Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

3.Commission of Technology and Innovation (CTI)

The CTI is also an institution dedicated to boosting innovation in Switzerland. Established in 1943, it was known as the Commission for the Promotion of Scientific Research[1]. It was initially established for the purpose of boosting economy and raising the employment rate, and renamed after 1996. The CTI and SNSF are two major entities dedicated to funding scientific research in Switzerland, and the difference between both resides in that the CTI is dedicated to funding R&D of the application technology and industrial technology helpful to Switzerland’s economic development.

Upon enforcement of the amended RIPA 2011, the CTI was officially independent from the Federal Office for Professional Education and Technology (OEPT) and became an independent entity entitled to making decisions and subordinated to the Federal Department of Economic Affairs (FDEA) directly[2]. The CTI is subject to the council system, consisting of 65 professional members delegated from industrial, academic and research sectors. The members assume the office as a part time job. CTI members are entitled to making decisions on funding, utilization of resources and granting of CTI Start-up Label independently[3].

The CTI primarily carries out the mission including promotion of R&D of industrial technology, enhancement of the market-orientation innovation process and delivery of R&D energy into the market to boost industrial innovation. For innovation, the CTI's core mission is categorized into[4]:

(1)Funding technology R&D activities with market potential

The CTI invests considerable funds and resources in boosting the R&D of application technology and industrial technology. The CTI R&D Project is intended to fund private enterprises (particularly small-sized and medium-sized enterprises) to engage in R&D of innovation technology or product. The enterprises may propose their innovative ideas freely, and the CTI will decide whether the funds should be granted after assessing whether the ideas are innovative and potentially marketable[5].

CTI’s funding is conditioned on the industrial and academic cooperation. Therefore, the enterprises must work with at least one research institution (including a university, university of science and technology, or ETH) in the R&D. Considering that small-sized and medium-sized enterprises usually do not own enough working funds, technology and human resources to commercialize creative ideas, the CTI R&D Project is intended to resolve the problem about insufficient R&D energy and funds of small- and medium-sized enterprises by delivering the research institutions’ plentiful research energy and granting the private enterprises which work with research institutions (including university, university of science and technology, or ETH) the fund. Notably, CTI’s funding is applicable to R&D expenses only, e.g., research personnel’s salary and expenditure in equipment & materials, and allocated to the research institutions directly. Meanwhile, in order to enhance private enterprises' launch into R&D projects and make them liable for the R&D success or failure, CTI’s funding will be no more than 50% of the total R&D budget and, therefore, the enterprises are entitled to a high degree of control right in the process of R&D.

The industrial types which the CTI R&D Project may apply to are not limited. Any innovative ideas with commercial potential may be proposed. For the time being, the key areas funded by CTI include the life science, engineering science, Nano technology and enabling sciences, etc.[6] It intends to keep Switzerland in the lead in these areas. As of 2011, in order to mitigate the impact of drastic CHF revaluation to the industries, the CTI launched its new R&D project, the CTI Voucher[7]. Given this, the CTI is not only an entity dedicated to funding but also plays an intermediary role in the industrial and academic sectors. Enterprises may submit proposals before finding any academic research institution partner. Upon preliminary examination of the proposals, the CTI will introduce competent academic research institutions to work with the enterprises in R&D, subject to the enterprises' R&D needs. After the cooperative partner is confirmed, CTI will grant the fund amounting to no more than CHF3,500,000 per application[8], provided that the funding shall be no more than 50% of the R&D project expenditure.

The CTI R&D Project not only boosts innovation but also raises private enterprises’ willingness to participate in the academic and industrial cooperation, thereby narrowing the gap between the supply & demand of innovation R&D in the industrial and academic sectors. Notably, the Project has achieved remarkable effect in driving private enterprises’ investment in technology R&D. According to statistical data, in 2011, the CTI solicited additional investment of CHF1.3 from a private enterprise by investing each CHF1[9]. This is also one of the important reasons why the Swiss innovation system always acts vigorously.

Table 1 2005-2011 Passing rate of application for R&D funding

|

Year |

2011 |

2010 |

2009 |

2008 |

2007 |

2006 |

2005 |

|

Quantity of applications |

590 |

780 |

637 |

444 |

493 |

407 |

522 |

|

Quantity of funded applications |

293 |

343 |

319 |

250 |

277 |

227 |

251 |

|

Pass rate |

56% |

44% |

50% |

56% |

56% |

56% |

48% |

Data source: Prepared by the Study

(2)Guiding high-tech start-up

Switzerland has learnt that high-tech start-ups are critical to the creation of high-quality employment and boosting of economic growth, and start-ups were able to commercialize the R&D results. Therefore, as of 2001, Switzerland successively launched the CTI Entrepreneurship and CTI Startup to promote entrepreneurship and cultivate high-tech start-ups.

1.CTI Entrepreneurship

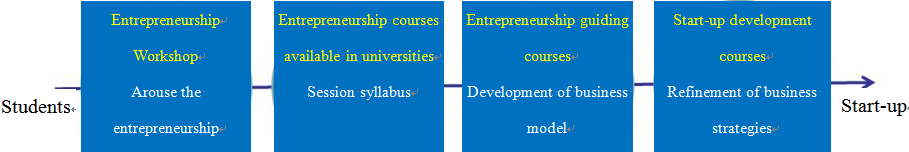

The CTI Entrepreneurship was primarily implemented by the Venture Lab founded by CTI investment. The Venture Lab launched a series of entrepreneurship promotion and training courses, covering day workshops, five-day entrepreneurship intensive courses, and entrepreneurship courses available in universities. Each training course was reviewed by experts, and the experts would provide positive advice to attendants about innovative ideas and business models.

Data source: Venture Lab Site

Fig. 3 Venture Lab Startup Program

2.CTI Startup

The CTI is dedicated to driving the economy by virtue of innovation as its priority mission. In order to cultivate the domestic start-ups with high growth potential in Switzerland, the CTI Startup project was launched in 1996[10] in order to provide entrepreneurs with the relevant guidance services. The project selected young entrepreneurs who provided innovative ideas, and guided them in the process of business start to work their innovative ideas and incorporate competitive start-ups.

In order to enable the funding and resources to be utilized effectively, the CTI Startup project enrolled entrepreneurs under very strict procedure, which may be categorized into four stages[11]:

Data source: CTI Startup Site

Fig. 4 Startup Plan Flow Chart

In the first stage, the CTI would preliminarily examine whether the applicant’s idea was innovative and whether it was technologically feasible, and help the applicant register with the CTI Startup project. Upon registration, a more concrete professional examination would be conducted at the second stage. The scope of examination included the technology, market, feasibility and management team’s competence. After that, at the stage of professional guidance, each team would be assigned a professional “entrepreneurship mentor”, who would help the team develop further and optimize the enterprise’s strategy, flow and business model in the process of business start, and provide guidance and advice on the concrete business issues encountered by the start-up. The stage of professional guidance was intended to guide start-ups to acquire the CTI Startup Label, as the CTI Startup Label was granted subject to very strict examination procedure. For example, in 2012, the CTI Startup project accepted 78 applications for entrepreneurship guidance, but finally the CTI Startup Label was granted to 27 applications only[12]. Since 1996, a total of 296 start-ups have acquired the CTI Startup Label, and more than 86% thereof are still operating now[13]. Apparently, the CTI Startup Label represents the certification for innovation and on-going development competence; therefore, it is more favored by investors at the stage of fund raising.

