI is an advisory entity dedicated to Swiss technology policies and responsible for providing the Swiss Federal Government and canton governments with the advice and suggestion on scientific, education and technology innovation policies. The Swiss National Science Foundation (SNSF) is an entity dedicated to boosting the basic scientific R&D, known as the two major funding entities together with CTI for Swiss technology R&D. The organizations, duties, functions and operations of certain important entities in the Swiss innovation system are introduced as following.

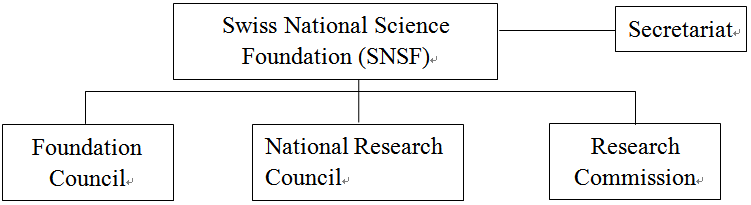

Date source: Swiss Federal Department of Economic Affairs, Education and Research official website

Fig. 1 Swiss Innovation Framework Dedicated to Boosting Industries-Swiss Federal Economic, Education and Research Organizational Chart

1. State Secretariat of Education, Research and Innovation (SERI)

SERI is subordinate to the Department of Economic Affairs, Education and Research, and is a department of the Swiss Federal Government dedicated to managing research and innovation. Upon enforcement of the new governmental organization act as of January 1, 2013, SERI was established after the merger of the State Secretariat for Education and Research, initially subordinate to Ministry of Interior, and the Federal Office for Professional Education and Technology (OEPT), initially subordinated to Ministry of Economic Affairs. For the time being, it governs the education, research and innovation (ERI). The transformation not only integrated the management of Swiss innovation system but also unified the orientations toward which the research and innovation policy should be boosted.

SERI’s core missions include “enactment of national technology policies”, “coordination of research activities conducted by higher education institutions, ETH, and other entities of the Federal Government in charge of various areas as energy, environment, traffic and health, and integration of research activities conducted by various government entities and allocation of education, research and innovation resources. Its functions also extend to funding the Swiss National Science Foundation (SNSF) to enable SNSF to subsidize the basic scientific research. Meanwhile, the international cooperation projects for promotion of or participation in research & innovation activities are also handled by SERI to ensure that Switzerland maintains its innovation strength in Europe and the world.

The Swiss Science and Technology Council (SSTC) is subordinate to SERI, and also the advisory unit dedicated to Swiss technology policies, according to Article 5a of RIPA[9]. The SSTC is responsible for providing the Swiss Federal Government and canton governments with advice and suggestion about science, education and innovation policies. It consists of the members elected from the Swiss Federal Council, and a chairman is elected among the members.

2. Swiss National Science Foundation (SNSF)

The Swiss National Science Foundation (SNSF) is one of the most important institutions dedicated to funding research, responsible for promoting the academic research related to basic science. It supports about 8,500 scientists each year. Its core missions cover funding as incentives for basic scientific research. It grants more than CHF70 million each year. Nevertheless, the application science R&D, in principle, does not fall in the scope of funding by the SNSF. The Foundation allocates the public research fund under the competitive funding system and thereby maintains its irreplaceable identity, contributing to continuous output of high quality in Switzerland.

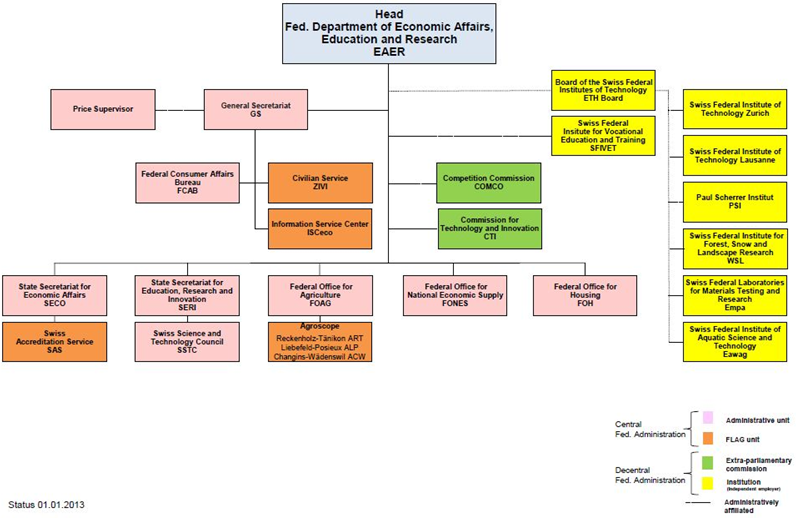

With the support from the Swiss Federal Government, the SNSF was established in 1952. In order to ensure independence of research, it was planned as a private institution when it was established[10]. Though the funding is provided by SERI, the SNSF still has a high degree of independence when performing its functions. The R&D funding granted by the SNSF may be categorized into the funding to free basic research, specific theme-oriented research, and international cooperative technology R&D, and the free basic research is granted the largest funding. The SNSF consists of Foundation Council, National Research Council and Research Commission[11].

