Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

I. Foreword

We hereby aim to analyze and research the role played by The Finnish Innovation Fund (“Sitra”) in boosting the national innovation ability and propose the characteristics of its organization and operation which may afford to facilitate the deliberation on Taiwan’s legal system. Sitra is an independent organization which is used to reporting to the Finnish Parliament directly, dedicated to funding activities to boost sustainable development as its ultimate goal and oriented toward the needs for social change. As of 2004, it promoted the fixed-term program. Until 2012, it, in turn, primarily engaged in 3-year program for ecological sustainable development and enhancement of society in 2012. The former aimed at the sustainable use of natural resources to develop new structures and business models and to boost the development of a bioeconomy and low-carbon society, while the latter aimed to create a more well-being-oriented public administrative environment to upgrade various public sectors’ leadership and decision-making ability to introduce nationals’ opinion to policies and the potential of building new business models and venture capital businesses[1].

II. Standing and Operating Instrument of Sitra

1. Sitra Standing in Boosting of Finnish Innovation Policies

(1) Positive Impact from Support of Innovation R&D Activities by Public Sector

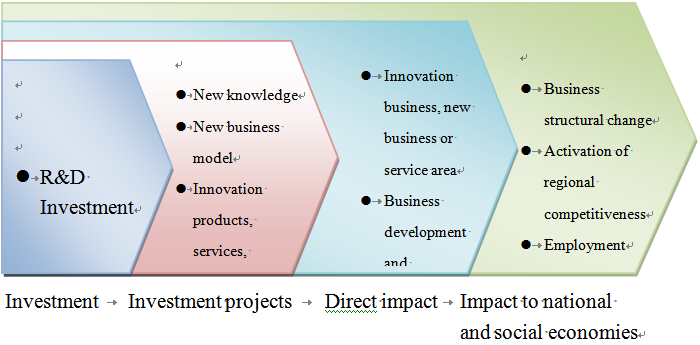

Utilization of public sector’s resources to facilitate and boost industrial innovation R&D ability is commonly applied in various countries in the world. Notwithstanding, the impact of the public sector’s investment of resources produced to the technical R&D and the entire society remains explorable[2]. Most studies still indicate positive impact, primarily as a result of the market failure. Some studies indicate that the impact of the public sector’s investment of resources may be observable at least from several points of view, including: 1. The direct output of the investment per se and the corresponding R&D investment potentially derived from investees; 2. R&D of outputs derived from the R&D investment, e.g., products, services and production methods, etc.; 3. direct impact derived from the R&D scope, e.g., development of a new business, or new business and service models, etc.; 4. impact to national and social economies, e.g., change of industrial structures and improvement of employment environment, etc. Most studies indicate that from the various points of view, the investment by public sector all produced positive impacts and, therefore, such investment is needed definitely[3]. The public sector may invest in R&D in diversified manners. Sitra invests in the “market” as an investor of corporate venture investment market, which plays a role different from the Finnish Funding Agency for Technology and Innovation (“Tekes”), which is more like a governmental subsidizer. Nevertheless, Finland’s characteristics reside in the combination of multiple funding and promotion models. Above all, due to the different behavior model, the role played by the former is also held different from those played by the general public sectors. This is why we choose the former as the subject to be studied herein.

Data source: Jari Hyvärinen & Anna-Maija Rautiainen, Measuring additionality and systemic impacts of public research and development funding – the case of TEKES, FINLAND, RESEARCH EVALUATION, 16(3), 205, 206 (2007).

Fig. 1 Phased Efforts of Resources Invested in R&D by Public Sector

(2) Two Sided f Role Played by Sitra in Boosting of Finnish Innovation Policies

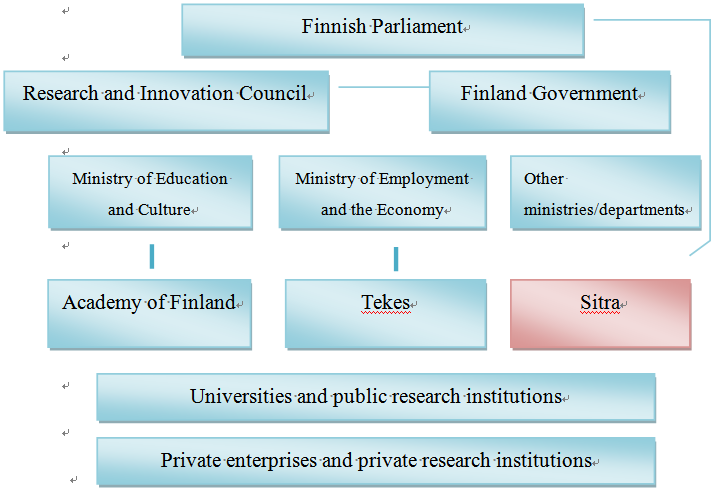

Sitra has a very special position in Finland’s national innovation policies, as it not only helps successful implementation of the innovation policies but also acts an intermediary among the relevant entities. Sitra was founded in 1967 under supervision of the Bank of Finland before 1991, but was transformed into an independent foundation under the direction of the Finnish Parliament[4].

Though Sitra is a public foundation, its operation will not be intervened or restricted by the government. Sitra may initiate any innovation activities for its new organization or system, playing a role dedicated to funding technical R&D or promoting venture capital business. Meanwhile, Sitra also assumes some special function dedicated to decision-makers’ training and organizing decision-maker network to boost structural change. Therefore, Sitra may be identified as a special organization which may act flexibly and possess resources at the same time and, therefore, may initiate various innovation activities rapidly[5].

Sitra is authorized to boost the development of innovation activities in said flexible and characteristic manner in accordance with the Finland Innovation Fund Act (Laki Suomen itsenäisyyden juhlarahastosta). According to the Act, Finland established Sitra in 1967 and Sitra was under supervision of Bank of Finland (Article 1). Sitra was established in order to boost the stable growth of Finland’s economy via the national instrument’s support of R&D and education or other development instruments (Article 2). The policies which Sitra may adopt include loaning or funding, guarantee, marketable securities, participation in cooperative programs, partnership or equity investment (Article 3). If necessary, Sitra may collect the title of real estate or corporate shares (Article 7).

Data source: Finnish innovation system, Research.fi, http://www.research.fi/en/innovationsystem.html (last visited Mar. 15, 2013).

Fig. 2 Finnish Scientific Research Organization Chart

Sitra's innovation role has been evolved through two changes. Specifically, Sitra was primarily dedicated to funding technical R&D among the public sectors in Finland, and the funding model applied by Sitra prior to the changes initiated the technical R&D promotion by Tekes, which was established in 1983. The first change of Sitra took place in 1987. After that, Sitra turned to focus on the business development and venture capital invested in technology business and led the venture capital investment. Meanwhile, it became a partner of private investment funds and thereby boosted the growth of venture capital investments in Finland in 1990. In 2000, the second change of Sitra took place and Sitra’s organization orientation was changed again. It achieved the new goal for structural change step by step by boosting the experimental social innovation activities. Sitra believed that it should play the role contributing to procedural change and reducing systematic obstacles, e.g., various organizational or institutional deadlocks[6].