Table 2 Execution of start-up plans for the latest three years

|

|

Quantity of application |

Quantity of accepted application |

Quantity of CTI Label granted |

|

2012 |

177 |

78 |

27 |

|

2011 |

160 |

80 |

26 |

|

2010 |

141 |

61 |

24 |

Data source: CTI Annual Report, prepared by the Study

Meanwhile, the “CTI Invest” platform was established to help start-up raise funds at the very beginning to help commercialize R&D results and cross the valley in the process of R&D innovation. The platform is a private non-business-making organization, a high-tech start-up fund raising platform co-established by CTI and Swiss investors[14]. It is engaged in increasing exposure of the start-ups and contact with investors by organizing activities, in order to help the start-ups acquire investment funds.

(3)Facilitating transfer of knowledge and technology between the academic sector and industrial sector

KTT Support (Knowledge & Technology Transfer (KTT Support) is identified as another policy instrument dedicated to boosting innovation by the CTI. It is intended to facilitate the exchange of knowledge and technology between academic research institutions and private enterprises, in order to transfer and expand the innovation energy.

As of 2013, the CTI has launched a brand new KTT Support project targeting at small-sized and medium-sized enterprises. The new KTT Support project consisted of three factors, including National Thematic Networks (NTNs), Innovation Mentors, and Physical and web-based platforms. Upon the CTI’s strict evaluation and consideration, a total of 8 cooperative innovation subjects were identified in 2012, namely, carbon fiber composite materials, design idea innovation, surface innovation, food study, Swiss biotechnology, wood innovation, photonics and logistics network, etc.[15] One NTN would be established per subject. The CTI would fund these NTNs to support the establishment of liaison channels and cooperative relations between academic research institutions and industries and provide small- and medium-sized enterprises in Switzerland with more rapid and easy channel to access technologies to promote the exchange of knowledge and technology between both parties. Innovation Mentors were professionals retained by the CTI, primarily responsible for evaluating the small-sized and medium-sized enterprises’ need and chance for innovation R&D and helping the enterprises solicit competent academic research partners to engage in the transfer of technology. The third factor of KTT Support, Physical and web-based platforms, is intended to help academic research institutions and private enterprises establish physical liaison channels through organization of activities and installation of network communication platforms, to enable the information about knowledge and technology transfer to be more transparent and communicable widely.

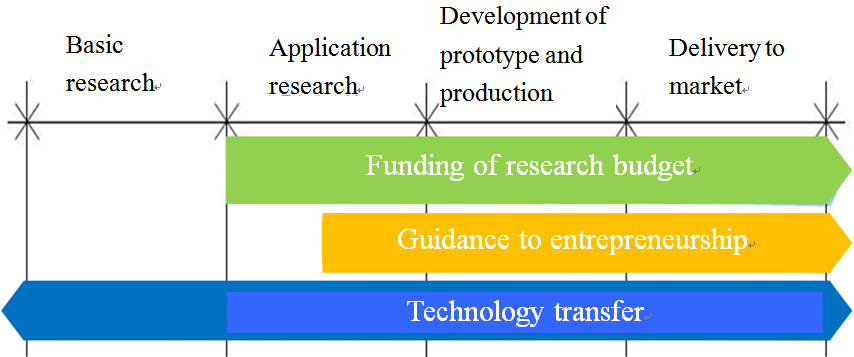

In conclusion, the CTI has been dedicated to enhancing the link between scientific research and the industries and urging the industrial sector to involve and boost the R&D projects with market potential. The CTI’s business lines are all equipped with corresponding policy instruments to achieve the industrial-academic cooperation target and mitigate the gap between the industry and academic sectors in the innovation chain. The various CTI policy instruments may be applied in the following manner as identified in the following figure.

Data source: CTI Annual Report 2011

Fig. 5 Application of CTI Policy Instrument to Innovation Chain

III. Swiss Technology R&D Budget Management and Allocation

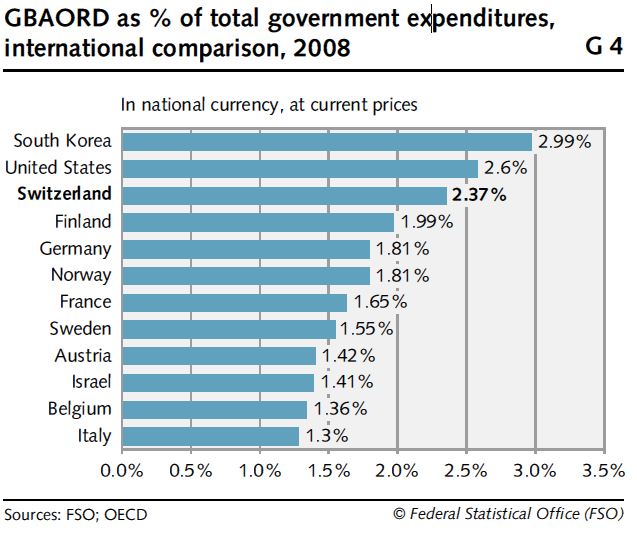

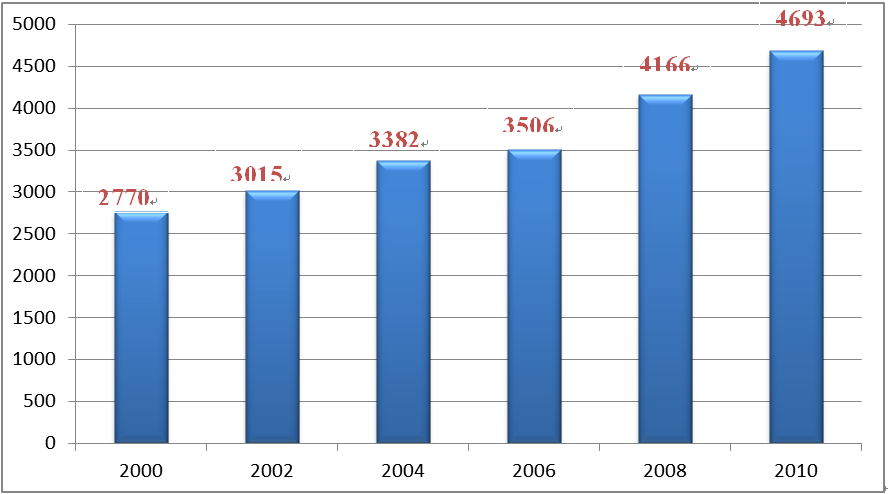

The Swiss Federal Government has invested considerable expenditures in technology R&D. According to statistic data provided by Swiss Federal Statistical Office (FSO) and OECD, the Swiss research expenditures accounted for 2.37% of the Federal Government’s total expenditures, following the U.S.A. and South Korea (see Fig. 6). Meanwhile, the research expenditures of the Swiss Government grew from CHF2.777 billion in 2000 to CHF4.639 billion in 2010, an average yearly growth rate of 5.9% (see Fig. 7). It is clear that Switzerland highly values its technology R&D.