Data source: prepared by the Study

Fig. 2 Swiss National Science Foundation Organizational Chart(1) Foundation Council

The Foundation Council is the supreme body of the SNSF[12], which is primarily responsible for making important decisions, deciding the role to be played by the SNSF in the Swiss research system, and ensuring SNSF’s compliance with the purpose for which it was founded. The Foundation Council consists of the members elected from the representatives from important research institutions, universities and industries in Swiss, as well as the government representatives nominated by the Swiss Federal Council. According to the articles of association of the SNSF[13], each member’s term of office should be 4 years, and the members shall be no more than 50 persons. The Foundation Council also governs the Executive Committee of the Foundation Council consisting of 15 Foundation members. The Committee carries out the mission including selection of National Research Council members and review of the Foundation budget.

(2) National Research Council

The National Research Council is responsible for reviewing the applications for funding and deciding whether the funding should be granted. It consists of no more than 100 members, mostly researchers in universities and categorized, in four groups by major[14], namely, 1. Humanities and Social Sciences; 2. Math, Natural Science and Engineering; 3. Biology and Medical Science; and 4. National Research Programs (NRPs)and National Centers of Competence in Research (NCCRs). The NRPs and NCCRs are both limited to specific theme-oriented research plans. The funding will continue for 4~5years, amounting to CHF5 million~CHF20 million[15]. The specific theme-oriented research is applicable to non-academic entities, aiming at knowledge and technology transfer, and promotion and application of research results. The four groups evaluate and review the applications and authorize the funding amount.

Meanwhile, the representative members from each group form the Presiding Board dedicated to supervising and coordinating the operations of the National Research Council, and advising the Foundation Council about scientific policies, reviewing defined funding policies, funding model and funding plan, and allocating funding by major.

(3) Research Commissions

Research Commissions are established in various higher education research institutions. They serve as the contact bridge between higher education academic institutions and the SNSF. The research commission of a university is responsible for evaluating the application submitted by any researcher in the university in terms of the school conditions, e.g., the school’s basic research facilities and human resource policies, and providing advice in the process of application. Meanwhile, in order to encourage young scholars to attend research activities, the research committee may grant scholarships to PhD students and post-doctor research[16].

~to be continued~

[1] SWISS FEDERAL STATISTICS OFFICE, Switzerland's population 2011 (2012), http://www.bfs.admin.ch/bfs/portal/en/index/news/publikationen.Document.163772.pdf (last visited Jun. 1, 2013).

[2] WORLD ECONOMIC FORUM [WEF], The Global Competiveness Report 2012-2013 (2012), http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2012-13.pdf (last visited Jun. 1, 2013); WEF, The Global Competiveness Report 2011-2012 (2011), http://www3.weforum.org/docs/WEF_GCR_Report_2011-12.pdf (last visited Jun. 1, 2013); WEF, The Global Competiveness Report 2010-2011 (2010), http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2010-11.pdf (last visited Jun. 1, 2013); WEF, The Global Competiveness Report 2009-2010 (2009),. http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2009-10.pdf (last visited Jun. 1, 2013).

[3] INSEAD, The Global Innovation Index 2012 Report (2012), http://www.globalinnovationindex.org/gii/GII%202012%20Report.pdf (last visited Jun. 1, 2013); INSEAD, The Global Innovation Index 2011 Report (2011), http://www.wipo.int/freepublications/en/economics/gii/gii_2011.pdf (last visited Jun. 1, 2013).

[4] SR 101 Art. 64: “Der Bund fördert die wissenschaftliche Forschung und die Innovation.”

[5] Forschungs- und Innovationsförderungsgesetz, vom 7. Oktober 1983 (Stand am 1. Januar 2013). For the full text, please see www.admin.ch/ch/d/sr/4/420.1.de.pdf (last visited Jun. 3, 2013).

[6] Id.

[7] Id.

[8] CTI, CTI Multi-year Program 2013-2016 7(2012), available at http://www.kti.admin.ch/?lang=en&download=NHzLpZeg7t,lnp6I0NTU042l2Z6ln1ad1IZn4Z2qZpnO2Yuq2Z6gpJCDeYR,hGym162epYbg2c_JjKbNoKSn6A-- (last visited Jun. 3, 2013).

[9] Supra note 5.

[10] Swiss National Science Foundation, http://www.snf.ch/E/about-us/organisation/Pages/default.aspx (last visited Jun. 3, 2013).

[11] Id.

[12] Foundation Council, Swiss National Science Foundation, http://www.snf.ch/E/about-us/organisation/Pages/foundationcouncil.aspx (last visited Jun. 3, 2013).

[13] See Statutes of Swiss National Science Foundation Art.8 & Art. 9, available at http://www.snf.ch/SiteCollectionDocuments/statuten_08_e.pdf (last visited Jun. 3, 2013).

[14] National Research Council, Swiss National Science Foundation, http://www.snf.ch/E/about-us/organisation/researchcouncil/Pages/default.aspx (last visted Jun.3, 2013).

[15] Theres Paulsen, VISION RD4SD Country Case Study Switzerland (2011), http://www.visionrd4sd.eu/documents/doc_download/109-case-study-switzerland (last visited Jun.6, 2013).

[16] Research Commissions, Swiss National Science Foundation, http://www.snf.ch/E/about-us/organisation/Pages/researchcommissions.aspx (last visted Jun. 6, 2013).

