To establish a trusted foundation for sports data compliance, the Sports Data Altruism Service releases the Sports Data Altruism Service Personal Data Assessment Legal Compliance Handbook

To establish a trusted foundation for sports data compliance, the Sports Data Altruism Service releases the Sports Data Altruism Service Personal Data Assessment Legal Compliance Handbook

2024/05/15

I. Introduction

The Sports Data Altruism Service aims to construct a blueprint for the development of sports and technology, to promote practical applications for sports scientific research results, to drive industry development, and to establish a sports data innovation ecosystem. This will be achieved through multi-ministerial/multi-agency value-added applications for sports data, multidisciplinary upgrading and transformation of sports technology, digital empowerment to establish a sports technology ecosystem, and public-private collaboration efforts.

The Sports Data Altruism Service aims to build a legal compliance platform, and to reinforce the trust foundation for legally-compliant sports data operations, all while balancing privacy protection and public interest. In pursuit of these ends, the Sports Data Altruism Service draws upon international data governance practices and trends, as well as current industry practices. It aims to develop guidelines and regulations that consider the value of sports data applications and apply them to data legal compliance operations for sports venues. The Service is also intended to help operators in the sports field maintain personal data protections and reasonable use. Consequently, in August 2023, the Sports Data Altruism Service released the Sports Data Altruism Service Personal Data Assessment Legal Compliance Handbook. For entities seeking to become Sports Data Altruism Service data providers, the Handbook explains the related regulations and provides important things to watch out for.

II. Structure of the Sports Data Altruism Service Personal Data Assessment Legal Compliance Handbook

The Handbook is divided into three sections:

A. Requirements for joining the Sports Data Altruism Service:

Before starting with the Sports Data Altruism Service, users must read and agree to the service’s Privacy Policy, Terms of Service, Notification Regarding Personal Data Collection and Personal Data Provision Agreement, and other important platform information.

The Privacy Policy explains how the platform collects, uses, and protects the information that users provide. If you wish to become a data provider or data user, the Terms of Service will explain what you need to comply with to do so. And if you decide to become a data provider or data user, you must register on this platform and must sign the "Notification and Letter of Consent for Collection, Processing, and Use of Personal Data" to state your agreement to provide your data to the platform.

B. Personal data subject rights protection mechanism for sports venue operators (data providers):

After becoming a Sports Data Altruism Service data provider, to lawfully obtain the personal sports data, the data provider must submit the Points of Note When Connecting to the Sports Data Altruism Service and Personal Sports Data Provision Agreement. This form, submitted in either paper or online format, must include a signature from the person whose personal sports data is to be used.

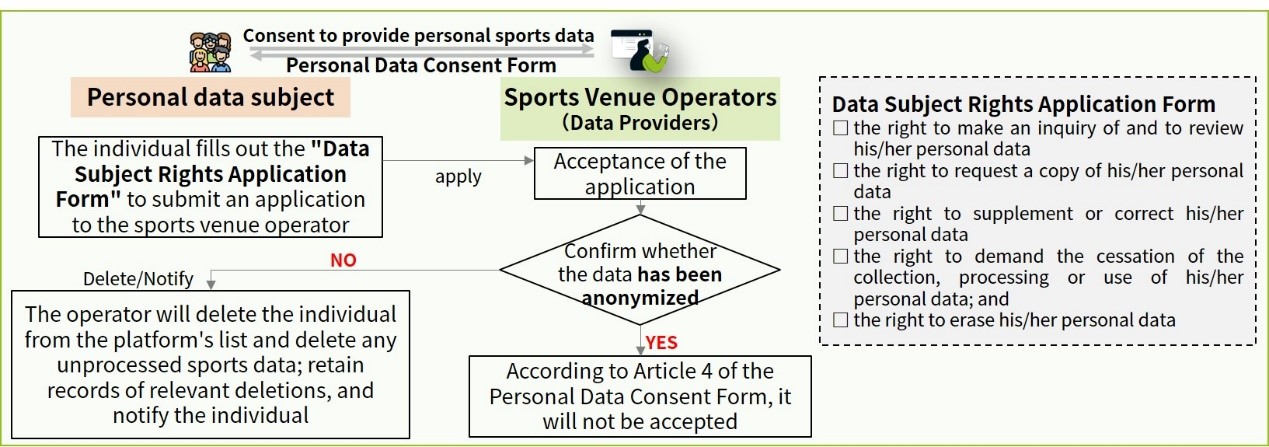

When a data subject needs to correct their personal data or no longer wishes to provide their data to the Sports Data Altruism Service, the data provider must provide the Exercise of Data Subject Rights Application Form. After the data subject submits the application, the sports venue operator must verify whether the data has been processed to the extent that it cannot be used to identify a specific individual. In accordance with Article 4 of the Points of Note When Connecting to the "Notice of Connection to the Sports Data Altruism Service Platform and Consent Form for Provision of Personal Sports Data", data that can no longer identify specific data subjects is no longer considered personal data, and is not subject to exercising of data subject rights, nor is it subject to deletion of statistical or analytical results based on such data. If the data has not been anonymized, the operator must remove the data subject from the list uploaded to the platform and delete any unprocessed sports data. They must also retain records of the deletion and notify the data subject.