.jpg)

Data source: FSO and OECD

Fig. 6 Percentage of Research Expenditures in Various Country Governments’ Total Expenditures (2008)

Data source: FSO and OECD

Fig. 7 Swiss Government Research Expenditures 2000-2010

1.Management of Swiss Technology R&D Budget

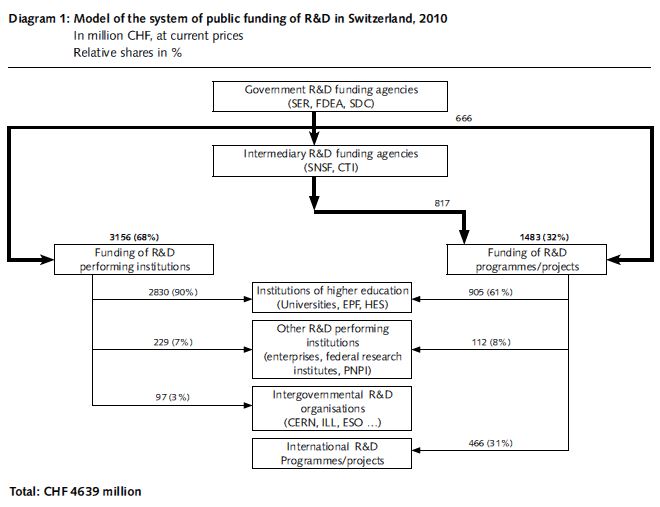

Swiss research expenditures are primarily allocated to the education, R&D and innovation areas, and play an important role in the Swiss innovation system. Therefore, a large part of the Swiss research expenditures are allocated to institutions of higher education, including ETH, universities, and UASs. The Swiss research expenditures are utilized by three hierarchies[16] (see Fig. 8):

- Government R&D funding agencies: The Swiss research budget is primarily executed by three agencies, including SERI, Federal Department of Economic Affairs, Education and Research, and Swiss Agency for Development and Cooperation (SDC).

- Intermediary R&D funding agencies: Including SNSC and CTI.

- Funding of R&D performing institutions: Including private enterprises, institutions of higher education and private non-profit-making business, et al.

Therefore, the Swiss Government research expenditures may be utilized by the Federal Government directly, or assigned to intermediary agencies, which will allocate the same to the R&D performing institutions. SERI will allocate the research expenditures to institutions of higher education and also hand a lot of the expenditures over to SNSF for consolidated funding to the basic science of R&D.

Data source: FSO

Fig. 8 Swiss Research Fund Utilization Mechanism

~to be continued~

[1] ORGANIZATION FOR ECONNOMIC CO-OPERATION AND DEVELOPMENT [OECD], OECD Reviews of Innovation Policy: Switzerland 27 (2006).

[2] As of January 1, 2013, the Federal Ministry of Economic Affairs was reorganized, and renamed into Federal Department of Economic Affairs, Education and Research (EAER).

[3] The Commission for Technology and Innovation CTI, THE COMMISSION FOR TECHOLOGY AND INNOVATION CTI, http://www.kti.admin.ch/org/00079/index.html?lang=en (last visited Jun. 3, 2013).

[4] Id.

[5] CTI INVEST, Swiss Venture Guide 2012 (2012), at 44, http://www.cti-invest.ch/getattachment/7f901c03-0fe6-43b5-be47-6d05b6b84133/Full-Version.aspx (last visited Jun. 4, 2013).

[6] CTI, CTI Activity Report 2012 14 (2013), available at http://www.kti.admin.ch/dokumentation/00077/index.html?lang=en&download=NHzLpZeg7t,lnp6I0NTU042l2Z6ln1ad1IZn4Z2qZpnO2Yuq2Z6gpJCDen16fmym162epYbg2c_JjKbNoKSn6A-- (last visited Jun. 3, 2013).

[7] CTI Voucher, THE COMMISSION FOR TECHOLOGY AND INNOVATION CTI, http://www.kti.admin.ch/projektfoerderung/00025/00135/index.html?lang=en (last visited Jun. 3, 2013).

[8] Id.

[9] CTI, CTI Activity Report 2011 20 (2012), available at http://www.kti.admin.ch/dokumentation/00077/index.html?lang=en&download=NHzLpZeg7t,lnp6I0NTU042l2Z6ln1ad1IZn4Z2qZpnO2Yuq2Z6gpJCDeYR,gWym162epYbg2c_JjKbNoKSn6A--(last visited Jun. 3, 2013).

[10] CTI Start-up Brings Science to Market, THE COMMISSION FOR TECHOLOGY AND INNOVATION CTI, http://www.ctistartup.ch/en/about/cti-start-/cti-start-up/ (last visited Jun. 5, 2013).

[11] Id.

[12] Supra note 8, at 45.

[13] Id.

[14] CTI Invest, http://www.cti-invest.ch/About/CTI-Invest.aspx (last visited Jun. 5, 2013).

[15] KTT Support, CTI, http://www.kti.admin.ch/netzwerke/index.html?lang=en (last visited Jun.5, 2013).

[16] Swiss Federal Statistics Office (SFO), Public Funding of Research in Switzerland 2000–2010 (2012), available at http://www.bfs.admin.ch/bfs/portal/en/index/themen/04/22/publ.Document.163273.pdf (last visited Jun. 20, 2013).