Taiwan Government passed The「Act for the Development of Biotech and New Pharmaceuticals Industry」for supporting the biopharmaceutical industry. The purpose of the Act is solely for biopharmaceutical industry, and building the leading economic force in Taiwan. To fulfill this goal, the Act has enacted regulations concerning funding, taxation and recruitment especially for the biopharmaceutical industry. The Act has been seen as the recent important law in the arena of upgrading industry regulation on the island. It is also a rare case where single legislation took place for particular industry. After the Act came into force, the government has promulgated further regulations to supplement the Act, including Guidance for MOEA-Approved Biotech and New Pharmaceuticals Company Issuing Stock Certificate, Deductions on Investments in R&D and Personnel Training of Biotech and New Pharmaceuticals Company, Guidance for Deduction Applicable to Shareholders of Profit-Seeking Enterprises -Biotech and New Pharmaceuticals Company etc. The following discussions are going to introduce the Act along with related incentive measures from an integrated standpoint. 1 、 Scope of Application According to Article 3 of the Act, 「Biotech and New Pharmaceuticals Industry」 refers to the industry that deals in New Rugs and High-risk Medical devices used by human beings, animals, and plants; 「Biotech and New Pharmaceuticals Company」 refers to a company in the Biotech and New Pharmaceuticals Industry that is organized and incorporated in accordance with the Company Act and engages in the research, development, and manufacture of new drugs and high-risk medical devices. Thus, the Act applies to company that conducts research and manufacture product in new drug or high-risk medical devices for human and animal use. Furthermore, to become a Biotech and New Pharmaceuticals Company stipulated in the Act, the Company must receive letter of approval to establish as a Biotech and New Pharmaceuticals Company valid for five years. Consequently, company must submit application to the authority for approval by meeting the following requirements: (1) Companies that conduct any R&D activities or clinical trials must receive permission, product registration, or proof of manufacture for such activities from a competent authority. However, for those conducted these activities outside the country will not apply. (2) When applied for funding for the previous year or in the same year, the expense on R&D in the previous year exceeds 5% of the total net revenue within the same year; or the expenses exceeds 10% of the total capital of the company. (3) Hired at least five R&D personnel majored in biotechnology. For New Drug and High-Risk Medical Device are confined in specific areas. New Drug provided in the Act refers to a drug that has a new ingredient, a new therapeutic effect or a new administration method as verified by the central competent authorities. And High-Risk Medical Device refers to a type of Class III medical devices implanted into human bodies as verified by the central competent authorities. Therefore, generic drug, raw materials, unimplanted medical device, and medical device are not qualified as type III, are all not within the scope of the Act and are not the subject matter the Act intends to reward. 2 、 Tax Benefits Article 5, 6 and 7 provided in the Act has followed the footsteps of Article 6 and 8 stipulated of the Statute, amending the rules tailored to the biopharmaceutical industry, and provided tax benefits to various entities as 「Biotech and New Pharmaceuticals Company」, 「Investors of Biotech and New Pharmaceuticals Industry」, 「Professionals and Technology Investors」. (1) Biotech and New Pharmaceuticals Company In an effort to advance the biopharmaceutical industry, alleviate financial burden of the companies and strengthen their R&D capacity. The Act has provided favorable incentive measures in the sector of R&D and personnel training. According to Article 5: 「For the purpose of promoting the Biotech and New Pharmaceuticals Industry, a Biotech and New Pharmaceuticals Company may, for a period of five years from the time it is subject to profit-seeking enterprise income tax payable, enjoy a reduction in its corporate income tax payable, for up to 35% of the total funds invested in research and development (R&D) and personnel training each year.」 Consequently, company could benefit through tax deduction and relieve from the stress of business operation. Moreover, in supporting Biotech and New Pharmaceutical Company to proceed in R&D and personnel training activities, the Act has set out rewards for those participate in ongoing R&D and training activities. As Article 5 provided that」 If the R&D expenditure of a particular year exceeds the average R&D expenditure of the previous two years, or if the personnel training expenditure of a particular year exceeds the average personnel training expenditure of the pervious two years, 50% of the exceed amount in excess of the average may be used to credit against the amount of profit-seeking enterprise income tax payable. 「However, the total amount of investment credited against by the payable corporate income tax in each year shall not exceed 50% of the amount of profit-seeking enterprise income tax payable by a Biotech and New Pharmaceuticals Company in a year, yet this restriction shall not apply to the amount to be offset in the last year of the aforementioned five-year period. Lastly, Article 5 of the Act shall not apply to Biotech and New Pharmaceutical Company that set up headquarters or branches outside of Taiwan. Therefore, to be qualified for tax deduction on R&D and personnel training, the headquarters or branches of the company must be located in Taiwan. (2) Investors of Biotech and New Pharmaceuticals Company To raise funding, expand business development, and attract investor continuing making investments, Article 6 of the Act has stated that 「In order to encourage the establishment or expansion of Biotech and New Pharmaceuticals Companies, a profit-seeking enterprise that subscribes for the stock issued by a Biotech and New Pharmaceuticals Company at the time of the latter's establishment or subsequent expansion; and has been a registered shareholder of the Biotech and New Pharmaceuticals Company for a period of 3 years or more, may, for a period of five years from the time it is subject to corporate income tax, enjoy a reduction in its profit-seeking enterprise income tax payable for up to 20% of the total amount of the price paid for the subscription of shares in such Biotech and New Pharmaceuticals Company.」 Yet 「If the afore-mentioned profit-seeking enterprise is a venture capital company (「VC」), such VC corporate shareholders may, for a period of five years from the fourth anniversary year of the date on which the VC becomes a registered shareholder of the subject Biotech and New Pharmaceuticals Company, enjoy a reduction in their profit-seeking enterprise income tax payable based on the total deductible amount enjoyed by the VC under Paragraph 1 hereof and the shareholders' respective shareholdings in the VC.」 