Among the innovation policies boosted by the Finnish Government, the support of Start-Ups via governmental power has always been the most important one. Therefore, the Finnish Government is used to playing a positive role in the process of developing the venture capital investment market. In 1967, the Government established a venture capital company named Sponsor Oy with the support from Bank of Finland, and Sponsor Oy was privatized after 1983. Finland Government also established Kera Innovation Fund (now known as Finnvera[7]) in 1971, which was dedicated to boosting the booming of Start-Ups in Finland jointly with Finnish Industry Investment Ltd. (“FII”) established by the Government in 1994, and Sitra, so as to make the “innovation” become the main development force of the country[8] .

Sitra plays a very important role in the foundation and development of venture capital market in Finland and is critical to the Finnish Venture Capital Association established in 1990. After Bank of Finland was under supervision of Finnish Parliament in 1991, Sitra became on the most important venture capital investors. Now, a large portion of private venture capital funds are provided by Sitra[9]. Since Sitra launched the new strategic program in 2004, it has turned to apply smaller sized strategic programs when investing young innovation companies, some of which involved venture capital investment. The mapping of young innovation entrepreneurs and angel investors started as of 1996[10].

In addition to being an important innovation R&D promoter in Finland, Sitra is also an excellent organization which is financially self-sufficient and tends to gain profit no less than that to be generated by a private enterprise. As an organization subordinated to the Finnish Parliament immediately, all of Sitra’s decisions are directly reported to the Parliament (public opinion). Chairman of Board, Board of Directors and supervisors of Sitra are all appointed by the Parliament directly[11]. Its working funds are generated from interest accruing from the Fund and investment income from the Fund, not tax revenue or budget prepared by the Government any longer. The total fund initially founded by Bank of Finland amounted to DEM100,000,000 (approximately EUR17,000,000), and was accumulated to DEM500,000,000 (approximately EUR84,000,000) from 1972 to 1992. After that, following the increase in market value, its nominal capital amounted to DEM1,400,000,000 (approximately EUR235,000,000) from 1993 to 2001. Obviously, Sitra generated high investment income. Until 2010, it has generated the investment income amounting to EUR697,000,000 .

In fact, Sitra’s concern about venture capital investment is identified as one of the important changes in Finland's national technical R&D polices after 1990[13]. Sitra is used to funding businesses in three manners, i.e., direct investment in domestic stock, investment in Finnish venture capital funds, and investment in international venture capital funds, primarily in four industries, technology, life science, regional cooperation and small-sized & medium-sized starts-up. Meanwhile, it also invests in venture capital funds for high-tech industries actively. In addition to innovation technology companies, technical service providers are also its invested subjects[14].

2. “Investment” Instrument Applied by Sitra to Boost Innovation Business

The Starts-Up funding activity conducted by Sitra is named PreSeed Program, including INTRO investors’ mapping platform dedicated to mapping 450 angel investment funds and entrepreneurs, LIKSA engaged in working with Tekes to funding new companies no more than EUR40,000 for purchase of consultation services (a half thereof funded by Tekes, and the other half funded by Sitra in the form of loan convertible to shares), DIILI service[15] dedicated to providing entrepreneurs with professional sale consultation resources to integrate the innovation activity (product thereof) and the market to remedy the deficit in the new company’s ability to sell[16].

The investment subjects are stated as following. Sitra has three investment subjects, namely, corporate investments, fund investments and project funding.

(1) Corporate investment

Sitra will not “fund” enterprises directly or provide the enterprises with services without consideration (small-sized and medium-sized enterprises are aided by other competent authorities), but invest in the businesses which are held able to develop positive effects to the society, e.g., health promotion, social problem solutions, utilization of energy and effective utilization of natural resources. Notwithstanding, in order to seek fair rate of return, Sitra is dedicated to making the investment (in various enterprises) by its professional management and technology, products or competitiveness of services, and ranging from EUR300,000 to EUR1,000,000 to acquire 10-30% of the ownership of the enterprises, namely equity investment or convertible funding. Sitra requires its investees to value corporate social responsibility and actively participate in social activities. It usually holds the shares from 4 years to 10 years, during which period it will participate the corporate operation actively (e.g., appointment of directors)[17].

(2) Fund investments

For fund investments[18], Sitra invests in more than 50 venture capital funds[19]. It invests in domestic venture capital fund market to promote the development of the market and help starts-up seek funding and create new business models, such as public-private partnerships. It invests in international venture capital funds to enhance the networking and solicit international funding, which may help Finnish enterprises access international trend information and adapt to the international market.

(3) Project funding

For project funding, Sitra provides the on-site information survey (supply of information and view critical to the program), analysis of business activities (analysis of future challenges and opportunities) and research & drafting of strategies (collection and integration of professional information and talents to help decision making), and commissioning of the program (to test new operating model by commissioning to deal with the challenge from social changes). Notwithstanding, please note that Sitra does not invest in academic study programs, research papers or business R&D programs[20].

(4) DIILI Investment Model Integrated With Investment Absorption

A Start-Up usually will not lack technologies (usually, it starts business by virtue of some advanced technology) or foresighted philosophy when it is founded initially, while it often lacks the key to success, the marketing ability. Sitra DIILI is dedicated to providing the professional international marketing service to help starts-up gain profit successfully. Owing to the fact that starts-up are usually founded by R&D personnel or research-oriented technicians, who are not specialized in marketing and usually retains no sufficient fund to employ marketing professionals, DILLI is engaged in providing dedicated marketing talents. Now, it employs about 85 marketing professionals and seeks to become a start-up partner by investing technical services.

Notwithstanding, in light of the characteristics of Sitra’s operation and profitability, some people indicate that it is more similar to a developer of an innovation system, rather than a neutral operator. Therefore, it is not unlikely to hinder some work development which might be less profitable (e.g., establishment of platform). Further, Sitra is used to developing some new investment projects or areas and then founding spin-off companies after developing the projects successfully. The way in which it operates seems to be non-compatible with the development of some industries which require permanent support from the public sector. The other issues, such as INTRO lacking transparency and Sitra's control over investment objectives likely to result in adverse choice, all arise from Sitra’s consideration to its own investment opportunities and profit at the same time of mapping. Therefore, some people consider that it should be necessary to move forward toward a more transparent structure or a non-income-oriented funding structure[21] . Given this, the influence of Sitra’s own income over upgrading of the national innovation ability when Sitra boosts starts-up to engage in innovation activities is always a concern remaining disputable in the Finnish innovation system.

3. Boosting of Balance in Regional Development and R&D Activities

In order to fulfill the objectives under Lisbon Treaty and to enable EU to become the most competitive region in the world, European Commission claims technical R&D as one of its main policies. Among other things, under the circumstance that the entire R&D competitiveness upgrading policy is always progressing sluggishly, Finland, a country with a population of 5,300,000, accounting for 1.1% of the population of 27 EU member states, was identified as the country with the No. 1 innovation R&D ability in the world by World Economic Forum in 2005. Therefore, the way in which it promotes innovation R&D policies catches the public eyes. Some studies also found that the close relationship between R&D and regional development policies of Finland resulted in the integration of regional policies and innovation policies, which were separated from each other initially, after 1990[22]. Finland has clearly defined the plan to exploit the domestic natural resources and human resources in a balanced and effective manner after World War II. At the very beginning, it expanded the balance of human resources to low-developed regions, in consideration of the geographical politics, but in turn, it achieved national balanced development by meeting the needs for a welfare society and mitigation of the rural-urban divide as time went by. The Finnish innovation policies which may resort to technical policies retroactively initially drove the R&D in the manners including upgrading of education degree, founding of Science and Technology Policy Council and Sitra, establishment of Academy of Finland (1970) and establishment of the technical policy scheme, et al.. Among other things, people saw the role played by Sitra in Finland’s knowledge-intensive society policy again. From 1991 to 1995, the Finnish Government officially included the regional competitiveness into the important policies. The National Industrial Policy for Finland in 1993 adopted the strategy focusing on the development based on competitive strength in the regional industrial communities[23].