- Fig. 3 Venture Lab Startup Program [ png ]

- Fig. 4 Startup Plan Flow Chart [ png ]

- Fig. 5 Application of CTI Policy Instrument to Innovation Chain [ png ]

- Fig. 6 Percentage of Research Expenditures in Various Country Governments’ Total Expenditures (2008) [ jpg ]

- Fig. 7 Swiss Government Research Expenditures 2000-2010 [ png ]

- Fig. 8 Swiss Research Fund Utilization Mechanism [ jpg ]

I.Introduction Recently, many countries have attracted by Israel’s technology innovation, and wonder how Israel, resource-deficiency and enemies-around, has the capacity to enrich the environment for innovative startups, innovative R&D and other innovative activities. At the same time, several cross-border enterprises hungers to establish research centers in Israel, and positively recruits Israel high-tech engineers to make more innovative products or researches. However, there is no doubt that Israel is under the spotlight in the era of innovation because of its well-shaped national technology system framework, innovative policies of development and a high level of R&D expenditure, and there must be something to learn from. Also, Taiwanese government has already commenced re-organization lately, how to tightly connect related public technology sectors, and make the cooperation more closely and smoothly, is a critical issue for Taiwanese government to focus on. Consequently, by the observation of Israel’s national technology system framework and technology regulations, Israel’s experience shall be a valuable reference for Taiwanese government to build a better model for public technology sectors for future cooperation. Following harsh international competition, each country around the world is trying to find out the way to improve its ability to upgrade international competitiveness and to put in more power to promote technology innovation skills. Though, while governments are wondering how to strengthen their countries’ superiority, because of the differences on culture and economy, those will influence governments’ points of view to form an appropriate national innovative system, and will come with a different outcome. Israel, as a result of the fact that its short natural resources, recently, its stunning performance on technology innovation system makes others think about whether Israel has any characteristics or advantages to learn from. According to Israeli Central Bureau of Statistics records, Israel’s national expenditures on civilian R&D in 2013 amounted to NIS 44.2 billion, and shared 4.2% of the GDP. Compared to 2012 and 2011, the national expenditure on civilian R&D in 2013, at Israel’s constant price, increased by 1.3%, following an increase of 4.5% in 2012 and of 4.1% in 2011. Owing to a high level of national expenditure poured in, those, directly and indirectly, makes the outputs of Israel’s intellectual property and technology transfer have an eye-catching development and performance. Based on Israeli Central Bureau of Statistics records, in 2012-2013, approximately 1,438 IP invention disclosure reports were submitted by the researchers of various universities and R&D institutions for examination by the commercialization companies. About 1,019 of the reports were by companies at the universities, an increase of 2.2% compared to 2010-2011, and a 1% increase in 2010-2011 compared to 2008-2009. The dominant fields of the original patent applicants were medicines (24%), bio-technology (17%), and medical equipment (13%). The revenues from sales of intellectual property and gross royalties amounted to NIS 1,881 million in 2012, compared to NIS 1,680 million in 2011, and increase of 11.9%. The dominant field of the received revenues was medicines (94%). The revenues from sales of intellectual property and gross royalties in university in 2012 amounted to NIS 1,853 million in 2012, compared to NIS 1,658 million in 2011, an increase of 11.8%. Therefore, by the observation of these records, even though Israel only has 7 million population, compared to other large economies in the world, it is still hard to ignore Israel’s high quality of population and the energy of technical innovation within enterprises. II.The Recent Situation of Israel’s Technology Innovation System A.The Determination of Israel’s Technology Policy The direction and the decision of national technology policy get involved in a country’s economy growth and future technology development. As for a government sector deciding technology policy, it would be different because of each country’s government and administrative system. Compared to other democratic countries, Israel is a cabinet government; the president is the head of the country, but he/she does not have real political power, and is elected by the parliament members in every five years. At the same time, the parliament is re-elected in every four years, and the Israeli prime minister, taking charge of national policies, is elected from the parliament members by the citizens. The decision of Israel’s technology policy is primarily made by the Israeli Ministers Committee for Science and Technology and the Ministry of Science and Technology. The chairman of the Israeli Ministry Committee for Science and Technology is the Minister of Science and Technology, and takes charge of making the guideline of Israel’s national technology development policy and is responsible for coordinating R&D activities in Ministries. The primary function of the Ministry of Science and Technology is to make Israel’s national technology policies and to plan the guideline of national technology development; the scope includes academic research and applied scientific research. In addition, since Israel’s technology R&D was quite dispersed, it means that the Ministries only took responsibilities for their R&D, this phenomenon caused the waste of resources and inefficiency; therefore, Israel government gave a new role and responsibility for the Chief Scientists Forum under the Ministry of Science and Technology in 2000, and wished it can take the responsibility for coordinating R&D between the government’s sectors and non-government enterprises. The determination of technology policy, however, tends to rely on counseling units to provide helpful suggestions to make technology policies more intact. In the system of Israel government, the units playing a role for counseling include National Council for Research and Development (NCRD), the Steering Committee for Scientific Infrastructure, the National Council for Civil Research and Development (MOLMOP), and the Chief Scientists Forums in Ministries. Among the aforementioned units, NCRD and the Steering Committee for Scientific Infrastructure not only provide policy counseling, but also play a role in coordinating R&D among Ministries. NCRD is composed by the Chief Scientists Forums in Ministries, the chairman of Planning and Budgeting Committee, the financial officers, entrepreneurs, senior scientists and the Dean of Israel Academy of Sciences and Humanities. NCRD’s duties include providing suggestions regarding the setup of R&D organizations and related legal system, and advices concerning how to distribute budgets more effectively; making yearly and long-term guidelines for Israel’s R&D activities; suggesting the priority area of R&D; suggesting the formation of necessary basic infrastructures and executing the priority R&D plans; recommending the candidates of the Offices of Chief Scientists in Ministries and government research institutes. As for the Steering Committee for Scientific