The government enacted this regulation to encourage corporations and VC to invest in biotech and new pharmaceutical company, and thus provide corporate shareholders with 20% of profit-seeking enterprise income tax payable deduction, and provide VC corporate shareholders tax deduction that proportion to its shareholdings in the VC. (3) Top Executives and Technology Investors Top Executives refer to those with biotechnology background, and has experience in serving as officer of chief executive (CEO) or manager; Technology Investors refer to those acquire shares through exchange of technology. As biopharmaceutical industry possesses a unique business model that demands intensive technology, whether top executives and technology investors are willing to participate in a high risk business and satisfy the needs of industry becomes a critical issue. Consequently, Article 7 of the Act stated that 「In order to encourage top executives and technology investors to participate in the operation of Biotech and New Pharmaceuticals Companies and R&D activities, and to share their achievements, new shares issued by a Biotech and New Pharmaceuticals Company to top executives and technology investors (in return of their knowledge and technology) shall be excluded from the amount of their consolidated income or corporate income of the then current year for taxation purposes; provided, however, that if the title to the aforesaid shares is transferred with or without consideration, or distributed as estate, the total purchase price or the market value of the shares at the time of transfer as a gift or distribution as estate shall be deemed income generated in that tax year and such income less the acquisition cost shall be reported in the relevant income tax return.」 Additionally, 「For the title transfer of shares under the preceding paragraph, the Biotech and New Pharmaceuticals Company concerned shall file a report with the local tax authorities within thirty 30 days from the following day of the title transfer.」 Purpose of this regulation is to attract top executives and technology personnel for the company in long-term through defer taxation. Moreover, the Biotech and New Pharmaceutical Company usually caught in a prolong period of losses, and has trouble financing through issuing new shares, as stipulated par value of each share cannot be less than NTD $10.Thus, in order to offer top executive and technology investors incentives and benefits under such circumstances, Article 8 has further provided that」Biotech and New Pharmaceutical Companies may issue subscription warrants to its top executives and technology investors, provided that the proposal for the issuance of the aforesaid subscription warrants shall pass resolution adopted by a majority votes of directors attended by at least two-thirds (2/3) of all the directors of the company; and be approved by the competent authorities. Holders of the subscription warrants may subscribe a specific number of shares at the stipulated price. The amount of stipulated price shall not be subject to the minimum requirement, i.e. par value of the shares, as prescribed under Article 140 of the Company Act. Subscription of the shares by exercising the subscription warrant shall be subject to income tax in accordance with Article 7 hereof. if a Biotech and New Pharmaceutical Company issue new shares pursuant to Article 7 hereof, Article 267 of the Company Act shall not apply. The top executives and technology investors shall not transfer the subscription warrant acquired to pursuant to this Article.」 These three types of tax benefits are detailed incentive measures tailor to the biopharmaceutical industry. However, what is noteworthy is the start date of the benefits provided in the Act. Different from the Statue, the Act allows company to enjoy these benefits when it begins to generate profits, while the Statute provides company tax benefits once the authority approved its application in the current year. Thus, Biotech and New Pharmaceuticals Company enjoys tax benefits as the company starts to make profit. Such approach reflects the actual business operation of the industry, and resolves the issue of tax benefits provided in the Statue is inapplicable to the biopharmaceutical industry. 3 、 Technical Assistance and Capital Investment Due to the R&D capacity and research personnel largely remains in the academic circle, in order to encourage these researchers to convert R&D efforts into commercial practice, the government intends to enhance the collaboration among industrial players, public institutions, and the research and academic sectors, to bolster the development of Biotech and New Pharmaceuticals Company. However, Article 13 of Civil Servants Service Act prohibits officials from engaging in business operation, the Act lifts the restriction on civil servants. According to Article 10 of the Act provided that」For a newly established Biotech and New Pharmaceuticals Company, if the person providing a major technology is a research member of the government research organization, such person may, with the consent of the government research organization, acquired 10% or more of the shares in the Biotech and New Pharmaceuticals Company at the time of its establishment, and act as founder, director, or technical adviser thereof. In such case, Article 13 of the Civil Servants Service Act shall not apply. And the research organization and research member referred to thereof shall be defined and identified by the Executive Yuan, in consultation with the Examination Yuan.」 This regulation was enacted because of the Civil Servants Services Act provided that public officials are not allowed to be corporate shareholders. However, under certain regulations, civil servants are allowed to be corporate shareholders in the sector of agriculture, mining, transportation or publication, as value of the shares cannot exceed 10% of the total value of the company, and the civil servant does not served in the institution. In Taiwan, official and unofficial research institution encompasses most of the biotechnology R&D capacity and research personnel. If a researcher is working for a government research institution, he would be qualified as a public servant and shall be governed by the Civil Servants Service Act. As a result of such restriction, the Act has lifted the restriction and encouraged these researchers to infuse new technologies into the industry. At last, for advancing the development of the industry, Article 11 also provided that 」R&D personnel of the academic and research sectors may, subject to the consent of their employers, served as advisors or consultants for a Biotech and New Pharmaceuticals Company.」 4 、 Other Regulations For introducing and transferring advanced technology in support of the biopharmaceutical industry, Article 9 stated that 「Organization formed with government funds to provide technical assistance shall provide appropriate technical assistance as may be necessary.」 Besides technical assistance, government streamlines the review process taken by various regulatory authorities, in order to achieve an improved product launch process result in faster time-to-market and time-to profit. As Article 12 provided that 「the review and approval of field test, clinical trials, product registration, and others, the central competent authorities shall establish an open and transparent procedure that unifies the review system.」

