The Demand of Intellectual Property Management for Taiwanese Enterprises

Science & Technology Law Institute (STLI), Institute for Information Industry has conducted the survey of “The current status and demand of intellectual property management for Taiwanese enterprises” to listed companies for consecutive four years since 2012. Based on the survey result, three trends of intellectual property management for Taiwanese enterprises have been found and four recommendations have been proposed with detail descriptions as below.

Background Since 1990, many countries like United States, Japan and EU understand that intellectual properties create higher value added than tangible assets do so these countries respectively transformed their economic types to knowledge-based economy so as to boost economic growth and competitiveness. For example, Japan has legislated “Intellectual Property Basic Act” in 2002 and established “the Intellectual Property Strategy Headquarters” in 2003. United States legislated “Prioritizing Resources and Organization for Intellectual Property Act (PRO-IP Act)” in 2008. China also announced “National Intellectual Property Strategic Principles” in June, 2008. Following the above international tendency of protecting intellectual properties, Korea government has promoted intellectual property related policies and legislated related acts since 2000, such as “Technology Transfer Promotion Act” in 2000, policy of supporting patent disputes settlements and shortened the length of patent examination procedure in 2004. Besides, on June 27, 2006, the Presidential Advisory Council on Education, Science and Technology (PACEST) announced “Strategy for Intellectual Property System Constructing Plan.” However, these policies or acts mainly focus on the protection and application of patent rights, not relate to other kinds of intellectual property rights such as trademark right, copyright etc. Until 2008, in order to advance the ability of national competition, Lee Myung-bak government had established “Presidential Council on National Competitiveness (PCNC)”. For the vision of transforming to the intellectual property based economy, the PCNC held its 15th meeting on July 29, 2009. The meeting, held at the Blue House, was attended by the president, the Chairman, and members of the Council. One of the agenda of the meeting is strategies for an intellectual property (IP) powerhouse to realize a creative economy. Three goals of the strategies includes being IP Top 5 nations (U.S., Japan, EU, Korea and China), improving technology balance of payments deficits, and enhancing the scale of copyright industry. Next, this study will introduce details of Korea IP related strategies for our nation’s reference. Introduction Korea IP strategy consists of 3 aspects (creation and application, law and regulation, infrastructure) and 11 missions. And the contents of 11 missions cover the creation, protection and application of intellectual property rights (patent, copyright, trademark, plant variety etc), namely the whole life cycle of intellectual property rights. Through announcement of IP Strategies, Korea hopes to protect intellectual property rights from every aspect and makes IP as essential driving force for national economic growth. 1. Creation and Application Aspect First, although the quantity of intellectual property rights (IPRs) of Korea is rapidly increased in recent years, the quality of intellectual property rights is not increased equally. Also, most of researchers do not receive appropriate rewards from R&D institutions, and then it might reduce further innovation. As above reasons, Korea IP strategy indicated that the government will raise “invention capital” to exploit, buy researchers’ new ideas, and make those ideas get legal protection. That is, the government will set up non-practicing entities (NPEs) with private business. The NPEs would buy intellectual properties from R&D institutions or researchers, and then license to enterprises who have need. After licensing, NPEs will share royalty which obtained from enterprises (licensees) with researchers appropriately. Besides, in order to encourage university, public R&D institutions to set up “technology holdings”, Korea government had amended “Industry Education and Corporation of Industry, Academic and Research Promotion Act”. The amendments are loosening establishment conditions of technology holdings, such as minimum portion of investment in technology has been lowered from 50% to 30%, and broadening the scope of business of technology holdings. 2. Law and Regulation Aspect Secondly, in aspect of law and regulation, in addition to encouraging creation of good quality of IP, Korea considers that intellectual property rights are needed to be protected legally. Therefore, the IP strategy especially pointed out that Korea would follow the example of Japan to legislate their own “Intellectual Property Basic Act”. According to Korea “Intellectual Property Basic Act”, it should establish a “Presidential Council on Intellectual Property”. The main work of this Council is planning and promoting intellectual property related policies. There are 5 chapters and 41 articles in Korea “Intellectual Property Basic Act”. The Act like Korea IP strategy is divided into three parts, that is, “creation and application”, “protection” and “infrastructure”. In fact, the legislation of Korea “Intellectual Property Basic Act” embodies the policies of IP strategy. Further, according to Korea “Intellectual Property Basic Act”, “Presidential Council on Intellectual Property” is to integrate IP related affairs of the administrations into one action plan and promote it. Moreover, according to Korea “Intellectual Property Basic Act”, the government should make medium-term and long-term policies and basic plans for the promotion of intellectual properties every 5 years and adjusts policies and plans periodically as well. Through framing, enacting and adjusting policies and plans, Korea expects to create a well-living environment for the development of intellectual property. 