Infrastructure, the role it plays includes providing advices concerning budgets and the development framework of technology basic infrastructures; providing counsel for Ministries; setting up the priority scientific plans and items, and coordinating activities of R&D between academic institutes and national research committee. At last, as for MOLMOP, it was founded by the Israeli parliament in 2002, and its primary role is be a counseling unit regarding technology R&D issues for Israel government and related technology Ministries. As for MOLMOP’s responsibilities, which include providing advices regarding the government’s yearly and long-term national technology R&D policies, providing the priority development suggestion, and providing the suggestions for the execution of R&D basic infrastructure and research plans. B.The Management and Subsidy of Israel’s Technology plans Regarding the institute for the management and the subsidy of Israel’s technology plans, it will be different because of grantee. Israel Science Foundation (ISF) takes responsibility for the subsidy and the management of fundamental research plans in colleges, and its grantees are mainly focused on Israel’s colleges, high education institutes, medical centers and research institutes or researchers whose areas are in science and technical, life science and medicine, and humanity and social science. As for the budget of ISF, it mainly comes from the Planning and Budgeting Committee (PBC) in Israel Council for Higher Education. In addition, the units, taking charge of the management and the subsidy of technology plans in the government, are the Offices of the Chief Scientist in Ministries. Israel individually forms the Office of the Chief Scientist in the Ministry of Agriculture and Rural Development, the Ministry of Communications, the Ministry of Defense, the Ministry of National Infrastructures, Energy and Water Resources, the Ministry of Health and the Ministry of Economy. The function of the Office of the Chief Scientist not only promotes and inspires R&D innovation in high technology industries that the Office the Chief Scientist takes charge, but also executes Israel’s national plans and takes a responsibility for industrial R&D. Also, the Office of the Chief Scientist has to provide aid supports for those industries or researches, which can assist Israel’s R&D to upgrade; besides, the Office of the Chief Scientists has to provide the guide and training for enterprises to assist them in developing new technology applications or broadening an aspect of innovation for industries. Further, the Office of the Chief Scientists takes charge of cross-country R&D collaboration, and wishes to upgrade Israel’s technical ability and potential in the area of technology R&D and industry innovation by knowledge-sharing and collaboration. III.The Recent Situation of the Management and the Distribution of Israel’s Technology Budget A.The Distribution of Israel’s Technology R&D Budgets By observing Israel’s national expenditures on civilian R&D occupied high share of GDP, Israel’s government wants to promote the ability of innovation in enterprises, research institutes or universities by providing national resources and supports, and directly or indirectly helps the growth of industry development and enhances international competitiveness. However, how to distribute budgets appropriately to different Ministries, and make budgets can match national policies, it is a key point for Israel government to think about. Following the Israeli Central Bureau of Statistics records, Israel’s technology R&D budgets are mainly distributed to some Ministries, including the Ministry of Science and Technology, the Ministry of Economy, the Ministry of Agriculture and Rural Development, the Ministry of National Infrastructures, Energy and Water Resources, the Israel Council for Higher Education and other Ministries. As for the share of R&D budgets, the Ministry of Science and Technology occupies the share of 1.7%, the Ministry of Economy is 35%, the Israel Council for Higher Education is 45.5%, the Ministry of Agriculture and Rural Development is 8.15%, the Ministry of National Infrastructures, Energy and Water Resources is 1.1%, and other Ministries are 7.8% From observing that Israel R&D budgets mainly distributed to several specific Ministries, Israel government not only pours in lot of budgets to encourage civilian technology R&D, to attract more foreign capitals to invest Israel’s industries, and to promote the cooperation between international and domestic technology R&D, but also plans to provide higher education institutes with more R&D budgets to promote their abilities of creativity and innovation in different industries. In addition, by putting R&D budgets into higher education institutes, it also can indirectly inspire students’ potential innovation thinking in technology, develop their abilities to observe the trend of international technology R&D and the need of Israel’s domestic industries, and further appropriately enhance students in higher education institutes to transfer their knowledge into the society. B.The Management of Israel’s Technology R&D Budgets Since Israel is a cabinet government, the cabinet takes responsibility for making all national technology R&D policies. The Ministers Committee for Science and Technology not only has a duty to coordinate Ministries’ technology policies, but also has a responsibility for making a guideline of Israel’s national technology development. The determination of Israel’s national technology development guideline is made by the cabinet conference lead by the Prime Minister, other Ministries does not have any authority to make national technology development guideline. Aforementioned, Israel’s national technology R&D budgets are mainly distributed to several specific Ministries, including the Ministry of Science and Technology, the Ministry of Economy, the Ministry of Agriculture and Rural Development, the Ministry of National Infrastructures, Energy and Water Resources, the Israel Council for Higher Education, and etc. As for the plan management units and plan execution units in Ministries, the Office of the Chief Scientist is the plan management unit in the Ministry of Science and Technology, and Regional Research and Development Centers is the plan execution unit; the Office of the Chief Scientist is the plan management unit in the Ministry of Economy, and its plan execution unit is different industries; the ISF is the plan management units in the Israel Council for Higher Education; also, the Office of the Chief Scientist is the plan management unit in the Ministry of Agriculture, and its plan execution units include the Institute of Field and Garden Corps, the Institute of Horticulture, the Institute of Animal, the Institute of Plan Protection, the Institute of Soil, Water & Environmental Sciences, the Institute for Technology and Storage of Agriculture Products, the Institute of Agricultural Engineering and Research Center; the Office of the Chief Scientist is the plan management unit in the Ministry of National Infrastructures, Energy and Water Resources, and its plan execution units are the Geological Survey of Israel, Israel Oceanographic and Limnological Research and the Institute of Earth and Physical. As for other Ministries, the Offices of the Chief Scientist are the plan management units for Ministries, and the plan execution unit can take Israel National Institute for Health Policy Research or medical centers for example.