The Tax Benefit of “Act for Establishment and Administration of Science Parks” and the Relational Norms for InnovationThe Tax Benefit of “Act for Establishment and Administration of Science Parks” and the Relational Norms for Innovation “Act for Establishment and Administration of Science Parks” was promulgated in 1979, and was amended entirely in May 15, 2018, announced in June 6. The title was revised from “Act for Establishment and Administration of Science ‘Industrial’ Parks” to “Act for Establishment and Administration of Science Parks” (it would be called “the Act” in this article). It was a significant transition from traditional manufacture into technological innovation. For encouraging different innovative technology enter into the science park, there is tax benefit in the Act. When the park enterprises import machines, equipment, material and so on from foreign country, the import duties, commodity tax, and business tax shall be exempted; moreover, when the park enterprises export products and services, it will have given favorable business and commodity tax free.[1] Furthermore, the park bureaus also exempt collection of land rent.[2] If they have approval for importing or exporting products, they do not need to apply for permission.[3] In the sub-law, there is also regulations of bonding operation.[4] To sum up, for applying the benefit of the act, enterprises approved for establishment in science parks still require to manufacture products. Such regulations are confined to industrial industry. Innovative companies dedicate in software, big data, or customer service, rarely gain benefits from taxation. In other norms,[5] there are also tax deduction or exemption for developing innovative industries. Based on promoting innovation, the enterprises following the laws of environmental protection, laborers’ safety, food safety and sanitation,[6] or investing in brand-new smart machines for their own utilize,[7] or licensing their intellectual property rights,[8] can deduct from its taxable income. In addition, the research creators from academic or research institutions,[9] or employee,[10] can declare deferral of the income tax payable for the shares distributed. In order to assist new invested innovative enterprises,[11] there are also relational benefit of tax. For upgrading the biotech and new pharmaceuticals enterprises, when they invest in human resource training, research and development, they can have deductible corporate income tax payable.[12] There is also tax favored benefits for small and medium enterprises in using of land, experiment of research, technology stocks, retaining of surplus, and additional employees hiring.[13] The present norms of tax are not only limiting in space or products but also encouraging in “research”. In other word, in each steps of the research of innovation, the enterprises still need to manufacture products from their own technology, fund and human resources. If the government could encourage open innovation with favored taxation, it would strengthen the capability of research and development for innovative enterprises. Supporting the innovation by taxation, the government can achieve the goal of scientific development more quickly and encourage them accepting guidance. “New York State Business Incubator and Innovation Hot Spot Support Act” can be an example, [14]the innovative enterprises accepting the guidance from incubators will have the benefit of tax on “personal income”, “sales and use” and “corporation franchise”. Moreover, focusing on key industries and exemplary cases, there are also the norms of tax exemption and tax abatement in China for promoting the development of technology.[15]The benefit of tax is not only in research but also in “the process of research”. To sum up, the government of Taiwan provides the benefit of tax for advancing the competition of outcomes in market, and for propelling the development of innovation. In order to accelerate the efficiency of scientific research, the government could draw lessons from America and China for enacting the norms about the benefit of tax and the constitution of guidance. [1] The Act §23. [2] Id. §24. [3] Id. §25. [4] Regulations Governing the Bonding Operations in Science Parks. [5] Such as Act for Development of Small and Medium Enterprises, Statute for Industrial Innovation, Act for the Development of Biotech and New Pharmaceuticals Industry. [6] Statute for Industrial Innovation §10. [7] Id. §10-1. [8] Id. §12-1. [9] Id. §12-2. [10] Id. §19-1. [11] Id. §23-1, §23-2, §23-3. [12] Act for the Development of Biotech and New Pharmaceuticals Industry §5, §6, §7. [13] Act for Development of Small and Medium Enterprises Chapter 4: §33 to §36-3. [14] New York State Department of Taxation and Finance Taxpayer Guidance Division, New York State Business Incubator and Innovation Hot Spot Support Act, Technical Memorandum TSB-M-14(1)C, (1)I, (2)S, at 1-6 (March 7, 2014), URL:http://www.wnyincubators.com/content/Innovation%20Hot%20Spot%20Technical%20Memorandum.pdf (last visited:December 18, 2019). [15] Enterprise Income Tax Law of the People’s Republic of China Chapter 4 “Preferential Tax Treatments”: §25 to §36 (2008 revised).