Also, some studies indicated that in consideration of Finland’s poor financial and natural resources, its national innovation system should concentrate the resources on the R&D objectives which meet the requirements about scale and essence. Therefore, the “Social Innovation, Social and Economic Energy Re-building Learning Society” program boosted by Sitra as the primary promoter in 2002 defined the social innovation as “the reform and action plan to enhance the regulations of social functions (law and administration), politics and organizational structure”, namely reform of the mentality and cultural ability via social structural changes that results in social economic changes ultimately. Notwithstanding, the productivity innovation activity still relies on the interaction between the enterprises and society. Irrelevant with the Finnish Government’s powerful direction in technical R&D activities, in fact, more than two-thirds (69.1%) of the R&D investment was launched by private enterprises and even one-thirds launched by a single enterprise (i.e., Nokia) in Finland. At the very beginning of 2000, due to the impact of globalization to Finland’s innovation and regional policies, a lot of R&D activities were emigrated to the territories outside Finland[24]. Multiple disadvantageous factors initiated the launch of national resources to R&D again. The most successful example about the integration of regional and innovation policies in Finland is the Centres of Expertise Programme (CEP) boosted by it as of 1990. Until 1994, there have been 22 centres of expertise distributed throughout Finland. The centres were dedicated to integrating local universities, research institutions and enterprise for co-growth. The program to be implemented from 2007 to 2013 planned 21 centres of expertise (13 groups), aiming to promote the corporate sectors’ cooperation and innovation activities. CEP integrated local, regional and national resources and then focused on the businesses designated to be developed[25].

[1] Sitra, http://www.sitra.fi/en (last visited Mar. 10, 2013).

[2] Jari Hyvärinen & Anna-Maija Rautiainen, Measuring additionality and systemic impacts of public research and development funding – the case of TEKES, FINLAND, RESEARCH EVALUATION, 16(3), 205, 208 (2007).

[3] id. at 206-214.

[4] Charles Edquist, Tterttu Luukkonen & Markku Sotarauta, Broad-Based Innovation Policy, in EVALUATION OF THE FINNISH NATIONAL INNOVATION SYSTEM – FULL REPORT 11, 25 (Reinhilde Veugelers st al. eds., 2009).

[5] id.

[6] id.

[7] Finnvera is a company specialized in funding Start-Ups, and its business lines include loaning, guarantee, venture capital investment and export credit guarantee, etc. It is a state-run enterprise and Export Credit Agency (ECA) in Finland. Finnvera, http://annualreport2012.finnvera.fi/en/about-finnvera/finnvera-in-brief/ (last visited Mar. 10, 2013).

[8] Markku Maula, Gordon Murray & Mikko Jääskeläinen, MINISTRY OF TRADE AND INDUSTRY, Public Financing of Young Innovation Companies in Finland 32 (2006).

[9] id. at 33.

[10] id. at 41.

[11] Sitra, http://www.sitra.fi/en (last visited Mar. 10, 2013).

[12] Sitra, http://www.sitra.fi/en (last visited Mar. 10, 2013).

[13] The other two were engaged in boosting the regional R&D center and industrial-academy cooperative center programs. Please see Gabriela von Blankenfeld-Enkvist, Malin Brännback, Riitta Söderlund & Marin Petrov, ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT [OECD],OECD Case Study on Innovation: The Finnish Biotechnology Innovation System 15 (2004).

[14] id. at20.

[15] DIILI service provides sales expertise for SMEs, Sitra, http://www.sitra.fi/en/articles/2005/diili-service-provides-sales-expertise-smes-0 (last visited Mar. 10, 2013).

[16] Maula, Murray & Jääskeläinen, supra note 8 at 41-42.

[17] Corporate investments, Sitra, http://www.sitra.fi/en/corporate-investments (last visited Mar. 10, 2013).

[18] Fund investments, Sitra, http://www.sitra.fi/en/fund-investments (last visited Mar. 10, 2013).

[19] The venture capital funds referred to herein mean the pooled investment made by the owners of venture capital, while whether it exists in the form of fund or others is not discussed herein.

[20] Project funding, Sitra, http://www.sitra.fi/en/project-funding (last visited Mar. 10, 2013).

[21] Maula, Murray & Jääskeläinen, supra note 8 at 42.

[22] Jussi S. Jauhiainen, Regional and Innovation Policies in Finland – Towards Convergence and/or Mismatch? REGIONAL STUDIES, 42(7), 1031, 1032-1033 (2008).

[23] id. at 1036.

[24] id. at 1038.

[25] id. at 1038-1039.