Source: Sports Data Altruism Service Personal Data Assessment Legal Compliance Handbook

Figure 1 Data Subject Rights Exercise Mechanism for Sports Venue Operators

C. Data protection management process for sports venue operators (data providers):

To assist sports venue operators in complying with personal data protection requirements, the Sports Data Altruism Service provides a personal data protection self-assessment tool. After an operator becomes a Sports Data Altruism Service data provider, they must assess their compliance with data protection laws by completing the Self-Assessment Form for Personal Data Protection in Collecting Public Sports Data by Sports Venue Operators (Data Providers). This helps operators understand the importance of personal data protection and establish a robust personal data protection management system, to achieve both data protection and reasonable usage.

The Self-Assessment Form for Personal Data Protection in Collecting Public Sports Data by Sports Venue Operators (Data Providers) is designed in accordance with the regulations of the Personal Data Protection Act and its enforcement rules. It includes 20 assessments in 10 major categories. When filling out the self-assessment form, the operator must provide the name of the self-assessment venue, the name of the person filling out the form, and the date. The form has to be completed based on the personal characteristic data and sports data that is to be uploaded to the Sports Data Altruism Service. However, not every assessment is mandatory. The form requires considering the operator’s actual situation to review the current practices related to personal data protection and management, then conducting the self-assessment based on this.

For more detailed information about the Sports Data Altruism Service Personal Data Assessment Legal Compliance Handbook, please visit the Sports Data Altruism Service website (https://www.data-sports.tw/#/SportData/Landing?redirect=%2FDashboard).