Research on Policies for building a digital nation in Recent Years (2016-2017)Research on Policies for building a digital nation in Recent Years (2016-2017) Recent years, the government has already made some proactive actions, including some policies and initiatives, to enable development in the digital economy and fulfill the vision of Digital Nation. Those actions are as follows: 1. CREATING THE “FOOD CLOUD” FOR FOOD SAFETY CONTROLS Government agencies have joined forces to create an integrated “food cloud” application that quickly alerts authorities to food safety risks and allows for faster tracing of products and ingredients. The effort to create the cloud was spearheaded by the Executive Yuan’s Office of Food Safety under the leadership of Vice Premier Chang San-cheng on January 12, 2016. The “food cloud” application links five core systems (registration, tracing, reporting, testing, and inspection) from the Ministry of Health and Welfare (MOHW) with eight systems from the Ministry of Finance, Ministry of Economic Affairs, Ministry of Education (MOE), Council of Agriculture and Environmental Protection Administration. The application gathers shares and analyzes information in a methodical and systematic manner by employing big data technology. To ensure the data can flow properly across different agencies, the Office of Food Safety came up with several products not intended for human consumption and had the MOHW simulate the flow of those products under import, sale and supply chain distribution scenarios. The interministerial interface successfully analyzed the data and generated lists of food risks to help investigators focus on suspicious companies. Based on these simulation results, the MOHW on September 2, 2015, established a food and drug intelligence center as a mechanism for managing food safety risks and crises on the national level. The technologies for big data management and mega data analysis will enable authorities to better manage food sources and protect consumer health. In addition, food cloud systems established by individual government agencies are producing early results. The MOE, for instance, rolled out a school food ingredient registration platform in 2014, and by 2015 had implemented the system across 22 countries and cities at 6,000 schools supplying lunches for 4.5 million students. This platform, which made school lunch ingredients completely transparent, received the 2015 eAsia Award as international recognition for the use of information technology in ensuring food safety. 2. REVISING DIGITAL CONVERGENCE ACTS On 2016 May 5th, the Executive Yuan Council approved the National Communications Commission's (NCC) proposals, drafts of “Broadcasting Terrestrial and Channel Service Suppliers Administration Act”, “Multichannel Cable Platform Service Administration Act”, “Telecommunications Service Suppliers Act”, “Telecommunications Infrastructure and Resources Administration Act”, “Electronic Communications Act”, also the five digital convergence laws. They will be sent to the Legislature for deliberation. But in the end, this version of five digital convergence bills did not pass by the Legislature. However, later on, November 16, 2017, The Executive Yuan approved the new drafts of “Digital Communication Act” and the “Telecommunication Service Management Act”. The “Digital Communication Act” and the “Telecommunication Service Management Act” focused summaries as follows: 1. The digital communication bill A. Public consultation and participation. B. The digital communication service provider ought to use internet resource reasonability and reveal network traffic control measures. C. The digital communication service provider ought to reveal business information and Terms of Service. D. The responsibility of the digital communication service provider. 2. The telecommunication service management bill A. The telecommunication service management bill change to use registration system. B. The general obligation of telecommunications to provide telecommunication service and the special obligation of Specific telecommunications. C. Investment, giving, receiving and merging rules of the telecommunication service. Telecommunications are optimism of relaxing rules and regulations, and wish it would infuse new life and energy into the market. Premier Lai instructed the National Communications Commission and other agencies to elucidate the contents of the two communication bills to all sectors of society, and communicate closely with lawmakers of all parties to build support for a quick passage of the bills. 3. FOCUSING ON ICT SECURITY TO BUILD DIGITAL COUNTRIES The development of ICT has brought convenience to life but often accompanied by the threat of illegal use, especially the crimes with the use of new technologies such as Internet techniques and has gradually become social security worries. Minor impacts may cause inconvenience to life while major impacts may lead to a breakdown of government functions and effects on national security. To enhance the capability of national security protection and to avoid the gap of national security, the Executive Yuan on August 1st 2016 has upgraded the Office of Information and Communication Security into the Agency of Information and Communication Security, a strategic center of R.O.C security work, integrating the mechanism of the whole government governance of information security, through specific responsibility, professionalism, designated persons and permanent organization to establish the security system, together with the relevant provisions of the law so that the country's information and communication security protection mechanism will become more complete. The efforts to the direction could be divided into three parts: First, strengthening the cooperation of government and private sectors of information security: In a sound basis of legal system, the government plans to strengthen the government and some private sectors’ information security protection abilities ,continue to study and modify the relevant amendments to the relevant provisions, strengthen public-private collaborative mechanism, deepen the training of human resources and enhance the protection of key information infrastructure of our country. Second, improving the information and communication security professional capability: information and communication security business is divided into policy and technical aspects. While the government takes the responsibility for policy planning and coordination, the technical service lies in an outsourcing way. Based on a sound legal system, the government will establish institutionalized and long-term operation modes and plan appropriate organizational structures through the discussion of experts and scholars from all walks of life. Third, formulating Information and Communication Safety Management Act and planning of the Fifth National Development Program for Information and Communication Security: The government is now actively promoting the Information and Communication Safety Management Act as the cornerstone for the development of the national digital security and information security industry. The main content of the Act provides that the applicable authorities should set up security protection plan at the core of risk management and the procedures of notification and contingency measures, and accept the relevant administrative check. Besides the vision of the Fifth National Development Program for Information and Communication Security which the government is planning now is to build a safe and reliable digital economy and establish a safe information and communication environment by completing the legal system of information and communication security environment, constructing joint defense system of the national Information and Communication security, pushing up the self-energy of the industries of information security and nurture high-quality human resources for elite talents for information security. 