3. Infrastructure Aspect Thirdly, even if good laws and regulations are already made and more government budget and human resource are invested, Korea is still deficient in well-prepared social infrastructure and leads to the situation that any promoting means of intellectual properties will be in vain. With regard to one of visions of Korea IP strategy,” being IP Top 5 power (U.S., Japan, EU, Korea and China)”, on the one hand, Korea domestic patent system should harmonize with international intellectual property regulations that includes loosening the conditions of application and renewal of patent and trademark. On the other hand, the procedure of patent application conforms to the international standard, that is, the written form of USA patent application becomes similar to the forms of world IP Top 3 power (U.S., Japan and EU) and member states of Paten Law Treaty (PLT). At the same time, Korea would join “Patent Prosecution Highway (PPH)” to enable Korea enterprises to acquire protection of patent rights around the world more rapidly. In addition, about the investigation of infringement of intellectual property rights, Korea IP strategy stated that it would strengthen control measures on nation border and broaden IP protection scope from only patent to trademark, copyright and geographical indications. Besides, Korea uses network technology to develop a 24-hour online monitoring system to track fakes and illegal copies. In addition to domestic IP protection, Korea enterprises may face IP infringement at overseas market, thus Korea government has provided supports for intellectual property rights disputes. For this sake, Korea choose overseas market such as Southeast Asia, China, and North America etc to establish “IP Desk” and “Copyright Center” for providing IP legal consultation, support of dispute-resolving expenses and information services for Korea enterprises. Korea IP strategy partially emphasizes on the copyright trading system As mentioned above, one of visions of Korea IP strategy is “enhancing the development of copyright industry”. It’s well-known that Korea culture industries like music, movie, TV, online game industries are vigorous in recent years. Those culture industries are closely connected to copyright, so development of copyright industry is set as priority policy of Korea. In order to enhance the development of Korea copyright industry, a well-trading environment or platform is necessary so as to make more copyrighted works to be exploited. Therefore, Korea Copyright Commission has developed “Integrated Copyright Number (ICN)” that is identification number for digital copyrighted work. Author or copyright owners register copyright related information on “Copyright Integrated Management System (CIMS)” which manages information of copyrighted works provided by the authors or copyright owners, and CIMS would give an ICN number for the copyrighted work, so that users could through the ICN get license easily on “Copyright License Management System (CLMS)” which makes transactions between licensors and licensees. By distributing ICN to copyrighted works, not only the licensee knows whom the copyright belongs to, but the CLMS would preserve license contracts to ensure legality of the licensee’s copyright. After copyright licensing, because of characteristic of digital and Internet, it makes illegal reproductions of copyrighted works easily and copyright owners are subject to significant damages. For this reason, Korea Ministry of Culture, Sports and Tourism (MCST) and Korea Intellectual property Office (KIPO) have respectively developed online intellectual property (copyright and trademark) monitoring system. The main purpose of these two systems is assisting copyright and trademark owners to protect their interests by collecting and analyzing infringement data, and then handing over these data to the judiciary. Conclusion Korea IP strategy has covered all types of intellectual properties clearly. The strategy does not emphasize only on patent, it also includes copyright, trademark etc. If Taiwan wants to transform the economic type to IP-based economy, like Korea, offering protection to other intellectual property rights should not be ignored, too. As Taiwan intends to promote cultural and creative industry and shows soft power of Taiwan around the world, the IP strategy of Taiwan should be planned more comprehensively in the future. In addition to protecting copyrights by laws and regulations, for cultural and creative industry, trading of copyrights is equally important. The remarkable part of Korea IP strategy is the construction of copyright online trading platform. Accordingly, Taiwan should establish our own copyright online trading platform combining copyright registration and source identification system, and seriously consider the feasibility of giving registered copyright legal effects. A well-trading platform integrating registration and source identification system might decrease risks during the process of licensing the copyright. At the same time, many infringements of copyrights are caused because of the nature of the modern network technology. In order to track illegal copies on the internet, Taiwan also should develop online monitoring system to help copyright owners to collect and preserve infringement evidences. In sum, a copyright trading system (including ICN and online intellectual property monitoring system) could reinforce soft power of Taiwan cultural and creative industry well.