The use of automated facial recognition technology and supervision mechanism in UK I. Introduction Automatic facial recognition (AFR) technology has developed rapidly in recent years, and it can identify target people in a short time. The UK Home Office announced the "Biometrics Strategy" on June 28, 2018, saying that AFR technology will be introduced in the law enforcement, and the Home Office will also actively cooperate with other agencies to establish a new oversight and advisory board in order to maintain public trust. AFR technology can improve law enforcement work, but its use will increase the risk of intruding into individual liberty and privacy. This article focuses on the application of AFR technology proposed by the UK Home Office. The first part of this article describes the use of AFR technology by the police. The second part focuses on the supervision mechanism proposed by the Home Office in the Biometrics Strategy. However, because the use of AFR technology is still controversial, this article will sort out the key issues of follow-up development through the opinions of the public and private sectors. The overview of the discussion of AFR technology used by police agencies would be helpful for further policy formulation. II. Overview of the strategy of AFR technology used by the UK police According to the Home Office’s Biometrics Strategy, the AFR technology will be used in law enforcement, passports and immigration and national security to protect the public and make these public services more efficient[1]. Since 2017 the UK police have worked with tech companies in testing the AFR technology, at public events like Notting Hill Carnival or big football matches[2]. In practice, AFR technology is deployed with mobile or fixed camera systems. When a face image is captured through the camera, it is passed to the recognition software for identification in real time. Then, the AFR system will process if there is a ‘match’ and the alarm would solicit an operator’s attention to verify the match and execute the appropriate action[3]. For example, South Wales Police have used AFR system to compare images of people in crowds attending events with pre-determined watch lists of suspected mobile phone thieves[4]. In the future, the police may also compare potential suspects against images from closed-circuit television cameras (CCTV) or mobile phone footage for evidential and investigatory purposes[5]. The AFR system may use as tools of crime prevention, more than as a form of crime detection[6]. However, the uses of AFR technology are seen as dangerous and intrusive by the UK public[7]. For one thing, it could cause serious harm to democracy and human rights if the police agency misuses AFR technology. For another, it could have a chilling effect on civil society and people may keep self-censoring lawful behavior under constant surveillance[8]. III. The supervision mechanism of AFR technology To maintaining public trust, there must be a supervision mechanism to oversight the use of AFR technology in law enforcement. The UK Home Office indicates that the use of AFR technology is governed by a number of codes of practice including Police and Criminal Evidence Act 1984, Surveillance Camera Code of Practice and the Information Commissioner’s Office (ICO)’s Code of Practice for surveillance cameras[9]. (I) Police and Criminal Evidence Act 1984 The Police and Criminal Evidence Act (PACE) 1984 lays down police powers to obtain and use biometric data, such as collecting DNA and fingerprints from people arrested for a recordable offence. The PACE allows law enforcement agencies proceeding identification to find out people related to crime for criminal and national security purposes. Therefore, for the investigation, detection and prevention tasks related to crime and terrorist activities, the police can collect the facial image of the suspect, which can also be interpreted as the scope of authorization of the PACE. (II) Surveillance Camera Code of Practice The use of CCTV in public places has interfered with the rights of the people, so the Protection of Freedoms Act 2012 requires the establishment of an independent Surveillance Camera Commissioner (SCC) for supervision. The Surveillance Camera Code of Practice proposed by the SCC sets out 12 principles for guiding the operation and use of surveillance camera systems. The 12 guiding principles are as follows[10]: A. Use of a surveillance camera system must always be for a specified purpose which is in pursuit of a legitimate aim and necessary to meet an identified pressing need. B. The use of a surveillance camera system must take into account its effect on individuals and their privacy, with regular reviews to ensure its use remains justified. C. There must be as much transparency in the use of a surveillance camera system as possible, including a published contact point for access to information and complaints. D. There must be clear responsibility and accountability for all surveillance camera system activities including images and information collected, held and used. E. Clear rules, policies and procedures must be in place before a surveillance camera system is used, and these must be communicated to all who need to comply with them. F. No more images and information should be stored than that which is strictly required for the stated purpose of a surveillance camera system, and such images and information should be deleted once their purposes have been discharged. G. Access to retained images and information should be restricted and there must be clearly defined rules on who can gain access and for what purpose such access is granted; the disclosure of images and information should only take place when it is necessary for such a purpose or for law enforcement purposes. H. Surveillance camera system operators should consider any approved operational, technical and competency standards relevant to a system and its purpose and work to meet and maintain those standards. I. Surveillance camera system images and information should be subject to appropriate security measures to safeguard against unauthorised access and use. J. There should be effective review and audit mechanisms to ensure legal requirements, policies and standards are complied with in practice, and regular reports should be published. K. When the use of a surveillance camera system is in pursuit of a legitimate aim, and there is a pressing need for its use, it should then be used in the most effective way to support public safety and law enforcement with the aim of processing images and information of evidential value. L. Any information used to support a surveillance camera system which compares against a reference database for matching purposes should be accurate and kept up to date. (III) ICO’s Code of Practice for surveillance cameras It must need to pay attention to the personal data and privacy protection during the use of surveillance camera systems and AFR technology. The ICO issued its Code of Practice for surveillance cameras under the Data Protection Act 1998 to explain the legal requirements operators of surveillance cameras. The key points of ICO’s Code of Practice for surveillance cameras are summarized as follows[11]: A. The use time of the surveillance camera systems should be carefully evaluated and adjusted. It is recommended to regularly evaluate whether it is necessary and proportionate to continue using it. B. A police force should ensure an effective administration of surveillance camera systems deciding who has responsibility for the control of personal information, what is to be recorded, how the information should be used and to whom it may be disclosed. C. Recorded material should be stored in a safe way to ensure that personal information can be used effectively for its intended purpose. In addition, the information may be considered to be encrypted if necessary. D. Disclosure of information from surveillance systems must be controlled and consistent with the purposes for which the system was established. E. Individuals whose information is recoded have a right to be provided with that information or view that information. The ICO recommends that information must be provided promptly and within no longer than 40 calendar days of receiving a request. F. The minimum and maximum retention periods of recoded material is not prescribed in the Data Protection Act 1998, but it should not be kept for longer than is necessary and should be the shortest period necessary to serve the purposes for which the system was established. (IV) A new oversight and advisory board In addition to the aforementioned regulations and guidance, the UK Home Office mentioned that it will work closely with related authorities, including ICO, SCC, Biometrics Commissioner (BC), and Forensic Science Regulator (FSR) to establish a new oversight and advisory board to coordinate consideration of law enforcement’s use of facial images and facial recognition systems[12]. To sum up, it is estimated that the use of AFR technology by law enforcement has been abided by existing regulations and guidance. Firstly, surveillance