4. THE DIGITAL NATION AND INNOVATIVE ECONOMIC DEVELOPMENT PLAN The Digital Nation and Innovative Economic Development Plan (2017-2025) known as “DIGI+” plan, approved by the Executive Yuan on November 24, 2016. The plan wants to grow nation’s digital economy to NT $ 6.5 trillion (US$205.9 billion), improve the digital lifestyle services penetration rate to 80 %, increase broadband connections to 2 Gbps, ensure citizens’ basic rights to have 25 Mbps broadband access, and put our nation among the top 10 information technology nations worldwide by 2025. The plan contains several important development strategies: DIGI+ Infrastructure: Build infrastructure conducive to digital innovation. DIGI+ Talent: Cultivate digital innovation talent. DIGI+ Industry: Support cross-industry transformation through digital innovation. DIGI+ Rights: Make R.O.C. an advanced society that respects digital rights and supports open online communities. DIGI+ Cities: Build smart cities through cooperation among central and local governments and the industrial, academic and research sectors. DIGI+ Globalization: Boost nation’s standing in the global digital service economy. The plan also highlights few efforts: First is to enrich “soft” factors and workforce to create an innovative environment for digital development. To construct this environment, the government will construct an innovation-friendly legal framework, cultivate interdisciplinary digital talent, strengthen research and develop advanced digital technologies. Second is to enhance digital economy development. The government will incentivize innovative applications and optimize the environment for digital commerce. Third, the government will develop an open application programming interface for government data and create demand-oriented, one-stop smart government cloud services. Fourth, the government will ensure broadband access for the disadvantaged and citizens of the rural area, implement the participatory process, enhance different kinds of international cooperation, and construct a comprehensive humanitarian legal framework with digital development. Five is to build a sustainable smart country. The government will use smart network technology to build a better living environment, promote smart urban and rural area connective governance and construction and use on-site research and industries innovation ecosystem to assist local government plan and promote construction of the smart country. In order to achieve the overall effectiveness of the DIGI + program, interdisciplinary, inter-ministerial, inter-departmental and inter-departmental efforts will be required to collaborate with the newly launched Digital National Innovation Economy (DIGI +) Promotion Team. 5. ARTIFICIAL INTELLIGENCE SCIENTIFIC RESEARCH STRATEGY The Ministry of Science and Technology (MOST) reported strategy plan for artificial intelligence (AI) scientific research at Cabinet meeting on August 24, 2017. Artificial intelligence is a powerful and inevitable trend, and it will be critical to R.O.C.’s competitiveness for the next 30 years. The ministry will devote NT$16 billion over the next five years to building an AI innovation ecosystem in R.O.C. According to MOST, the plan will promote five strategies: 1. Creating an AI platform to provide R&D services MOST will devote NT$5 billion over the next four years to build a platform, integrating the resources, providing a shared high-speed computing environment and nurturing emerging AI industries and applications. 2. Establishing an AI innovative research center MOST will four artificial intelligence innovation research centers across R.O.C. as part of government efforts to enhance the nation’s competitiveness in AI technology. The centers will support the development of new AI in the realms of financial technology, smart manufacturing, smart healthcare and intelligent transportation systems. 3. Setting up AI robot maker spaces An NT$2 billion, four-year project assisting industry to develop the hardware-software integration of robots and innovative applications was announced by the Ministry of Science and Technology. 4. Subsidizing a semiconductor “moonshot” program to explore ambitious and groundbreaking smart technologies This program will invest NT$4 billion from 2018 through 2021 into developing semiconductors and chip systems for edge devices as well as integrating the academic sector’s R&D capabilities and resources. the project encompasses cognitive computing and AI processor chips; next-generation memory designs; process technologies and materials for key components of sensing devices; unmanned vehicles, AR and VR; IoT systems and security. 5. Organizing Formosa Grand Challenge competitions The program is held in competitions to engage young people in the development of AI applications. The government hopes to extend R.O.C.’s industrial advantages and bolster the country’s international competitiveness, giving R.O.C. the confidence to usher in the era of AI applications. All of these efforts will weave people, technologies, facilities, and businesses into a broader AI innovation ecosystem. 6. INTELLIGENT TRANSPORTATION SYSTEM PLANS Ministry of Transportation and Communications (MOTC) launched plans to develop intelligent transportation systems at March 7th in 2017. MOTC integrates transportation and information and communications technology through these plans to improve the convenience and reduce the congestion of the transportation. These plans combine traffic management systems for highways, freeways and urban roads, a multi-lane free-flow electronic toll collection system, bus information system that provides timely integrated traffic information services, and public transportation fare card readers to reduce transport accidence losses, inconvenience of rural area, congestion of main traffic arteries and improve accessibility of public transportation. There are six plans are included: 1. Intelligent transportation safety plan; 2. Relieve congestion on major traffic arteries; 3. Make transportation more convenient in Eastern Taiwan and remote areas; 4. Integrate and share transportation resources; 5. Develop “internet-of-vehicles” technology applications; and 6. Fundamental R&D for smart transportation technology. These plans promote research and development of smart vehicles and safety intersections, develop timely bus and traffic information tracking system, build a safe system of shared, safe and green-energy smart system, and subsidize the large vehicles to install the vision enhancement cameras to improve the safety of transportation. These plans also use eTag readers, vehicle sensors and info communication technologies to gather the traffic information and provide timely traffic guidance, reduce the congestion of the traffic flow. These plans try to use demand-responsive transit system with some measures such as combine public transportation and taxi, to improve the flexibility of the public traffic service and help the basic transportation needs of residents in eastern Taiwan and rural areas to be fulfilled. A mobile transport service interface and a platform that integrating booking and payment processes are also expected to be established to provide door-to-door transportation services and to integrate transportation resources. And develop demonstration projects of speed coordination of passenger coach fleets, vehicle-road interaction technology, and self-driving car to investigate and verify the issues in technological, operational, industrial, legal environments of internet-of-vehicles applications in our country. Last but not least, research and development on signal control systems that can be used in both two and four-wheeled vehicles, and deploy an internet-of-vehicles prototype platform and develop drones traffic applications. These plans are expected to reduce 25% traffic congestion, 20% of motor vehicle incidence, leverage 10% using rate of public transportation, raise 20% public transportation service accessibility of rural area and create NT$30 billion production value. After accomplishing these targets, the government can establish a comprehensive transportation system and guide industry development of relating technology areas. Through the aforementioned initiatives, programs, and plans, the government wants to construct the robust legal framework and policy environment for digital innovation development, and facilitate the quality of citizens in our society.