Brief Overview of the Recent Progress of the TIPS Project and Important Developments of Taiwan’s IP Protection EnvironmentChien-Shan Chiu I. Introduction Taiwan, a country with limited natural resources, has been seen to create rapid economic development for the past few decades. This achievement has been praised as an “economic miracle” and making Taiwan one of Asia’s “Four Tigers1”. The success is a result of the tremendous hard work and efforts exerted by the local people and enterprises and the forward-looking national policies initiated by the government. Recognizing fast technology breakthroughs and globalization trend are going to have major impacts on the traditional ways of managing business and may as a result change the current competitive landscape, the government of Taiwan has promoted vigorously of transforming Taiwan into a “green silicon island” with high value-added production2. The goal is to make Taiwan an innovation headquarters for local enterprises and a regional research and development center for international corporations. It is hoped that eventually, Taiwan will not only be known as a country manufacturing high-quality “ Made in Taiwan” products as it is now, but also an innovative country producing products that are “Designed in Taiwan”. In order to encourage more innovation and to create more high value-added products, several national strategies were initiated by the government. One of the most important policies in today’s knowledge-based economy is certainly to provide a sound and effective intellectual property protection environment so that the results created from human intelligence can be well protected and utilized. This essay provides an overview of the recent progress of the TIPS (stands for Taiwan Intellectual Property System) project, which is currently promoted by the Science and Technology Law Center. The TIPS project is an innovative program solely developed by the Taiwanese scholars in year 2003 and has since achieved quite significant success. The second part of this essay gives a brief introduction of the recent changes made to the intellectual property system in Taiwan. II. Overview of the Recent Progress of the TIPS Project 1. The “Developmental Stage” The TIPS project has been promoted at the initiative of the Intellectual Property Office of the Ministry of Economic Affairs in 2003. The main goal of this project is to develop a set of guidelines for managing intellectual property to be implemented by the Taiwanese enterprises. At “developmental stage”, academic journal articles and relevant legislative requirements were gathered; intellectual property management experts were consulted and companies with good and effective intellectual property management practices were interviewed. All of the information and advises were collected and analyzed and formulated into a set of guidelines which basically covers the whole cycle of intellectual property management right starts from its creation, protection, maintenance and exploitation. The types of intellectual property rights managed include patent, trade mark, copyright and trade secret. A hearing for the draft guidelines was held in 2004. A pilot study was done by selecting eight representative domestic companies in 2005. All the public opinions, comments and advises from the trial companies were collected and used to revise the draft guidelines. The revised guidelines were then formally promulgated on March 23, 2007. The project then entered into a full “promotional stage” where the Science and Technology Law Centered entrusted by The Industrial Development Bureau of the Ministry of Economic Affairs was responsible for promoting the project. As the fundamental objective of TIPS is to assist companies to establish an effective internal intellectual property management system at relatively low cost, the whole system was developed based upon the ISO 9001:2000 Quality Management Standard. Since the ISO standards are widely recognized and adopted by many Taiwanese enterprises, for an enterprise with ISO system implemented, TIPS can be easily integrated into the existing ISO standards, conflicts between these two systems will be minimized and it will only require minimum organization structural changes and implementation costs. Further, by incorporating the PDCA (Plan-Do-Check-Action) model and “process-oriented approach” of ISO 9001:2000, the IP management processes implemented within an enterprise possess the feature of being able to be continuously improved. 2. The “Promotional Stage” In order to facilitate the promotion and draw more public attention to TIPS, various supplementary measures were introduced: (1) Free on-line self-assessment tool A collection of 50 questions is provided on the TIPS website3. Once a company has registered as a member of TIPS (simply by filling up some details about the company), it can use these questions to self-assess the effectiveness and adequacy of its existing (if any) IP management infrastructure. After the company has completed all the questions, the on-line tool would automatically generate few suggestions relating to the management of intellectual property based on the answers provided by the company. The company can also find out how they stand among all the enterprises which have taken the assessment previously. The on-line self-assessment tool is the initial step for those companies wanting to know more about TIPS. Once they