camera systems must be used on the purposes for which the system was established. Secondly, clear responsibility and accountability mechanisms should be ensured. Thirdly, individuals whose information is recoded have the right to request access to relevant information. In the future, the new oversight and advisory board will be asked to consider issues relating to law enforcement’s use of AFR technology with greater transparency. IV. Follow-up key issues for the use of AFR technology Regarding to the UK Home Office’s Biometrics Strategy, members of independent agencies such as ICO, BC, SCC, as well as civil society, believe that there are still many deficiencies, the relevant discussions are summarized as follows: (I) The necessity of using AFR technology Elizabeth Denham, ICO Commissioner, called for looking at the use of AFR technology carefully, because AFR is an intrusive technology and can increase the risk of intruding into our privacy. Therefore, for the use of AFR technology to be legal, the UK police must have clear evidence to demonstrate that the use of AFR technology in public space is effective in resolving the problem that it aims to address[13]. The Home Office has pledged to undertake Data Protection Impact Assessments (DPIAs) before introducing AFR technology, including the purpose and legal basis, the framework applies to the organization using the biometrics, the necessity and proportionality and so on. (II)The limitations of using facial image data The UK police can collect, process and use personal data based on the need for crime prevention, investigation and prosecution. In order to secure the use of biometric information, the BC was established under the Protection of Freedoms Act 2012. The mission of the BC is to regulate the use of biometric information, provide protection from disproportionate enforcement action, and limit the application of surveillance and counter-terrorism powers. However, the BC’s powers do not presently extend to other forms of biometric information other than DNA or fingerprints[14]. The BC has expressed concern that while the use of biometric data may well be in the public interest for law enforcement purposes and to support other government functions, the public benefit must be balanced against loss of privacy. Hence, legislation should be carried to decide that crucial question, instead of depending on the BC’s case feedback[15]. Because biometric data is especially sensitive and most intrusive of individual privacy, it seems that a governance framework should be required and will make decisions of the use of facial images by the police. (III) Database management and transparency For the application of AFR technology, the scope of biometric database is a dispute issue in the UK. It is worth mentioning that the British people feel distrust of the criminal database held by the police. When someone is arrested and detained by the police, the police will take photos of the suspect’s face. However, unlike fingerprints and DNA, even if the person is not sued, their facial images are not automatically deleted from the police biometric database[16]. South Wales Police have used AFR technology to compare facial images of people in crowds attending major public events with pre-determined watch lists of suspected mobile phone thieves in the AFR field test. Although the watch lists are created for time-limited and specific purposes, the inclusion of suspects who could possibly be innocent people still causes public panic. Elizabeth Denham warned that there should be a transparency system about retaining facial images of those arrested but not charged for certain offences[17]. Therefore, in the future the UK Home Office may need to establish a transparent system of AFR biometric database and related supervision mechanism. (IV) Accuracy and identification errors In addition to worrying about infringing personal privacy, the low accuracy of AFR technology is another reason many people oppose the use of AFR technology by police agencies. Silkie Carlo, director of Big Brother Watch, said the police must immediately stop using the AFR technology and avoid mistaking thousands of innocent citizens as criminals; Paul Wiles, Biometrics Commissioner, also called for legislation to manage AFR technology because of its accuracy is too low and the use of AFR technology should be tested and passed external peer review[18]. In the Home Office’s Biometric Strategy, the scientific quality standards for AFR technology will be established jointly with the FSR, an independent agency under the Home Office. In other words, the Home Office plans to extend the existing forensics science regime to regulate AFR technology. Therefore, the FSR has worked with the SCC to develop standards relevant to digital forensics. The UK government has not yet seen specific standards for regulating the accuracy of AFR technology at the present stage. V. Conclusion From the discussion of the public and private sectors in the UK, we can summarize some rules for the use of AFR technology. Firstly, before the application of AFR technology, it is necessary to complete the pre-assessment to ensure the benefits to the whole society. Secondly, there is the possibility of identifying errors in AFR technology. Therefore, in order to maintain the confidence and trust of the people, the relevant scientific standards should be set up first to test the system accuracy. Thirdly, the AFR system should be regarded as an assisting tool for police enforcement in the initial stage. In other words, the information analyzed by the AFR system should still be judged by law enforcement officials, and the police officers should take the responsibilities. In order to balance the protection of public interest and basic human rights, the use of biometric data in the AFR technology should be regulated by a special law other than the regulations of surveillance camera and data protection. The scope of the identification database is also a key point, and it may need legislators’ approval to collect and store the facial image data of innocent people. Last but not least, the use of the AFR system should be transparent and the victims of human rights violations can seek appeal. [1] UK Home Office, Biometrics Strategy, Jun. 28, 2018, https://www.gov.uk/government/publications/home-office-biometrics-strategy (last visited Aug. 09, 2018), at 7. [2] Big Brother Watch, FACE OFF CAMPAIGN: STOP THE MET POLICE USING AUTHORITARIAN FACIAL RECOGNITION CAMERAS, https://bigbrotherwatch.org.uk/all-campaigns/face-off-campaign/ (last visited Aug. 16, 2018). [3] Lucas Introna & David Wood, Picturing algorithmic surveillance: the politics of facial recognition systems, Surveillance & Society, 2(2/3), 177-198 (2004). [4] Supra note 1, at 12. [5] Id, at 25. [6] Michael Bromby, Computerised Facial Recognition Systems: The Surrounding Legal Problems (Sep. 2006)(LL.M Dissertation Faculty of Law University of Edinburgh), http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.197.7339&rep=rep1&type=pdf , at 3. [7] Owen Bowcott, Police face legal action over use of facial recognition cameras, The Guardian, Jun. 14, 2018, https://www.theguardian.com/technology/2018/jun/14/police-face-legal-action-over-use-of-facial-recognition-cameras (last visited Aug. 09, 2018). [8] Martha Spurrier, Facial recognition is not just useless. In police hands, it is dangerous, The Guardian, May 16, 2018, https://www.theguardian.com/commentisfree/2018/may/16/facial-recognition-useless-police-dangerous-met-inaccurate (last visited Aug. 17, 2018). [9] Supra note 1, at 12. [10] Surveillance Camera Commissioner, Surveillance camera code of practice, Oct. 28, 2014, https://www.gov.uk/government/publications/surveillance-camera-code-of-practice (last visited Aug. 17, 2018). [11] UK Information Commissioner’s Office, In the picture: A data protection code of practice for surveillance cameras and personal information, Jun. 09, 2017, https://ico.org.uk/for-organisations/guide-to-data-protection/encryption/scenarios/cctv/ (last visited Aug. 10, 2018). [12] Supra note 1, at 13. [13] Elizabeth Denham, Blog: facial recognition technology and law enforcement, Information Commissioner's Office, May 14, 2018, https://ico.org.uk/about-the-ico/news-and-events/blog-facial-recognition-technology-and-law-enforcement/ (last visited Aug. 14, 2018). [14] Monique Mann & Marcus Smith, Automated Facial Recognition Technology: Recent Developments and Approaches to Oversight, Automated Facial Recognition Technology, 10(1), 140 (2017). [15] Biometrics Commissioner, Biometrics Commissioner’s response to the Home Office Biometrics Strategy, Jun. 28, 2018, https://www.gov.uk/government/news/biometrics-commissioners-response-to-the-home-office-biometrics-strategy (last visited Aug. 15, 2018). [16] Supra note 2. [17] Supra note 13. [18] Jon Sharman, Metropolitan Police's facial recognition technology 98% inaccurate, figures show, INDEPENDENT, May 13, 2018, https://www.independent.co.uk/news/uk/home-news/met-police-facial-recognition-success-south-wales-trial-home-office-false-positive-a8345036.html (last visited Aug. 09, 2018).

Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System3.Commission of Technology and Innovation (CTI) The CTI is also an institution dedicated to boosting innovation in Switzerland. Established in 1943, it was known as the Commission for the Promotion of Scientific Research[1]. It was initially established for the purpose of boosting economy and raising the employment rate, and renamed after 1996. The CTI and SNSF are two major entities dedicated to funding scientific research in Switzerland, and the difference between both resides in that the CTI is dedicated to funding R&D of the application technology and industrial technology helpful to Switzerland’s economic development. Upon enforcement of the amended RIPA 2011, the CTI was officially independent from the Federal Office for Professional Education and Technology (OEPT) and became an independent entity entitled to making decisions and subordinated to the Federal Department of Economic Affairs (FDEA) directly[2]. The CTI is subject to the council system, consisting of 65 professional members delegated from industrial, academic and research sectors. The members assume the office as a part time job. CTI members are entitled to making decisions on funding, utilization of resources and granting of CTI Start-up Label independently[3]. The CTI primarily carries out the mission including promotion of R&D of industrial technology, enhancement of the market-orientation innovation process and delivery of R&D energy into the market to boost industrial innovation. For innovation, the CTI's core mission is categorized into[4]: (1)Funding technology R&D activities with market potential The CTI invests considerable funds and resources in boosting the R&D of application technology and industrial technology. The CTI R&D Project is intended to fund private enterprises (particularly small-sized and medium-sized enterprises) to engage in R&D of innovation technology or product. The enterprises may propose their innovative ideas freely, and the CTI will decide whether the funds should be granted after assessing whether the ideas are innovative and potentially marketable[5]. CTI’s funding is conditioned on the industrial and academic cooperation. Therefore, the enterprises must work with at least one research institution (including a university, university of science and technology, or ETH) in the R&D. Considering that small-sized and medium-sized enterprises usually do not own enough working funds, technology and human resources to commercialize creative ideas, the CTI R&D Project is intended to resolve the problem about insufficient R&D energy and funds of small- and medium-sized enterprises by delivering the research institutions’ plentiful research energy and granting the private enterprises which work with research institutions (including university, university of science and technology, or ETH) the fund. Notably, CTI’s funding is applicable to R&D expenses only, e.g., research personnel’s salary and expenditure in equipment & materials, and allocated to the research institutions directly. Meanwhile, in order to enhance private enterprises' launch into R&D projects and make them liable for the R&D success or failure, CTI’s funding will be no more than 50% of the total R&D budget and, therefore, the enterprises are entitled to a high degree of control right in the process of R&D. The industrial types which the CTI R&D Project may apply to are not limited. Any innovative ideas with commercial potential may be proposed. For the time being, the key areas funded by CTI include the life science, engineering science, Nano technology and enabling sciences, etc.[6] It intends to keep Switzerland in the lead in these areas. As of 2011, in order to mitigate the impact of drastic CHF revaluation to the industries, the CTI launched its new R&D project, the CTI Voucher[7]. Given this, the CTI is not only an entity dedicated to funding but also plays an intermediary role in the industrial and academic sectors. Enterprises may submit proposals before finding any academic research institution partner. Upon preliminary examination of the proposals, the CTI will introduce competent academic research institutions to work with the enterprises in R&D, subject to the enterprises' R&D needs. After the cooperative partner is confirmed, CTI will grant the fund amounting to no more than CHF3,500,000 per application[8], provided that the funding shall be no more than 50% of the R&D project expenditure. The CTI R&D Project not only boosts innovation but also raises private enterprises’ willingness to participate in the academic and industrial cooperation, thereby narrowing the gap between the supply & demand of innovation R&D in the industrial and academic sectors. Notably, the Project has achieved remarkable effect in driving private enterprises’ investment in technology R&D. According to statistical data, in 2011, the CTI solicited additional investment of CHF1.3 from a private enterprise by investing each CHF1[9]. This is also one of the important reasons why the Swiss innovation system always acts vigorously. Table 1 2005-2011 Passing rate of application for R&D funding Year 2011 2010 2009 2008 2007 2006 2005 Quantity of applications 590 780 637 444 493 407 522 Quantity of funded applications 293 343 319 250 277 227 251 Pass rate 56% 44% 50% 56% 56% 56% 48% Data source: Prepared by the Study (2)Guiding high-tech start-up Switzerland has learnt that high-tech start-ups are critical to the creation of high-quality employment and boosting of economic growth, and start-ups were able to commercialize the R&D results. Therefore, as of 2001, Switzerland successively launched the CTI Entrepreneurship and CTI Startup to promote entrepreneurship and cultivate high-tech start-ups. 1.CTI Entrepreneurship The CTI Entrepreneurship was primarily implemented by the Venture Lab founded by CTI investment. The Venture Lab launched a series of entrepreneurship promotion and training courses, covering day workshops, five-day entrepreneurship intensive courses, and entrepreneurship courses available in universities. Each training course was reviewed by experts, and the experts would provide positive advice to attendants about innovative ideas and business models. Data source: Venture Lab Site Fig. 3 Venture Lab Startup Program 2.CTI Startup The CTI is dedicated to driving the economy by virtue of innovation as its priority mission. In order to cultivate the domestic start-ups with high growth potential in Switzerland, the CTI Startup project was launched in 1996[10] in order to provide entrepreneurs with the relevant guidance services. The project selected young entrepreneurs who provided innovative ideas, and guided them in the process of business start to work their innovative ideas and incorporate competitive start-ups. In order to enable the funding and resources to be utilized effectively, the CTI Startup project enrolled entrepreneurs under very strict procedure, which may be categorized into four stages[11]: Data source: CTI Startup Site Fig. 4 Startup Plan Flow Chart In the first stage, the CTI would preliminarily examine whether the applicant’s idea was innovative and whether it was technologically feasible, and help the applicant register with the CTI Startup project. Upon registration, a more concrete professional examination would be conducted at the second stage. The scope of examination included the technology, market, feasibility and management team’s competence. After that, at the stage of professional guidance, each team would be assigned a professional “entrepreneurship mentor”, who would help the team develop further and optimize the enterprise’s strategy, flow and business model in the process of business start, and provide guidance and advice on the concrete business issues encountered by the start-up. The stage of professional guidance was intended to guide start-ups to acquire the CTI Startup Label, as the CTI Startup Label was granted subject to very strict examination procedure. For example, in 2012, the CTI Startup project accepted 