Introducing and analyzing the Scope and Benefits of the Regulation「Statute for Upgrading Industries」in The Biotechnology Industry in TaiwanThe recent important regulation for supporting the biopharmaceutical industry in Taiwan has been the 「Statute for Upgrading Industries」 (hereinafter referred to as 「the Statute」).The main purpose of the Statue is for upgrading all industry for future economic development, so it applies to various industries, ranging from agriculture, industrial and service businesses. In other words, the Statute does not offer incentive measures to biopharmaceutical industry in particular, but focuses on promoting the industry development in general. Statute for Upgrading Industry and Related Regulations Generally speaking, the Statute has a widespread influence on industry development in Taiwan. The incentive measures provided in the Statute is complicated and covered other related regulations under its legal framework. Thus, the article will be taking a multi-facet perspective in discussing the how Statute relates to the biopharmaceutical industry. 1 、 Scope of Application According to Article 1 of the Statute, the term 「industries」 refers to agricultural, industrial and service businesses. Consequently, nearly all kinds of industries fall under this definition, and the Statute is applicable to all of them. Moreover, in order to promote the development and application of emerging technology as well as cultivating the recognized industry, the Statute provides much more favorable terms to these industries. These emerging and major strategic industries includes computer, communication and consumer electronics (3C), precise mechanics and automation, aerospace, biomedical and chemical production, green technology, material science, nanotechnology, security and other product or service recognized by the Executive Yuan. 2 、 Tax Benefits The Statute offers several types of tax benefits, so the industry could receive sufficient reward in every way it could, and promote a sound cycle in creating new values through these benefits. (1) Benefits for the purchase of automation equipment The said procured equipment and technology over NTD600, 000 may credit a certain percentage of the investment against the amount of profit-seeking enterprise income tax payable for the then current year. For the purchase of production technology, 5% may be credited. For the purchase of equipment, 7% may be credited. And any investment plan that includes the purchasing of equipment for automation can qualify for a low-interest preferential loan. Besides, for science-based industrial company imported overseas equipment that is not manufacture by local manufactures, from January 1, 2002, the imported equipment shall be exempted from import and business tax. And if the company is a bonded factory, the raw materials to be imported from abroad by it shall also be exempt from import duties and business tax. (2) Benefits for R&D expenditure Expenditure concurred for developing new products, improving production technology, or improving label-providing technology may credit 30%of the investment against the amount of profit-seeking enterprise income tax payable for the then current year. Research expenditures of the current year exceeding the average research expenditure for the past two years, the excess in research expenditure shall be 50% deductible. Instruments and equipments purchased by for exclusive R&D purpose, experimentation, or quality inspection may be accelerated to two years. At last, Biotech and New Pharmaceuticals Company engages in R&D activities, such as Contract research Organization (CRO), may credit 30% of the investment against the amount of profit-seeking enterprise income tax payable. (3) Personnel Training When a company trained staff and registered for business-related course, may credit 30% of the training cost against the amount of profit-seeking enterprise income tax payable for the then current year. Where training expenses for the current year exceeds the two-year average, 50% of the excess portion may be credited. (4) Benefit for Newly Emerging Strategic Industries Corporate shareholders invest in newly emerging strategic industries are entitled to select one of the following tax benefits: A profit seeking enterprise may credit up to 20% of the price paid for acquisition of such stock against the profit seeking enterprise income tax. An individual may credit up to 10%. As of January and once every year, there will be a 1% reduction of the price paid for acquisition of such stock against the consolidated income tax payable in the then current year. A company, within two years from the beginning date for payment of the stock price by its shareholders, selects, with the approval of its shareholder meeting, the application of an exemption from profit-seeking enterprise income tax and waives the shareholders investment credit against payable income tax as mentioned above. However, that once the selection is made, no changes shall be allowed. (5) Benefits for Investment in Equipment or Technology Used for Pollution Control To prevent our environment from further pollution, the Government offers tax benefits to reward companies in making improvements. Investment in equipment or technology used for pollution control may credit 7% of the equipment expenditure, and 5% of the expenditure on technology against the amount of profit-seeking enterprise income tax payable for the then current year. For any equipment that has been verified in use and specialized in air pollution control, noise pollution control, vibration control, water pollution control, environmental surveillance and waste disposal, shall be exempt from import duties and business tax. And for investment plans that planned implementation of energy saving systems can apply for a low interest loan. (6) Incentive for Operation Headquarter To encourage companies to utilize worldwide resources and set up international operation network, if they established operation headquarters within the territory of the Republic of China reaching a specific size and bringing about significant economic benefit, their following incomes shall be exempted from profit-seeking enterprise income tax: The income derived from provision of management services or R&D services. The royalty payment received under its investments to its affiliates abroad. The investment return and asset disposal received under its investment to its affiliates abroad. (7) Exchange of Technology for Stock Option The emerging-industrycompany recognized by government, upon adoption of a resolution by a majority voting of the directors present at a meeting of its board of directors attended by two-thirds of the directors of the company, may issue stock options to corporation or individual in exchange for authorization or transfer of patent and technologies. (8) Deferral of Taxes on the Exchange of Technology for Shares Taxes on income earned by investors from the acquisition of shares in emerging-industry companies in exchange for technology will be deferred for five years, on condition that the shares exchanged for technology amount to more than 20% of the company's total stock equity and that the number of persons who obtain shares in exchange for technology does not exceed five. 3 、 Technical Assistance and Capital Investment The rapid industry development has been closely tied to the infusion of funds. In addition to tax benefits, the Statute incorporates regulations especially for technical assistance and capital investment as below: (1) In order to introduce or transfer advanced technologies, technical organization formed with the contribution of government shall provide appropriate technical assistance as required. (2) In order to advance technologies, enhance R&D activities and further upgrade industries, the relevant central government authorities in charge of end enterprises may promote the implementation of industrial and technological projects by providing subsidies to such R&D projects. (3) In order to assist the start-up of domestic small-medium technological enterprises and the overall upgrading of the entire industries, guidance and assistance shall be provided for the development of venture capital enterprises.