realize that they are far behind the requirements of an effective IP management system, they can then move on to the next stage to implement TIPS. (2) On-Site Diagnostic and Consulting Service Once a company has completed the on-line self-assessment questions, it is then eligible to apply for a more detailed assessment of its internal IP management infrastructure conducted by a qualified IP service consultant. The IP service consultant will interview the managers responsible for managing IP related matters within a company and check relevant internal policies and documents. Concrete advises in relation to the implementation of TIPS will be given based on the inadequacies and problems uncovered during the on-site visit. The cost for the diagnostic and consulting service is fully covered by the government. (3) Model Companies Every year since 2004, some model companies are chosen as “demonstrative” companies for the implementation of TIPS. For instance, a total of 14 enterprises were selected as model companies this year. Among these companies, 3 “clusters of enterprises”, each of which contains 3 companies were chosen. The so-called “cluster of enterprises” is a group of companies that can be constituted by companies providing similar products or services within the same industry, or companies having the relationships as suppliers and consumers or companies within the same corporate structure. The introducing of implementing TIPS through “cluster of enterprises” is a promotion strategy that aims to disseminate the TIPS project more effectively and efficiently. For these selected model companies, certain percentage of the cost for implementing TIPS is subsidized by the government. (4) Certification After an enterprise has fully implemented TIPS, they can then apply for certification. All the prescribed documents must firstly be sent to the TIPS working team which is responsible for all the administrative works of TIPS. After a formality check, 2 or 3 (depending on the size of the enterprise) IP experts will be chosen to conduct an on-site inspection to determine whether the newly implemented IP management system meets the minimum requirements of TIPS. If the experts are satisfied with the inspection result, a certificate for the compliance of TIPS will be issued by the Industrial Development Bureau (IDB) of the Ministry of Economic Affairs. The certificate serves as government’s assurance to the public that the certified enterprise has at least the minimum ability (evaluated in accordance with government’s standard) to manage and protect its intellectual property. (5) IP Management Courses Three types of courses are provided to train IP management personnel. The basic course is an introductory course, which covers the basic principles of TIPS. The intermediate course called The Practical Implementation Course covers more detailed explanations of TIPS and how it can be implemented into the enterprise. Any person who has completed this course and passed the test will receive a certificate. The advance course called Self-Assessment Course teaches students how to evaluate and determine whether their newly developed IP management system conforms to the TIPS requirements. Again, a person who has completed this course and passed the test will receive a certificate. In order for an enterprise to be eligible to apply for a certificate for the compliance of TIPS, the enterprise must firstly furnish a self-assessment report to be completed by a “qualified person”. Such “qualified person” is the person who has successfully obtained the certificate for the completion of Self-Assessment Course. 3. Achievement The TIPS project has received wide recognition since it first launched in year 2004. To the end of 2008, 297 enterprises have completed the on-line self-assessment questions; 73 companies have received on-site diagnostic and consultation services; 618 persons have taken the IP management courses; 45 enterprises have successfully obtained the certificates for the compliance of TIPS and more than142 enterprises have either completed or in the middle of implementing TIPS. Benefits of implementing TIPS as reported by TIPS implemented enterprises are summarized as follows: (1) Company A: Implementing TIPS provides an assurance that Company A has adequate ability to protect the technology secrecy belongs to its international client. Company A thus obtained a new purchasing order worth more than NT$ 100 million. (2) Company B: TIPS assists in enhancing the level of trust on the company’s ability to protect its international client’s confidential information. A new purchasing order worth NT $ 30 million is placed by such client. (3) Company C: Through systematic IP management and IP inventory audit, Company C starts to formulate a plan for licensing out its non-core IP assets. (4) Company D: The alignment of R&D and business strategies required by TIPS ensures the accuracy of the R&D direction. The systematic way of managing the R&D projects also reduces the R&D phase to 45 days, saving R&D expenditure by 10%. (5) Company E: Implementing TIPS helps Company E to formulate a more clear and definite IP mapping strategy. Company E plans to implement TIPS into its whole corporate group in 2008. (6) Company D: Systematic IP management has reduced the number of litigation allegations. Company D plans to implement TIPS into every business unit within its corporate structure in 2008. 