78 applications for entrepreneurship guidance, but finally the CTI Startup Label was granted to 27 applications only[12]. Since 1996, a total of 296 start-ups have acquired the CTI Startup Label, and more than 86% thereof are still operating now[13]. Apparently, the CTI Startup Label represents the certification for innovation and on-going development competence; therefore, it is more favored by investors at the stage of fund raising. Table 2 Execution of start-up plans for the latest three years Quantity of application Quantity of accepted application Quantity of CTI Label granted 2012 177 78 27 2011 160 80 26 2010 141 61 24 Data source: CTI Annual Report, prepared by the Study Meanwhile, the “CTI Invest” platform was established to help start-up raise funds at the very beginning to help commercialize R&D results and cross the valley in the process of R&D innovation. The platform is a private non-business-making organization, a high-tech start-up fund raising platform co-established by CTI and Swiss investors[14]. It is engaged in increasing exposure of the start-ups and contact with investors by organizing activities, in order to help the start-ups acquire investment funds. (3)Facilitating transfer of knowledge and technology between the academic sector and industrial sector KTT Support (Knowledge & Technology Transfer (KTT Support) is identified as another policy instrument dedicated to boosting innovation by the CTI. It is intended to facilitate the exchange of knowledge and technology between academic research institutions and private enterprises, in order to transfer and expand the innovation energy. As of 2013, the CTI has launched a brand new KTT Support project targeting at small-sized and medium-sized enterprises. The new KTT Support project consisted of three factors, including National Thematic Networks (NTNs), Innovation Mentors, and Physical and web-based platforms. Upon the CTI’s strict evaluation and consideration, a total of 8 cooperative innovation subjects were identified in 2012, namely, carbon fiber composite materials, design idea innovation, surface innovation, food study, Swiss biotechnology, wood innovation, photonics and logistics network, etc.[15] One NTN would be established per subject. The CTI would fund these NTNs to support the establishment of liaison channels and cooperative relations between academic research institutions and industries and provide small- and medium-sized enterprises in Switzerland with more rapid and easy channel to access technologies to promote the exchange of knowledge and technology between both parties. Innovation Mentors were professionals retained by the CTI, primarily responsible for evaluating the small-sized and medium-sized enterprises’ need and chance for innovation R&D and helping the enterprises solicit competent academic research partners to engage in the transfer of technology. The third factor of KTT Support, Physical and web-based platforms, is intended to help academic research institutions and private enterprises establish physical liaison channels through organization of activities and installation of network communication platforms, to enable the information about knowledge and technology transfer to be more transparent and communicable widely. In conclusion, the CTI has been dedicated to enhancing the link between scientific research and the industries and urging the industrial sector to involve and boost the R&D projects with market potential. The CTI’s business lines are all equipped with corresponding policy instruments to achieve the industrial-academic cooperation target and mitigate the gap between the industry and academic sectors in the innovation chain. The various CTI policy instruments may be applied in the following manner as identified in the following figure. Data source: CTI Annual Report 2011 Fig. 5 Application of CTI Policy Instrument to Innovation Chain III. Swiss Technology R&D Budget Management and Allocation The Swiss Federal Government has invested considerable expenditures in technology R&D. According to statistic data provided by Swiss Federal Statistical Office (FSO) and OECD, the Swiss research expenditures accounted for 2.37% of the Federal Government’s total expenditures, following the U.S.A. and South Korea (see Fig. 6). Meanwhile, the research expenditures of the Swiss Government grew from CHF2.777 billion in 2000 to CHF4.639 billion in 2010, an average yearly growth rate of 5.9% (see Fig. 7). It is clear that Switzerland highly values its technology R&D. Data source: FSO and OECD Fig. 6 Percentage of Research Expenditures in Various Country Governments’ Total Expenditures (2008) Data source: FSO and OECD Fig. 7 Swiss Government Research Expenditures 2000-2010 1.Management of Swiss Technology R&D Budget Swiss research expenditures are primarily allocated to the education, R&D and innovation areas, and play an important role in the Swiss innovation system. Therefore, a large part of the Swiss research expenditures are allocated to institutions of higher education, including ETH, universities, and UASs. The Swiss research expenditures are utilized by three hierarchies[16] (see Fig. 8): Government R&D funding agencies: The Swiss research budget is primarily executed by three agencies, including SERI, Federal Department of Economic Affairs, Education and Research, and Swiss Agency for Development and Cooperation (SDC). Intermediary R&D funding agencies: Including SNSC and CTI. Funding of R&D performing institutions: Including private enterprises, institutions of higher education and private non-profit-making business, et al. Therefore, the Swiss Government research expenditures may be utilized by the Federal Government directly, or assigned to intermediary agencies, which will allocate the same to the R&D performing institutions. SERI will allocate the research expenditures to institutions of higher education and also hand a lot of the expenditures over to SNSF for consolidated funding to the basic science of R&D. Data source: FSO Fig. 8 Swiss Research Fund Utilization Mechanism ~to be continued~ [1] ORGANIZATION FOR ECONNOMIC CO-OPERATION AND DEVELOPMENT [OECD], OECD Reviews of Innovation Policy: Switzerland 27 (2006). [2] As of January 1, 2013, the Federal Ministry of Economic Affairs was reorganized, and renamed into Federal Department of Economic Affairs, Education and Research (EAER). [3] The Commission for Technology and Innovation CTI, THE COMMISSION FOR TECHOLOGY AND INNOVATION CTI, http://www.kti.admin.ch/org/00079/index.html?lang=en (last visited Jun. 3, 2013). [4] Id. [5] CTI INVEST, Swiss Venture Guide 2012 (2012), at 44, http://www.cti-invest.ch/getattachment/7f901c03-0fe6-43b5-be47-6d05b6b84133/Full-Version.aspx (last visited Jun. 4, 2013). [6] CTI, CTI Activity Report 2012 14 (2013), available at http://www.kti.admin.ch/dokumentation/00077/index.html?lang=en&download=NHzLpZeg7t,lnp6I0NTU042l2Z6ln1ad1IZn4Z2qZpnO2Yuq2Z6gpJCDen16fmym162epYbg2c_JjKbNoKSn6A-- (last visited Jun. 3, 2013). [7] CTI Voucher, THE COMMISSION FOR TECHOLOGY AND INNOVATION CTI, http://www.kti.admin.ch/projektfoerderung/00025/00135/index.html?lang=en (last visited Jun. 3, 2013). [8] Id. [9] CTI, CTI Activity Report 2011 20 (2012), available at http://www.kti.admin.ch/dokumentation/00077/index.html?lang=en&download=NHzLpZeg7t,lnp6I0NTU042l2Z6ln1ad1IZn4Z2qZpnO2Yuq2Z6gpJCDeYR,gWym162epYbg2c_JjKbNoKSn6A--(last visited Jun. 3, 2013). [10] CTI Start-up Brings Science to Market, THE COMMISSION FOR TECHOLOGY AND INNOVATION CTI, http://www.ctistartup.ch/en/about/cti-start-/cti-start-up/ (last visited Jun. 5, 2013). [11] Id. [12] Supra note 8, at 45. [13] Id. [14] CTI Invest, http://www.cti-invest.ch/About/CTI-Invest.aspx (last visited Jun. 5, 2013). [15] KTT Support, CTI, http://www.kti.admin.ch/netzwerke/index.html?lang=en (last visited Jun.5, 2013). [16] Swiss Federal Statistics Office (SFO), Public Funding of Research in Switzerland 2000–2010 (2012), available at http://www.bfs.admin.ch/bfs/portal/en/index/themen/04/22/publ.Document.163273.pdf (last visited Jun. 20, 2013).