Taiwan Planed Major Promoting Program for Biotechnology and Pharmaceutical IndustryTaiwan Government Lauched the “Biotechnology Action Plan” The Taiwan Government has planned to boost the support and develop local industries across the following six major sectors: biotechnology, tourism, health care, green energy, innovative culture and post-modern agriculture. As the biotechnology industry has reached its maturity by the promulgation of "Biotech and New Pharmaceutical Development Act" in July, 2007, it will be the first to take the lead among the above sectors. Thus, the Executive Yuan has launched the Biotechnology Action Plan as the first project in building the leading industry sectors, to upgrade local industries and stimulate future economic growth. Taiwan Government Planed to Promote the Biotechnology and Other newly Industries by Investing Two Hundred Billion To expand every industrial scale, enhance industrial value, increase the value around the main industrial field, and to encourage the industrial development by government investments for creating the civil working opportunities to reach the goal of continuous economic development, the Executive Yuan Economic Establishment commission has expressed that, the government has selected six newly industrials including "Biotechnology", "Green Energy", "Refined Agriculture", "Tourism", "Medicare", and "Culture Originality" on November 19, 2009 to promote our national economic growth. The government will invest two hundred billion NT dollars to support the industrial development aggressively and to enhance the social investments from year 2009 to 2012. According to a Chung-Hua Institution for Economic Research report, the future growth rate will reach 8.16% after the evaluation, Hence, the future of the industries seems to be quite bright. Currently, the government plans to put money into six newly industries through the existing ways for investment. For instance, firstly, in accordance with the "Act For The Development Of Biotech And New Pharmaceuticals Industry" article 5 provision 1 ",for the purpose of promoting the Biotech and New Pharmaceuticals Industry, a Biotech and New Pharmaceuticals Company may, for a period of five years from the time it is subject to corporate income tax, enjoy a reduction in its corporate income tax payable for up to thirty-five percent (35%) of the total funds invested in research and development ("R&D") and personnel training each year; provided, however, that if the R&D expenditure of a particular year exceeds the average R&D expenditure of the previous two years or if the personnel training expenditure of a particular year exceeds the average personnel training expenditure of the previous two years, fifty percent (50%) of the amount in excess of the average may be used to credit against the amount of corporate income tax payable. Secondly, according to same act of the article 6 provision 1 ", in order to encourage the establishment or expansion of Bio tech and New Pharmaceuticals Companies, a profit-seeking enterprise that (i) subscribes for the stock issued by a Biotech and New Pharmaceuticals Company at the time of the latter's establishment or subsequent expansion; and (ii) has been a registered shareholder of the Biotech and New Pharmaceuticals Company for a period of three (3) years or more, may, for a period of five years from the time it is subject to corporate income tax, enjoy a reduction in its corporate income tax payable for up to twenty percent (20%) of the total amount of price paid for the subscription of shares in such Biotech and New Pharmaceuticals Company; provided that such Biotech and New Pharmaceuticals Company has not applied for exemption from corporate income tax or shareholders investment credit based on the subscription price under other applicable laws and regulations. Thirdly, to promote the entire biotechnological industry development, the government has drafted the "Biotechnology Takeoff Package" for subsidizing the startup´s social investment companies which can satisfy the conditions to invest in "Drug discovery", "Medical Device" or other related biotech industries up to 5 billion with the capital invest in domestic industry over 50%, , with operating experience of multinational biotech investment companies with capital over 150 million in related industrial fields, and with the working experiences of doctor accumulated up to 60 years. Additionally, the refined agriculture industry field has not only discovered the gene selected products, but also combined the tourism with farming business for new business model creation. According to the "Guidelines for Preferential Loans for the Upgrading of Tourism Enterprises" point 4 provision 1, the expenditure for spending on machine, instruments, land or repairing can be granted a preferential loan in accordance with the rule of point 6, and government will provide a subsidy of interest for loaning Tourism Enterprises with timely payments. At last, Council for Economic Planning and Development also points out because most of technology industry has been impacted seriously by fluctuation of international prosperity due to conducting the export trade oriented strategy. Furthermore, the aspects of our export trade of technology industry have been impacted by the U.S. financial crisis and the economic decay in EU and US; and the industrial development seems to face the problem caused by over centralization in Taiwan. Hence, the current framework of domestic industry should be rearranged and to make it better by promoting the developmental project of six newly industries. Taiwan Government Had Modifies Rules to Accelerate NDA Process and Facilitate Development of Clinical Studies in Taiwan In July 2007, the "Biotech and New Pharmaceutical Development Act" modified many regulations related to pharmaceutical administration, taxes, and professionals in Taiwan. In addition, in order to facilitate the development of the biotechnology and pharmaceutical industries, the government has attempted to create a friendly environment for research and development by setting up appropriate regulations and application systems. These measures show that the Taiwanese government is keenly aware that these industries have huge potential value. To operate in coordination with the above Act and to better deal with the increasing productivity of pharmaceutical R&D programs in Taiwan, the Executive Yuan simplified the New Drug Application (NDA) process to facilitate the submission that required Certificate of Pharmaceutical Product (CPP) for drugs with new ingredients. The current NDA process requires sponsors to submit documentation as specified by one of the following four options: (1) three CPPs from three of "ten medically-advanced countries," including Germany, the U.S., England, France, Japan, Switzerland, Canada, Australia, Belgium, and Sweden; (2) one CPP from the U.S., Japan, Canada, Australia, or England and one CPP from Germany, France, Switzerland, Sweden, or Belgium; (3) a Free Sale Certificate (FSC) from one of ten medically-advanced countries where the pharmaceuticals are originally produced and one CPP from one of the other nine countries; or (4) a CPP from the European Medicines Agency. Thus, the current NDA process requires sponsors to spend inordinate amounts of time and incur significant costs to acquire two or three FSCs or CPPs from ten medically-advanced countries in order to submit an NDA in Taiwan. According to the new rules, sponsors will not have to submit above CPPs if (1) Phase I clinical studies have been conducted in Taiwan, and Phase III Pivotal Trial clinical studies have been simultaneously conducted both in Taiwan and in another country or (2) Phase II and Phase III Pivotal Trial clinical studies have been simultaneously conducted both in Taiwan and in another country. Besides, the required minimum numbers of patients were evaluated during each above phase. Therefore, sponsors who conduct clinical studies in Taiwan and in another country simultaneously could reduce their costs and shorten the NDA process in Taiwan. The new rules aim to encourage international pharmaceutical companies to conduct clinical studies in Taiwan or to conduct such studies cooperatively with Taiwanese pharmaceutical companies. Such interactions will allow Taiwanese pharmaceutical companies to participate in development and implementation of international clinical studies in addition to benefiting from the shortened NDA process. Therefore, the R&D abilities and the internationalization of the Taiwanese pharmaceutical industry will be improved.