4. Proposed New Features of TIPS In answering to the responses receiving from the TIPS implemented enterprises, two new measures are going to be launched in 2009. First, enterprises with effective IP management system and strategies are encouraged to write up an Intellectual Property Management Report summarizing their business, R&D and IP management strategies as well as their accumulated IP assets. Second, an Experience-Sharing Platform is going to be established where enterprises can freely exchange their experiences of managing IP and how to formulate an effective IP management strategy. III. Recent Development of Taiwan’s IP Protection Environment Year 2008 can be said to be a significant year for the history of IP development in Taiwan where three completely new legislations have taken effect this year. The Intellectual Property Court Organization Act4 and the Intellectual Property Case Adjudication Act5 were both promulgated on March 28 2007 and effective as of July 1 under which a new IP Court was established with new laws to govern the adjudication of IP cases. The Patent Attorney Act which governs the qualification and registration of a new patent attorney profession was promulgate on July 11 2007 and effective as of January 11 2008. It is believed that through the commencement of these three new legislations, the accuracy, consistency as well as efficiency of resolving IP-related disputes in Taiwan are going to be significantly improved. A short introduction for each of the three new legislations is provided below: 1. New IP Court A new IP Court was established pursuant to the Intellectual Property Court Organization Act and began to hear cases on July 1 2008. This Court is given jurisdiction to hear first and second instances of a civil action, first instance of an administrative action and the second instance of a criminal action for matters concerning IP rights. For examples, interests arising under the Patent Act, the Trade Mark Act, the Copyright Act, the Trade Secret Act, the Optical Disk Act, the Species of Plants and Seedling Act, the Fair Trade Act and the Regulation Governing the Protection of Integrated Circuits Configurations. Unlike previously, where the validity issues must be determined by the administrative court, the newly established IP Court can hear and decide the validity of an intellectual property right at issue. This will significantly improve the efficiency of resolving an IP dispute. Eight experienced judges were chosen to sit on the bench of the IP Court. Since most IP related matters involve complex technical issues, nine technical examination officers with various technical backgrounds from the Taiwan Intellectual Property Office were chosen to assist and provide their technical expertise and opinions to the IP Court judges. 2. New Laws Governing IP Litigation (1) Litigation procedures The Intellectual Property Case Adjudication Act prescribes rules for adjudicating IP-related disputes. The Act recommends to try an IP infringement case through a 3-step processes. First, to determine the validity of an IP right. Second, to determine whether an IP right has been infringed and finally, to calculate the damages. The IP Court may at any state dismiss the case if it finds the IP right at issue is invalid or not infringed. In order to avoid unnecessary efforts spent on determining whether an IP right is infringed if such right is in fact invalid, the Act requires the IP Court to determine whether a right is infringed only after the invalidity defense raised by the defendant is dismissed. (2) Preliminary injunction The Intellectual Property Case Adjudication Act also introduces the criteria used by the US courts to determine whether a preliminary injunction order should be granted. Before the enactment of this new Act, the requirements for granting preliminary injunction in Taiwan were quite loose as the court could grant a preliminary injunction order without firstly reviewing the merit of the case. The new adopted US criteria require the judges to determine the likelihood of success on the merits of the case; whether a substantial threat of irreparable damage or injury would be caused if injunction is not granted; the balance of harms weighs in favor of the party seeking the preliminary injunction and the impact of the decision on public interest. As the criteria become stricter, it is believed that less preliminary injunctions will be granted. A plaintiff seeking a preliminary injunction order in the future shall put in more efforts in preparing evidences and reasons arguing that an injunction maintaining the status quo is necessary. (3) Protective orders (as to confidential information) As most IP litigation cases involve matters concerning confidential information or trade secrets, which are often crucial for the survival of an enterprise, the Intellectual Property Case Adjudication Act introduces a protective order into practice to preserve the confidentiality of specific information given by parties to the suit or a third party. A party to the suit or a third party can apply to the court to issue a protective order restraining the accessibility to the protected confidential information and restraining those who have accessed to the confidential information from disclosing it to others. Any intentional violation of the protective order is subject to a criminal liability. It is expected that by introducing the protective order, confidential