Finland’s Technology Innovation SystemI. Introduction When, Finland, this country comes to our minds, it is quite easy for us to associate with the prestigious cell-phone company “NOKIA”, and its unbeatable high technology communication industry. However, following the change of entire cell-phone industry, the rise of smart phone not only has an influence upon people’s communication and interaction, but also makes Finland, once monopolized the whole cell-phone industry, feel the threat and challenge coming from other new competitors in the smart phone industry. However, even though Finland’s cell-phone industry has encountered frustrations in recent years in global markets, the Finland government still poured many funds into the area of technology and innovation, and brought up the birth of “Angry Birds”, one of the most popular smart phone games in the world. The Finland government still keeps the tradition to encourage R&D, and wishes Finland’s industries could re-gain new energy and power on technology innovation, and indirectly reach another new competitive level. According to the Statistics Finland, 46% Finland’s enterprises took innovative actions upon product manufacturing and the process of R&D during 2008-2010; also, the promotion of those actions not merely existed in enterprises, but directly continued to the aspect of marketing and manufacturing. No matter on product manufacturing, the process of R&D, the pattern of organization or product marketing, we can observe that enterprises or organizations make contributions upon innovative activities in different levels or procedures. In the assignment of Finland’s R&D budgets in 2012, which amounted to 200 million Euros, universities were assigned by 58 million Euros and occupied 29% R&D budgets. The Finland Tekes was assigned by 55 million Euros, and roughly occupied 27.5% R&D budgets. The Academy of Finland (AOF) was assigned by 32 million Euros, and occupied 16% R&D budges. The government’s sectors were assigned by 3 million Euros, and occupied 15.2% R&D budgets. Other technology R&D expenses were 2.1 million Euros, and roughly occupied 10.5% R&D. The affiliated teaching hospitals in universities were assigned by 0.36 million Euros, and occupied 1.8% R&D budgets. In this way, observing the information above, concerning the promotion of technology, the Finland government not only puts more focus upon R&D innovation, but also pays much attention on education quality of universities, and subsidizes various R&D activities. As to the Finland government’s assignment of budges, it can be referred to the chart below. As a result of the fact that Finland promotes industries’ innovative activities, it not only made Finland win the first position in “Growth Competitiveness Index” published by the World Economic Forum (WEF) during 2000-2006, but also located the fourth position in 142 national economy in “The Global Competitiveness Report” published by WEF, preceded only by Swiss, Singapore and Sweden, even though facing unstable global economic situations and the European debt crisis. Hence, observing the reasons why Finland’s industries have so strong innovative power, it seems to be related to the Finland’s national technology administrative system, and is worthy to be researched. II. The Recent Situation of Finland’s Technology Administrative System A. Preface Finland’s administrative system is semi-presidentialism, and its executive power is shared by the president and the Prime Minister; as to its legislative power, is shared by the Congress and the president. The president is the Finland’s leader, and he/she is elected by the Electoral College, and the Prime Minister is elected by the Congress members, and then appointed by the president. To sum up, comparing to the power owned by the Prime Minister and the president in the Finland’s administrative system, the Prime Minister has more power upon executive power. So, actually, Finland can be said that it is a semi-predisnetialism country, but trends to a cabinet system. Finland technology administrative system can be divided into four parts, and the main agency in each part, based upon its authority, coordinates and cooperates with making, subsidizing, executing of Finland’s technology policies. The first part is the policy-making, and it is composed of the Congress, the Cabinet and the Research and Innovation Council; the second part is policy management and supervision, and it is leaded by the Ministry of Education and Culture, the Ministry of Employment and the Economy, and other Ministries; the third part is science program management and subsidy, and it is composed of the Academy of Finland (AOF), the National Technology Agency (Tekes), and the Finnish National Fund Research and Development (SITRA); the fourth part is policy-executing, and it is composed of universities, polytechnics, public-owned research institutions, private enterprises, and private research institutions. Concerning the framework of Finland’s technology administrative, it can be referred to below. B. The Agency of Finland’s Technology Policy Making and Management (A) The Agency of Finland’s Technology Policy Making Finland’s technology policies are mainly made by the cabinet, and it means that the cabinet has responsibilities for the master plan, coordinated operation and fund-assignment of national technology policies. The cabinet has two councils, and those are the Economic Council and the Research and Innovation Council, and both of them are chaired by the Prime Minister. The Research and Innovation Council is reshuffled by the Science and Technology Policy Council (STPC) in 1978, and it changed name to the Research and Innovation Council in Jan. 2009. The major duties of the Research and Innovation Council include the assessment of country’s development, deals with the affairs regarding science, technology, innovative policy, human resource, and provides the government with aforementioned schedules and plans, deals with fund-assignment concerning public research development and innovative research, coordinates with all government’s activities upon the area of science, technology, and innovative policy, and executes the government’s other missions. The Research and Innovation Council is an integration unit for Finland’s national technology policies, and it originally is a consulting agency between the cabinet and Ministries. However, in the actual operation, its scope of authority has already covered coordination function, and turns to direct to make all kinds of policies related to national science technology development. In addition, the consulting suggestions related to national scientific development policies made by the Research and Innovation Council for the cabinet and the heads of Ministries, the conclusion has to be made as a “Key Policy Report” in every three year. The Report has included “Science, Technology, Innovation” in 2006, “Review 2008” in 2008, and the newest “Research and Innovation Policy Guidelines for 2011-2015” in 2010. Regarding the formation and duration of the Research and Innovation Council, its duration follows the government term. As for its formation, the Prime Minister is a chairman of the Research and Innovation Council, and the membership consists of the Minister of Education and Science, the Minister of Economy, the Minister of Finance and a maximum of six other ministers appointed by the Government. In addition to the Ministerial members, the Council shall comprise ten other members appointed by the Government for the parliamentary term. The Members must comprehensively represent expertise in research and innovation. The structure of Council includes the Council Secretariat, the Administrative Assistant, the Science and Education Subcommittee, and the Technology and Innovation Subcommittee. The Council has the Science and Education Subcommittee and the Technology and Innovation Subcommittee with preparatory tasks. There are chaired by the Ministry of Education and Science and by the Minister of Economy, respectively. The Council’s Secretariat consists of one full-time Secretary General and two full-time Chief Planning Officers. The clerical tasks are taken care of at the Ministry of Education and Culture. (B) The Agency of Finland’s Technology Policy Management The Ministries mainly take the responsibility for Finland’s technology policy management, which includes the Ministry of Education and Culture, the Ministry of Employment and Economy, the Ministry of Social Affairs and Health, the Ministry of Agriculture and Forestry, the Ministry of Defense, the Ministry of Transport and Communication, the Ministry of Environment, the Ministry of Financial, and the Ministry of Justice. In the aforementioned Ministries, the Ministry of Education and Culture and the Ministry of Employment and Economy are mainly responsible for Finland national scientific technology development, and take charge of national scientific policy and national technical policy, respectively. The goal of national scientific policy is to promote fundamental scientific research and to build up related scientific infrastructures; at the same time, the authority of the Ministry of Education and Culture covers education and training, research infrastructures, fundamental research, applied research, technology development, and commercialization. The main direction of Finland’s national scientific policy is to make sure that scientific technology and innovative activities can be motivated aggressively in universities, and its objects are, first, to raise research funds and maintain research development in a specific ratio; second, to make sure that no matter on R&D institutions or R&D training, it will reach fundamental level upon funding or environment; third, to provide a research network for Finland, European Union and global research; fourth, to support the research related to industries or services based upon knowledge-innovation; fifth, to strengthen the cooperation between research initiators and users, and spread R&D results to find out the values of commercialization, and then create a new technology industry; sixth, to analyze the performance of national R&D system. As for the Ministry of Employment and Economy, its major duties not only include labor, energy, regional development, marketing and consumer policy, but also takes responsibilities for Finland’s industry and technical policies, and provides industries and enterprises with a well development environment upon technology R&D. The business scope of the Ministry of Employment and Economy puts more focus on actual application of R&D results, it covers applied research of scientific technology, technology development, commercialization, and so on. The direction of Finland’s national technology policy is to strengthen the ability and creativity of industries’ technology development, and its objects are, first, to develop the new horizons of knowledge with national innovation system, and to provide knowledge-oriented products and services; second, to promote the efficiency of the government R&D funds; third, to provide cross-country R&D research networks, and support the priorities of technology policy by strengthening bilateral or multilateral cooperation; fourth, to raise and to broaden the efficiency of research discovery; fifth, to promote the regional development by technology; sixth, to evaluate the performance of technology policy; seventh, to increase the influence of R&D on technological change, innovation and society; eighth, to make sure that technology fundamental structure, national quality policy and technology safety system will be up to international standards. (C) The Agency of Finland’s Technology Policy Management and Subsidy As to the agency of Finland’s technology policy management and subsidy, it is composed of the Academy of Finland (AOF), the National Technology Agency (Tekes), and the Finnish National Fund Research and Development (SITRA). The fund of AOF comes from the Ministry of Education and Culture; the fund of Tekes comes from the Ministry of Employment and Economy, and the fund of SITRA comes from independent public fund supervised by the Finland’s Congress. (D) The Agency of Finland’s Technology Plan Execution As to the agency of Finland’s technology plan execution, it mainly belongs to the universities under Ministries, polytechnics, national technology research institutions, and other related research institutions. Under the Ministry of Education and Culture, the technology plans are executed by 16 universities, 25 polytechnics, and the Research Institute for the Language of Finland; under the Ministry of Employment and Economy, the technology plans are executed by the Technical Research Centre of Finland (VTT), the Geological Survey of Finnish, the National Consumer Research Centre; under the Ministry of Social Affairs and Health, the technology plans are executed by the National Institute for Health and Welfare, the Finnish Institute of Occupational Health, and University Central Hospitals; under the Ministry of Agriculture and Forestry, the technology plans are executed by the Finnish Forest Research Institute (Metla), the Finnish Geodetic Institute, and the Finnish Game and Fisheries Research Institute (RKTL); under the Ministry of Defense, the technology plans are executed by the Finnish Defense Forces’ Technical Research Centre (Pvtt); under the Ministry of Transport and Communications, the technology plans are executed by the Finnish Meteorological Institute; under the Ministry of Environment, the technology plans are executed by the Finnish Environment Institute (SYKE); under the Ministry of Financial, the technology plans are executed by the Government Institute for Economic Research (VATT). At last, under the Ministry of Justice, the technology plans are executed by the National Research Institute of Legal Policy.