Taiwan Recent Regulatory Development- Promoting Biotech and New Pharmaceuticals IndustryOver the past twenty years, the Government has sought to cultivate the biopharmaceutical industry as one of the future major industry in Taiwan. Back in 1982, the Government has begun to regard biotechnology as a key technology in Technology Development Program, demonstrated that biotechnology is a vital technology in pursuit of future economic growth. Subsequently, the Government initiated national programs that incorporated biotechnology as a blueprint for future industrial development. In order to enhance our competitiveness and building an initial framework for the industry, The Executive Yuan has passed the Biotechnology Industry Promotion Plan. As the Government seeks to create future engines of growth by building an environment conducive for enterprise development, the Plan has been amended four times, and implemented measures focused on the following six areas: related law and regulations, R&D and applications, technology transfer and commercialization, personnel training, investment promotion and coordination, marketing information and marketing service. In 2002, the Executive Yuan approved the Challenge 2008, a six-year national development plan, pointing out biotechnology industry as one of the Two Trillion, Twin Stars industries. The Government planned for future economic growth by benefiting through the attributes of the biotechnology: high-tech, high-reward and less pollution. Thus, since 1997 the Strategic Review Board (SRB) under the Executive Yuan Science and Technology Advisory Panel has taken action in coordinating government policies with industry comments to form a sound policy for the biotechnology industry. Additionally, a well-established legal system for sufficient protection of intellectual property rights is the perquisite for building the industry, as the Government recognized the significance through amending and executing related laws and regulations. By stipulating data exclusivity and experimental use exception in the Pharmaceutical Affair Act, tax benefits provided in Statute for Upgrading Industries , Incentives for Production and R&D of Rare Disease Medicine, Incentives for Medical Technology Research and Development, provide funding measures in the Guidance of Reviewing Programs for Promoting Biotechnology Investment. Clearly, the government has great expectation for the industry through establishing a favorable environment by carrying out these policies and revising outdated regulations. Thus, the Legislative Yuan has passed the “Act for The Development of Biotechnology and New Pharmaceuticals Industry” in June, 2007, and immediately took effect in July. The relevant laws and regulations became effective as well, driving the industry in conducting researches on new drugs and manufacturing new products, increasing sales and expanding the industry to meet an international level. For a biopharmaceutical industry that requires long-term investment and costly R&D, incentive measures is vital to the industry’s survival before the product launches the market. Accordingly, this article will be introducing the recent important regulation that supports the biopharmaceutical industry in Taiwan, and analyzing the government’s policies. Biotechnology is increasingly gaining global attention for its potential in building future economic growth and generating significant profits. In an effort to support the biotechnology industry in Taiwan, the Government has made a step forward by enacting the “Act for the Development of Biotech and New Pharmaceutical Industry”. The biopharmaceutical industry is characterized as high-risk and high-reward, strong government support and a well-developed legal system plays a vital role from its establishment throughout the long term development. Therefore, the Act was enacted tailor to the Biotech and New Pharmaceutical Industry, primarily focuses on tax benefits, R&D activities, personnel recruitment and investment funding, in support of start-up companies and attracting a strong flow of funding worldwide. To pave the way for promoting the biopharmaceutical industry and the Biotech and New Pharmaceutical Company, here the article will be introducing the incentive measures provided in the Act, and supporting development of the industry, demonstrating the efforts made by the Government to build a “Bio-tech Island”. Reference “Act for Development of Biotech and New Pharmaceutical Industry”, webpage of Law and Regulations Database of the Republic of China. 4 July, 2007. Ministry of Justice, Taiwan. 5 Nov. 2008 http://law.moj.gov.tw/Eng/Fnews/FnewsContent.asp?msgid=3180&msgType=en&keyword=undefined

- Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

- The Demand of Intellectual Property Management for Taiwanese Enterprises

- Blockchain in Intellectual Property Protection

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

- Recent Federal Decisions and Emerging Trends in U.S. Defend Trade Secrets Act Litigation

- The effective and innovative way to use the spectrum: focus on the development of the "interleaved/white space"

- Copyright Ownership for Outputs by Artificial Intelligence

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System