information or trade secret holder may become more willing to reveal such information, which may assist improving the accuracy of resolving the disputes between parties. (4) Improved evidence preservation procedure Unlike the US court system, Taiwan, a civil law country, does not have discovery or Markman hearing procedures. Before the enactment of the Intellectual Property Case Adjudication Act, even though a judge can ask the parties to preserve evidences for the use of the trial, the judge is however, given no authority of compulsory execution. A party can refuse to comply with the judge’s request without any legal consequence. The new Act now provides compulsory execution of an evidence preservation order. Parties who are subject to the evidence preservation order are obligated to comply with the order. Furthermore, the judge may also request assistance from technical examiners or police department to provide advises. 3. New Patent Attorney Profession The Patent Attorney Act sets the requirements for becoming a qualified patent attorney in Taiwan. According to the Act, patent attorneys should be specialized in both technology and patent regulations. A candidate must firstly pass the Patent Attorney Eligibility Examination, followed by a period of prevocational training, such candidate is then able to register with the Taiwan Intellectual Property Office and join the Patent Attorneys Association. It is hoped that by introducing the new patent attorney profession, the quality of patent applications will be improved and thus reduce the ever increasing workload of patent examiners. IV. Conclusion The initiative of the TIPS project, the establishment of the IP court and the newly implemented patent attorney system all demonstrate the government’s determination to create a more sound and efficient environment for the protection of intellectual property. The overwhelming success of the TIPS project evidenced by the number of enterprises implementing the system indicates that Taiwanese companies are self-motivated, able to see the importance of intellectual property as their main source of competiveness and are ready and willing to move into the next stage of “innovative” management. It is believed that through the government’s pragmatic and foresight policies coupled with the adventurous and hard work spirits possessed by the local enterprises, Taiwan will eventually reach its goal of becoming a “green silicon island”, creating another “economic miracle”. Along with Singapore, Hong Kong and South Korea. http://www.asianinfo.org/asianinfo/taiwan/pro-economy.htm (last visited: 12/31/2008) TIPS website: http://www.tips.org.tw/ http://www.taie.com.tw/English/970520a.pdf (last visited: 12/3132008) http://www.taie.com.tw/English/970520a.pdf (last visited: 12/3132008)

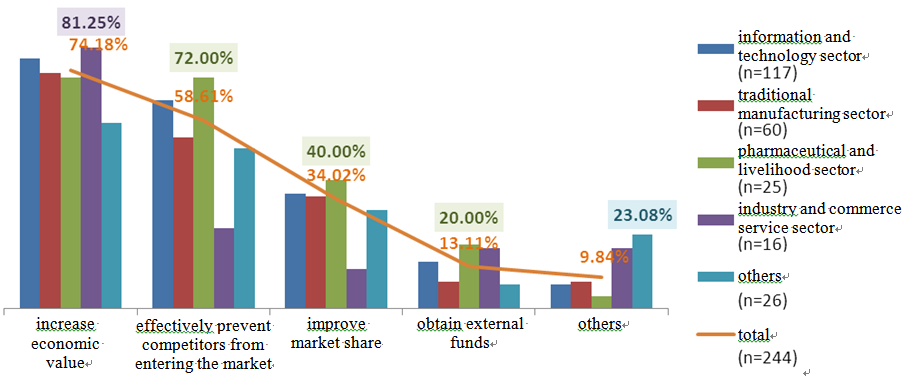

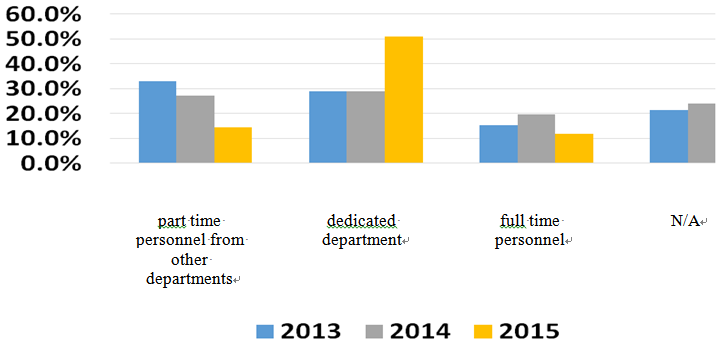

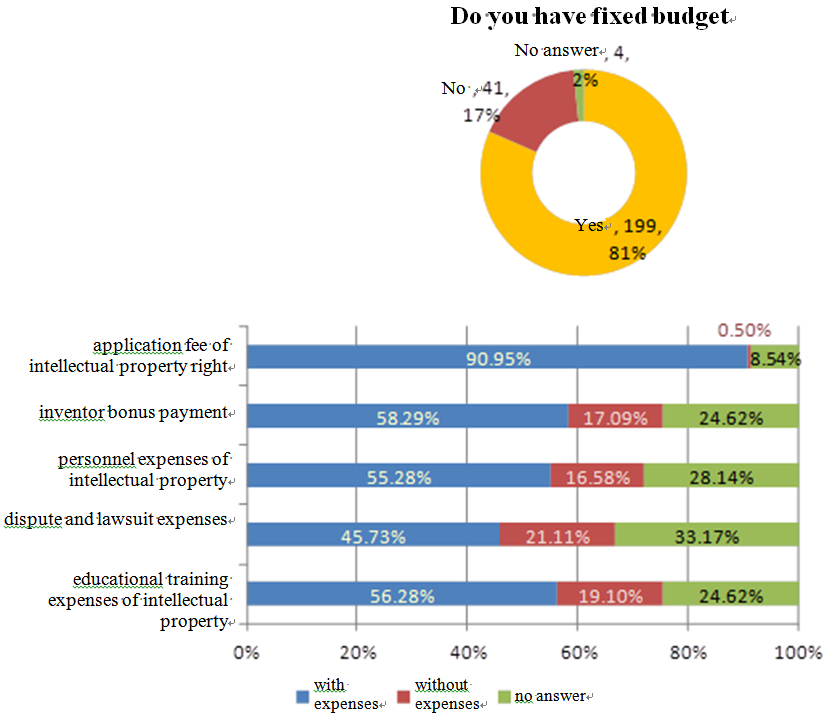

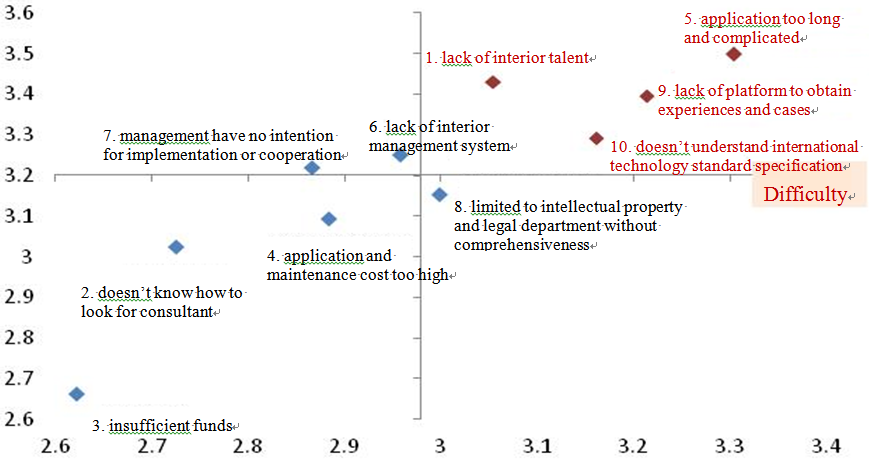

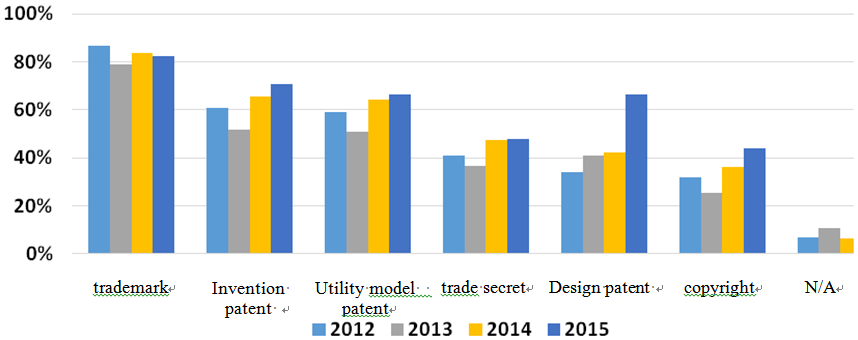

The Taiwan Intellectual Property Awareness and Management SurveyThe “National Intellectual Property Strategy Program” was announced by the Taiwan government in November 2011 in an effort to promote and raise the intellectual property capability of Taiwanese firms. As policy adviser to the Ministry of Economic Affairs in drafting the “National Intellectual Property Strategy Program,” the Science and Technology Institute under the Institute for Information Industry (STLI) conducted a survey in 2012 in order to gain a broad overview of the level of IP awareness and IP management and use among Taiwanese firms. The survey was distributed to 1,384 firms that are listed either on the Taiwan Stock Exchange or the Gre Tai Securities Markets. 281 companies responded to the survey, achieving a survey response rate of almost 20%. The content of the survey was divided into three parts: IP knowledge and understanding, current IP management within the companies and IP issues that companies face. The Importance of IP to Businesses Intellectual property has become a commonplace asset owned by firms. The growing significance of intellectual property to companies in general is undeniable, and firms are recognizing this as well. An overwhelming 93% of the respondents claim to own some form of intellectual property. The most common type of intellectual property owned by companies is trademarks, followed by patents and trade secret. Many companies are also actively seeking to obtain more intellectual property. Over 68% of the respondents indicated that they have submitted applications for formal intellectual property rights in the past two years. 