1. Organization Framework In the organization framework of critical infrastructure protection, there are mainly the public departments and the PPP organizations. The functions and task description of relevant organizations are as follows. (1) Department of Homeland Security After the September 11 attacks in America, the Homeland Security Act was passed in November 2002, and based on this act, 23 federal organizations, plans and offices were integrated to establish the Department of Homeland Security (DHS) to take responsibility for homeland security in America. The tasks include: (1) to analyze intelligence data collected from various departments such as the Central Intelligence Agency (CIA) and the Federal Bureau of Investigation (FBI) so that any threats to security can be discovered in time, (2) to protect and defend critical infrastructure, (3) to coordinate and lead America to prevent and respond to the attacks from nuclear weapons, biochemical weapons and other and (4) to coordinate the tasks of the federal government, including emergency and rescue. For the task regarding critical infrastructure and critical information infrastructure protection, the main units in charge are the Office of Infrastructure Protection (OIP) and the Office of Cybersecurity and Communications (CS&C) subordinate to National Protection and Programs Directorate (NPPD), Department of Homeland Security (DHS), to reduce the risk in both physical and cyber security to maintain national security1 (2) Congress Relevant units and committees are established both in the Senate and the House of Representatives to be responsible for protection and making policies pertinent to important critical infrastructure and critical information infrastructure. (3) Computer Crime and Intellectual Property Section In 1991, the Department of Justice (DOS) established the Computer Crime and Intellectual Property Section (CCIPS), a section of the Criminal Division, to be responsible for all crime combating computer and intellectual property. Computer crime is referred to cases which include electronic penetrations, data thefts, and cyber attacks to the important critical infrastructure. CCIPS also prevents, investigates, and prosecutes computer crimes by working with other government agencies, the private sector, academic institutions, and foreign counterparts. (4) Other Relevant PPP Organizations 2The Information Sharing and Analysis Center (ISAC) is responsible for the information security message sharing among the industries of each critical infrastructure to ensure the liaison and cooperation among industries. Finally, for the issue on critical information infrastructure, especially cyber crimes, both the National Cyber Security Alliance (NCSA) and the Cross Sector Cyber Security Working Group (CSCSWG) are designated to serve as crucial roles in governmental and non-governmental internet security prevention to be responsible for techniques and education. 2. Notification System (1)Computer Emergency Response Team Coordination Center The Computer Emergency Response Team Coordination Center (CERT/CC) run by Carnegie Mellon University is the oldest and most important early-warning organization for information security in the USA. With its experts studying internet vulnerabilities and risk assessment released regularly, it reminds people of the possible dangers which exist in the information age and the need to improve internet security. (2)US Computer Emergency Readiness Team The US Computer Emergency Readiness Team (US-CERT) was established in 2003. It is responsible for protecting the infrastructure of the internet in America and for coordinating and providing response support and defense against national cyber attacks. It interacts with federal agencies, industry, the research community, state government, and others to disseminate reasoned and actionable cyber security information to the public. (3)Federal Bureau of Investigation The Federal Bureau of Investigation (FBI), the first early warning center of critical infrastructure at the national level, is responsible for providing the information pertinent to legal execution presently and also taking responsibility for the investigation of cyber crime. (4)Information Sharing and Analysis Centers Currently, industry in America, including finance, telecommunications, energy, traffic, water resources, together established individual Information Sharing and Analysis Centers (ISACs) based on the policy made in PDD-63. The ISAC of the financial system established in October 1999 being the first established center. These ISACs further work together to form an ISAC Council to integrate the information from each of them and improve their interaction and information sharing. 3. Legal Norms In reference to the laws and regulations of critical infrastructure protection, America has aimed at critical infrastructure protection and computer crime to formulate the following regulations. (1) Federal Advisory Committee Act of 1972 According to the Federal Advisory Committee Act (FACA), the advisory committee can be established in every federal agency to provide the public, along with received open advice, with relevant objectives, and to prevent the public from being inappropriately influenced by the policies made by the government. However, to keep the private institutions which run the critical infrastructures from worrying the inappropriate leak of the sensitive information provided and consulted by them, Critical Infrastructure Partnership Advisory Council was established so that the Secretary of Homeland Security has the right to disregard the regulations of FACA and establish an independent advisory committee. (2) Computer Fraud and Abuse Act of 19863 The Computer Fraud and Abuse Act (CFAA) was enacted and implemented in 1986. It mainly regulates computer fraud and abuse. The Act states that it is against the law for anyone to access a protected computer without authorization. However, it also recognizes the fact that accessing a computer system of electronic and magnetic records does not mean a violation of the law. According to the CFAA, what is needed is one of the following requirements to be the wrongful conduct regulated in the Act: (1) whoever intentionally accesses a computer to obtain specific information inside the government or whoever has influenced the transmission function of the computer system; (2) whoever intentionally accesses a computer to obtain a protected database (including the information contained in a financial record of a financial institution or of a card issuer, or the information contained in a file of a consumer reporting agency on a consumer, or the information from any department of agency of the United States, or the conduct involving an interstate transaction); (3) whoever intentionally accesses any nonpublic computer of a department or agency of the United States, and causes damage. In addition, the Act also prohibits conduct such as transmitting malicious software, and defrauding traffic in any password or similar information. For any person who suffers damage or loss by reason of a violation of the law, he/she may maintain a civil action to obtain compensatory damages and injunctive relief or other equitable relief. However, the Computer Abuse Amendment Act (1994) expands the above Act, planning to include the conduct of transmitting viruses and malicious program into the norms whose regulatory measures were adopted by the USA Patriot Act enacted in October 20014 (3) Homeland Security Act of 20025 The Homeland Security Act provides the legal basis for the establishment of the Department of Homeland Security and integrates relevant federal agencies into it. The Act also puts information analysis and measures of critical infrastructure protection into the norm. And, the norm in which private institutions are encouraged to voluntarily share with DHS the information security message of important critical infrastructure is regulated in the Critical Infrastructure Information Act: Procedures for Handling Critical Infrastructure Information. According to the Act, the DHS should have the obligation to keep the information provided by private institutions confidential, and this information is exempted from disclosure by the Freedom of Information Act. (4) Freedom of Information Act Many critical infrastructures in America are regulated by governmental laws, yet they are run by private institutions. Therefore, they should obey the law and provide the government with the operation report and the sensitive information related with critical infrastructure. However, knowing that people can file a request at will to review relevant data from the government agencies based on the Freedom of Information Act (FOIA), then the security of national critical infrastructure may be exposed to the danger of being attacked. Therefore, the critical infrastructure, especially the information regarding the safety system, early warning, and interdependent units, are all exempted by the Freedom of Information Act. (5) Terrorism Risk Insurance Act of 20026 After the 911 Incident, Congress in America passed the Terrorism Risk Insurance Act to establish the mechanism to underwrite terrorism risk insurance, in which insurance companies are required to provide terrorism attack risk insurance and the federal government will also cover part of loss for severe attacks. 1.http://www.dhs.gov/xabout/structure/editorial_0794. shtm (last accessed at 21. 07. 2009). 2.http://www.thei3p.org/ (last accessed at 21. 07. 2009). 3.http://www.panix.com/~eck/computer-fraud-act. html (last accessed at 21. 07. 2009). 4.Mark G. Milone, Hacktivism:Securing the National Infrastructure, 58 Bus. Law, 389-390, 2002. 5.http://www.dhs.gov/xlibrary/assets/hr_5005_enr.pdf (last accessed at 21. 07. 2009). 6.http://www.ustreas.gov/offices/domestic-finance/financial-institution/terrorism-insurance/pdf/hr3210.pdf (last accessed at 21. 07. 2009).