Finland’s Technology Innovation SystemI. Introduction When, Finland, this country comes to our minds, it is quite easy for us to associate with the prestigious cell-phone company “NOKIA”, and its unbeatable high technology communication industry. However, following the change of entire cell-phone industry, the rise of smart phone not only has an influence upon people’s communication and interaction, but also makes Finland, once monopolized the whole cell-phone industry, feel the threat and challenge coming from other new competitors in the smart phone industry. However, even though Finland’s cell-phone industry has encountered frustrations in recent years in global markets, the Finland government still poured many funds into the area of technology and innovation, and brought up the birth of “Angry Birds”, one of the most popular smart phone games in the world. The Finland government still keeps the tradition to encourage R&D, and wishes Finland’s industries could re-gain new energy and power on technology innovation, and indirectly reach another new competitive level. According to the Statistics Finland, 46% Finland’s enterprises took innovative actions upon product manufacturing and the process of R&D during 2008-2010; also, the promotion of those actions not merely existed in enterprises, but directly continued to the aspect of marketing and manufacturing. No matter on product manufacturing, the process of R&D, the pattern of organization or product marketing, we can observe that enterprises or organizations make contributions upon innovative activities in different levels or procedures. In the assignment of Finland’s R&D budgets in 2012, which amounted to 200 million Euros, universities were assigned by 58 million Euros and occupied 29% R&D budgets. The Finland Tekes was assigned by 55 million Euros, and roughly occupied 27.5% R&D budgets. The Academy of Finland (AOF) was assigned by 32 million Euros, and occupied 16% R&D budges. The government’s sectors were assigned by 3 million Euros, and occupied 15.2% R&D budgets. Other technology R&D expenses were 2.1 million Euros, and roughly occupied 10.5% R&D. The affiliated teaching hospitals in universities were assigned by 0.36 million Euros, and occupied 1.8% R&D budgets. In this way, observing the information above, concerning the promotion of technology, the Finland government not only puts more focus upon R&D innovation, but also pays much attention on education quality of universities, and subsidizes various R&D activities. As to the Finland government’s assignment of budges, it can be referred to the chart below. As a result of the fact that Finland promotes industries’ innovative activities, it not only made Finland win the first position in “Growth Competitiveness Index” published by the World Economic Forum (WEF) during 2000-2006, but also located the fourth position in 142 national economy in “The Global Competitiveness Report” published by WEF, preceded only by Swiss, Singapore and Sweden, even though facing unstable global economic situations and the European debt crisis. Hence, observing the reasons why Finland’s industries have so strong innovative power, it seems to be related to the Finland’s national technology administrative system, and is worthy to be researched. II. The Recent Situation of Finland’s Technology Administrative System A. Preface Finland’s administrative system is semi-presidentialism, and its executive power is shared by the president and the Prime Minister; as to its legislative power, is shared by the Congress and the president. The president is the Finland’s leader, and he/she is elected by the Electoral College, and the Prime Minister is elected by the Congress members, and then appointed by the president. To sum up, comparing to the power owned by the Prime Minister and the president in the Finland’s administrative system, the Prime Minister has more power upon executive power. So, actually, Finland can be said that it is a semi-predisnetialism country, but trends to a cabinet system. Finland technology administrative system can be divided into four parts, and the main agency in each part, based upon its authority, coordinates and cooperates with making, subsidizing, executing of Finland’s technology policies. The first part is the policy-making, and it is composed of the Congress, the Cabinet and the Research and Innovation Council; the second part is policy management and supervision, and it is leaded by the Ministry of Education and Culture, the Ministry of Employment and the Economy, and other Ministries; the third part is science program management and subsidy, and it is composed of the Academy of Finland (AOF), the National Technology Agency (Tekes), and the Finnish National Fund Research and Development (SITRA); the fourth part is policy-executing, and it is composed of universities, polytechnics, public-owned research institutions, private enterprises, and private research institutions. Concerning the framework of Finland’s technology administrative, it can be referred to below. B. The Agency of Finland’s Technology Policy Making and Management (A) The Agency of Finland’s Technology Policy Making Finland’s technology policies are mainly made by the cabinet, and it means that the cabinet has responsibilities for the master plan, coordinated operation and fund-assignment of national technology policies. The cabinet has two councils, and those are the Economic Council and the Research and Innovation Council, and both of them are chaired by the Prime Minister. The Research and Innovation Council is reshuffled by the Science and Technology Policy Council (STPC) in 1978, and it changed name to the Research and Innovation Council in Jan. 2009. The major duties of the Research and Innovation Council include the assessment of country’s development, deals with the affairs regarding science, technology, innovative policy, human resource, and provides the government with aforementioned schedules and plans, deals with fund-assignment concerning public research development and innovative research, coordinates with all government’s activities upon the area of science, technology, and innovative policy, and executes the government’s other missions. The Research and Innovation Council is an integration unit for Finland’s national technology policies, and it originally is a consulting agency between the cabinet and Ministries. However, in the actual operation, its scope of authority has already covered coordination function, and turns to direct to make all kinds of policies related to national science technology development. In addition, the consulting suggestions related to national scientific development policies made by the Research and Innovation Council for the cabinet and the heads of Ministries, the conclusion has to be made as a “Key Policy Report” in every three year. The Report has included “Science, Technology, Innovation” in 2006, “Review 2008” in 2008, and the newest “Research and Innovation Policy Guidelines for 2011-2015” in 2010. Regarding the formation and duration of the Research and Innovation Council, its duration follows the government term. As for its formation, the Prime Minister is a chairman of the Research and Innovation Council, and the membership consists of the Minister of Education and Science, the Minister of Economy, the Minister of Finance and a maximum of six other ministers appointed by the Government. In addition to the Ministerial members, the Council shall comprise ten other members appointed by the Government for the parliamentary term. The Members must comprehensively represent expertise in research and innovation. The structure of Council includes the Council Secretariat, the Administrative Assistant, the Science and Education Subcommittee, and the Technology and Innovation Subcommittee. The Council has the Science and Education Subcommittee and the Technology and Innovation Subcommittee with preparatory tasks. There are chaired by the Ministry of Education and Science and by the Minister of Economy, respectively. The Council’s Secretariat consists of one full-time Secretary General and two full-time Chief Planning Officers. The clerical tasks are taken care of at the Ministry of Education and Culture. (B) The Agency of Finland’s Technology Policy Management The Ministries mainly take the responsibility for Finland’s technology policy management, which includes the Ministry of Education and Culture, the Ministry of Employment and Economy, the Ministry of Social Affairs and Health, the Ministry of Agriculture and Forestry, the Ministry of Defense, the Ministry of Transport and Communication, the Ministry of Environment, the Ministry of Financial, and the Ministry of Justice. In the aforementioned Ministries, the Ministry of Education and Culture and the Ministry of Employment and Economy are mainly responsible for Finland national scientific technology development, and take charge of national scientific policy and national technical policy, respectively. The goal of national scientific policy is to promote fundamental scientific research and to build up related scientific infrastructures; at the same time, the authority of the Ministry of Education and Culture covers education and training, research infrastructures, fundamental research, applied research, technology development, and commercialization. The main direction of Finland’s national scientific policy is to make sure that scientific technology and innovative activities can be motivated aggressively in universities, and its objects are, first, to raise research funds and maintain research development in a specific ratio; second, to make sure that no matter on R&D institutions or R&D training, it will reach fundamental level upon funding or environment; third, to provide a research network for Finland, European Union and global research; fourth, to support the research related to industries or services based upon knowledge-innovation; fifth, to strengthen the cooperation between research initiators and users, and spread R&D results to find out the values of commercialization, and then create a new technology industry; sixth, to analyze the performance of national R&D system. As for the Ministry of Employment and Economy, its major duties not only include labor, energy, regional development, marketing and consumer policy, but also takes responsibilities for Finland’s industry and technical policies, and provides industries and enterprises with a well development environment upon technology R&D. The business scope of the Ministry of Employment and Economy puts more focus on actual application of R&D results, it covers applied research of scientific technology, technology development, commercialization, and so on. The direction of Finland’s national technology policy is to strengthen the ability and creativity of industries’ technology development, and its objects are, first, to develop the new horizons of knowledge with national innovation system, and to provide knowledge-oriented products and services; second, to promote the efficiency of the government R&D funds; third, to provide cross-country R&D research networks, and support the priorities of technology policy by strengthening bilateral or multilateral cooperation; fourth, to raise and to broaden the efficiency of research discovery; fifth, to promote the regional development by technology; sixth, to evaluate the performance of technology policy; seventh, to increase the influence of R&D on technological change, innovation and society; eighth, to make sure that technology fundamental structure, national quality policy and technology safety system will be up to international standards. (C) The Agency of Finland’s Technology Policy Management and Subsidy As to the agency of Finland’s technology policy management and subsidy, it is composed of the Academy of Finland (AOF), the National Technology Agency (Tekes), and the Finnish National Fund Research and Development (SITRA). The fund of AOF comes from the Ministry of Education and Culture; the fund of Tekes comes from the Ministry of Employment and Economy, and the fund of SITRA comes from independent public fund supervised by the Finland’s Congress. (D) The Agency of Finland’s Technology Plan Execution As to the agency of Finland’s technology plan execution, it mainly belongs to the universities under Ministries, polytechnics, national technology research institutions, and other related research institutions. Under the Ministry of Education and Culture, the technology plans are executed by 16 universities, 25 polytechnics, and the Research Institute for the Language of Finland; under the Ministry of Employment and Economy, the technology plans are executed by the Technical Research Centre of Finland (VTT), the Geological Survey of Finnish, the National Consumer Research Centre; under the Ministry of Social Affairs and Health, the technology plans are executed by the National Institute for Health and Welfare, the Finnish Institute of Occupational Health, and University Central Hospitals; under the Ministry of Agriculture and Forestry, the technology plans are executed by the Finnish Forest Research Institute (Metla), the Finnish Geodetic Institute, and the Finnish Game and Fisheries Research Institute (RKTL); under the Ministry of Defense, the technology plans are executed by the Finnish Defense Forces’ Technical Research Centre (Pvtt); under the Ministry of Transport and Communications, the technology plans are executed by the Finnish Meteorological Institute; under the Ministry of Environment, the technology plans are executed by the Finnish Environment Institute (SYKE); under the Ministry of Financial, the technology plans are executed by the Government Institute for Economic Research (VATT). At last, under the Ministry of Justice, the technology plans are executed by the National Research Institute of Legal Policy.

- Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

- The Demand of Intellectual Property Management for Taiwanese Enterprises

- Blockchain in Intellectual Property Protection

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

- Recent Federal Decisions and Emerging Trends in U.S. Defend Trade Secrets Act Litigation

- The effective and innovative way to use the spectrum: focus on the development of the "interleaved/white space"

- Copyright Ownership for Outputs by Artificial Intelligence

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System