84% of the respondents agreed with the statement that they believe intellectual property can bring added value for the firm. In addition, over 78% of the respondents also believe that intellectual property helps enhancing the company’s market position. It is clear that the majority of Taiwan firms already consider intellectual property to be a vital asset for their business and that building up and expanding their IP portfolio has become a top priority. This is also reflected in the annual spending that firms allocate for intellectual property. The survey respondents were asked whether a specific budget is allocated toward spending related to intellectual property every year, and the majority of the respondents, almost 70%, responded in the positive. Particularly, the respondents pointed out that they commit the most resources to obtaining and maintaining intellectual property rights every year. 10% of the respondents even indicated that they spent over NT$5 million annually on obtaining and maintaining intellectual property rights. The respondents were also asked about spending on inventor incentive, IP personnel, IP disputes and litigations and staff IP training. The results showed that companies commit the least spending on providing IP training for staff, with more than half of the respondents noting that they spend less than NT$500,000 on IP training each year and only 14% of the respondents noted that they will increase spending on IP training the following year. Weakness in Generating Value from IP As noted above, Taiwan firms are actively seeking to obtain more intellectual property and building up their IP assets. With almost 70% of the respondents noting that they have applied for intellectual property rights in the last two years shows that companies are generating quite a lot intellectual property, but whether all the intellectual property generated is being exploited and creating commercial and economic benefits remains doubtful. Most of the firms, almost 86% of the respondents, acquired their intellectual property through their own research and development (R&D). In contrast, the proportion of firms using other means of acquiring intellectual property is quite low, with only 17% of the respondents acquiring intellectual property through acquisition and 28% through licensing, while 41% percent of the respondents acquired their intellectual property by joint research or contracted research with others. With R&D being the major source of intellectual property for firms, firms are clearly putting in a lot of investment into acquiring intellectual property. However, the returns on these investments may not be proportionate. When asked whether the firm license out their intellectual property, only 13.5% of the respondents claimed to be doing so. This suggests that most Taiwanese firms are not using their intellectual property to generate revenue and commercial value. Instead, intellectual property is still mostly regarded and used as merely a defensive tool against infringement. Companies in Taiwan are also facing increasing risks of being involved in IP-related disputes and litigations. More than 30% of the respondents have already been involved in some kind of IP-related disputes and litigations in the past. The most common type of litigations faced by Taiwanese companies are patent infringement, followed by trademarks infringement, piracy and counterfeit, and disputes with (former) employees. Furthermore, more than 50% of the firms that have been involved in IP litigations noted that patent infringement and trademarks infringement pose the most detriment to the company’s business operations in general. It is evident that intellectual property has become a competitive weapon in businesses, and IP disputes and litigations are inevitable threats that most firms must face in today’s business world. Hence, it is essential for firms to have the necessary strategies and protection in place in order to minimize the risks created by potential legal disputes. With this in mind, it is worrisome to observe that most firms have not incorporated intellectual property into the company risk management program. Nearly 86.1% of the respondents claim to have some kind of risk management program in place within the company, but when asked what is included in the risk management program. Only 40.7% of the firms with risk management programs said that intellectual property is included, which is considerably lower than other types of risks generally seen in risk management programs. With IP disputes and litigations becoming an increasing threat that may bring negative impact for businesses, Taiwanese firms need to incorporate and strengthen IP risk management within the company. IP still not widely considered as business strategy With intellectual property being an important asset, firms should also have the necessary infrastructure and resources to manage IP accordingly and integrate IP into the company’s overall business operations. However, more than 50% of the respondents do not have designated personnel or department that is specifically responsible for managing the company’s intellectual property. Nearly 33% of the respondents indicated that the responsibility for managing IP is shared by other departments within the firm. When further asked about the tasks of the designated personnel or department that is responsible for IP, it is observed that the designated personnel/department mostly undertake routine tasks such as filing for patent applications and trademark registrations and maintaining relevant databases. Tasks such as patent mapping and competitive landscape analysis are the least performed tasks. The proportion of designated personnel/department for IP that are involved in the company’s business and research strategic decision making process is also quite low. This suggests that despite the importance of IP to firms, many Taiwanese firms still have not integrated IP into their overall research and business strategies and utilize their intellectual property as a strategic tool in their business operations. Low Levels of IP Awareness and Training within Firms In order to gauge the level of IP knowledge and understanding in Taiwanese