Implementing Information Security to Protect Individuals' PrivacyThe development of new technology is bound to have both positive and negative effects. However, when a new technology is first introduced, it is common for insufficient attention to be paid to its negative aspects, either because there has not been time to accumulate sufficient experience in using it or because users are blinded by the potential benefits. It is only later, when the technology begins to be abused, that people wake up to the potential dangers. The evolution of computers and the Internet is a classic example of this phenomenon. While the rapid development of information technology has helped to stimulate the flow of information in every corner of society, cyberspace has also become the setting for a wide range of criminal activities. In many cases, countries' existing legal and regulatory frameworks have proved inadequate to cope with the threat posed by the various forms of unauthorized access. A variety of forms of cyber-crime have developed, including denial-of-service attacks, unauthorized accessing of databases, phishing, identity theft and online fraud or intimidation. Cyber-crime may involve making unauthorized use of individuals' personal information, stealing companies' confidential business information or selling state secrets; these new types of crime thus affect every level of society. The effects can be catastrophic, hence the growing importance is now being attached to information security, including both the establishment of effective management mechanisms to prevent cyber-crime from occurring in the first place and the development of the capabilities needed to detect such crime when it occurs. Recognizing the need to plug the gaps in the existing legal and regulatory framework in the face of cyber-crime, countries all over the world are working on the formulation of new legislation, and Taiwan is no exception. The following sections will discuss the key developments in the laws and regulations governing information security in Taiwan in recent years. I. The Convention on Cyber-crime and Chapter 36 of Taiwan’s Criminal Code (offences relating to the abuse of computers) Today, governments throughout the world are formulating measures to combat criminal activity that makes use of the Internet (cyber-crime). In many cases these measures are based on the Convention on Cyber-crime announced by the European Commission on November 23, 2001, and which came into effect on July 1, 2004. This convention is the first international agreement to be established specifically to combat cyber-crime. Its contents include discussion of the various types of cyber-crime, regulations governing the obtaining of electronic evidence, provisions for mutual assistance between nations in judicial matters with respect to cyber-crime and measures to encourage multilateral collaboration. The European Commission asked all signatory nations to revise their own national laws so that they conform to the provisions of the Convention, with the aim of establishing a unified international framework for combating cyber-crime. Responding to the international trend towards the enactment of legislation to fight cyber-crime and to eliminate any loopholes in Taiwanese law that might result in Taiwan becoming a haven for cyber-criminals, on June 25, 2003 the Taiwanese government added a new chapter, Chapter 36 (Offences Relating to the abuse of Computers) to Taiwan's Criminal Code. It contains six articles covering four types of crime: unauthorized access (Article 358), the unauthorized acquisition, deletion or titleeration of electromagnetic records (Article 359), unauthorized use of or interference with a computer system (Article 360) and creating computer programs specifically for the perpetration of a crime (Article 362). Article 361 specifies that more severe punishment should be imposed in the case of violations carried out against the computers or other equipment of a public service organization, and Article 363 states that the provisions of Articles 358–360 shall apply only after prosecution is instituted upon complaint. These new articles provide a clear legal basis for the punishment of common types of cyber-crime such as unauthorized access by hackers, the spreading of computer viruses and the use of Trojan horse programs. In formulating these articles, reference was made to the categorization of cyber-crimes used in the Convention on Cyber-crime and to the suggestions for revision of national laws put forward there. Article 36 is thus in broad conformity with current international practice in this regard and can be expected to achieve significant results in terms of combating cyber-crime. II. The authority of law enforcement to get evidence and ISPs liability In its discussion of the securing of electromagnetic records by law enforcement agencies, the Convention on Cyber-crime notes that such securing of records falls into two broad categories: immediate access and non-immediate access. Immediate access includes the monitoring of communications by law enforcement agencies, non-immediate access relates mainly to the data retention obligations imposed on Internet Service Providers (ISPs). As regards the regulatory framework for the monitoring of communications, Communications Protection and Surveillance Act came into effect in Taiwan on July 16, 1999. According to its provisions, monitoring of communications may only be implemented when it is deemed necessary to protect national security or to maintain social order. Warrants for such surveillance may only be issued if the content of the communications is related to a threat to national security or to the maintenance of social