firms, the survey also contained 10 very basic questions on intellectual property. Surprisingly, the respondents that answered all the questions correctly were less than 4%. The proportion of respondents that correctly answered 5 or less questions did not even reach 50%. This means that Taiwanese firms still lack fundamental IP knowledge and understanding in general. This is also reflected in the response to the question whether the company has an overall IP policy in place, which also serves as an indication of the level awareness and concern with intellectual property within the firm. An IP policy that is distributed to company staff means that IP awareness is promoted within the company. However, almost 40% of the respondents claimed that there is no overall IP policy within the company, and nearly 30% of the respondents noted that even if there is an IP policy, it is not made widely known to company staff. This reveals that many Taiwanese companies still need to undertake more IP awareness promotion within the firm. More IP awareness promotion is also justified by the results to the question as to whether the company provides IP training for company staff. The results showed that almost 44% of the respondents do not provide any form of training in IP to company staff at all. This also corresponds to the result noted earlier that most respondents commit the least funding to providing IP training each year. Providing regular IP training to staff is certainly still not the norm for most Taiwanese firms. Issues facing businesses and their policy needs Taiwanese firms still faces many difficulties and challenges in their intellectual property management and hope that the government could provide them with the assistance and resources needed to help them enhance their intellectual property capacity and capability. Some of the major difficulties that the respondents pointed out in the survey include the lack of IP experts and professionals. It is difficult for firms to find and hire people with adequate professional IP skills, as the education and training currently provided by universities and professional schools do not seem to meet the actual IP needs of companies. Another major difficulty faced by Taiwanese firms is the lack of information and knowledge regarding international technical standards and standard setting organizations. A significant portion of the respondents expressed the wish for the government to help them gain entry and participation in international standard setting organizations. Among the other difficulties, the regulatory complexity and lack of clarity with the ownership of intellectual property arising from government-contracted research, which poses as barrier for firms in obtaining licenses for use and exploitation, is also an issue that the majority of the respondents hope the government could improve. In addition to the difficulties mentioned above that Taiwanese firms hope the government would help them encounter, the respondents were also asked specifically what other resources and assistance they would like to seek from the government. 69.4% of the respondents hope that the government could provide more training courses and seminars on IP. Many respondents are also seeking a common platform that can unify all resources that could help enhance IP management. Expert assistance and consultation on obtaining intellectual property rights and providing information on international IP protection and litigation are also resources that Taiwanese firms desire. More than 50% of the respondents also indicated that they would like to receive assistance in establishing IP management system within their firms. Conclusion The results of the survey provided insight into the level of IP management among companies in Taiwan. Although the importance of intellectual property for businesses is undeniable and widely recognized by firms, the results of the survey revealed that there is still much room for improvement and for Taiwanese firms to put in more efforts into strengthening and enhancing their IP capabilities. In general, Taiwanese firms have not incorporated their intellectual property into their management strategies and derived adequate value. Intellectual property remains mostly a defensive tool against infringement. Furthermore, there is still need for greater promotion of IP awareness among firms and within firms. With these IP management difficulties and deficiencies in mind, it should be noted that the respondents of this survey are all listed companies that are already of a certain size and scale and should have greater resources in their disposal to commit to their IP management. It would be reasonable to assume that small and medium firms, with significantly less resources, would face even more difficulties and challenges. Using this survey results as reference, the “National Intellectual Property Strategy Survey” would seek to help Taiwanese companies address these IP issues and provide adequate assistance and resources in overcoming the challenges Taiwanese companies face with their IP management. It is also hoped that this survey would be carried out regularly in the future, and that the survey results from 2012 would serve as a baseline for future surveys that will assist in observing the progress Taiwanese businesses are making in IP management and provide a whole picture of the level of IP awareness and management within Taiwanese firms.