order. Furthermore, the crime in question must be a serious one. In principle, the period for which surveillance is implemented should not exceed 30 days. These restrictions reflect the government’s determination to ensure that citizens' right to privacy is protected. While the Internet is an environment conducive to the maintenance of anonymity, electromagnetic records are easy to erase. Effective investigation of cyber-crime requires automatic recording of communications by the equipment used to transmit the messages, that is to say, it requires the retention of historic data. As regards the extent to which companies are required to collaborate with law enforcement agencies and the conditions applying to the making available of electromagnetic records, these issues relate to the public's right to privacy, and the law in this area needs to be very clear and precise. For the most part, data retention obligations are laid down in Taiwan’s Telecommunications Act. In Taiwan ISPs are classed as "Type II Telecommunications Operators". Article 27 of the Administrative Regulations on Type II Telecommunications Businesses stipulates that Type II telecommunications operators may be required to confirm the existence of, and provide the contents of, customers' communications for the purpose of investigation or collection of evidence upon request in accordance with the requirements of the law. ISPs are required to retain, for a period of between 1 and 6 months, data relating to the account number of subscribers, the times and dates of communications, the times at which subscribers logged on and off, free e-mail accounts, the IP addresses used when applying for Web space and the time and date when such applications were made, the IP address used to make postings on message boards and newsgroups, the time and date when such postings were made and subscribers' e-mail communications records. If a Type II telecommunications operator violates these provisions, he may be fined between NT$200,000 and NT$1 million and be required to remedy the situation within a specified time limit in accordance with Paragraph 2 of Article 64 of the Telecommunications Law. If he fails to remedy the situation within the specified time limit, his license may be revoked. III. The Legal Framework for Personal Data Protection titlehough, as outlined above, some revisions have already been made to the legal framework governing information security, there are still many areas which need to be reviewed. One of the most important is the protection of personal information. Following the explosive growth of the Internet, customer-related information is being processed by computers on a large scale in many different industries. With so many companies collaborating with other firms or adopting new marketing methods, the value and importance of personal information is being reassessed. The dramatic increase in the number of online scams in Taiwan in recent years has made the protection of privacy a focus of attention. The existing Computer-processed Personal Data Protection Law, drawn up to target specific industries, does not really provide adequate protection. A new Personal Data Protection Act, drawn up with reference to the European Union’s Directive (95/46/EC) on the Protection of Individuals with regard to the Processing of Personal Data and on the Free Movement of Such Data and the personal information protection legislation adopted in the USA and Japan, has already been submitted to the Legislative Yuan for deliberation. The key differences between this new Act and the existing Computer-processed Personal Data Protection Law are as follows. Protection is no longer industry-specific, it now applies to both natural and juristic persons and to both public and private agencies. The scope of protection has been expanded to include hard copies of documents containing personal information, and five new types of "sensitive information" – information relating to criminal records, medical examinations, medical records, sexual history and genetic information – have been added. Special restrictions apply to the collection and processing of these types of data. The Personal Data Protection Act also imposes stricter requirements on public and private agencies with regard to the protection of individuals' personal data. For example, agencies must formulate personal data protection plans and measures for dealing with personal data once those data are no longer needed for business purposes. If an agency discovers that an individual's personal data have been stolen, leaked, titleered or violated in any way, they are required to notify by telephone or letter the agency responsible for notifying the individual concerned as soon as possible. If these provisions are violated, the agency's responsible person will be liable for administrative punishment. The new Act also gives regulatory authorities greater powers to undertaking auditing in this area, makes provision for class action suits and increases the amount of compensation to be paid to victims. It is expected that these mechanisms will help boost awareness of the importance of information security in all sectors, thereby helping to ensure better protection for the public's personal information. IV. Management of Unsolicited Commercial E-Mail The widespread utilization of e-mail has created a brand new marketing channel, so that e-mail can fairly be described as one of the most important "killer applications" to which the Internet has given rise. Today, spamming is causing serious problems for both e-mail users and ISPs. E-mail users are concerned about their privacy being violated and about having their e-mail box stuffed full of junk e-mail. Spamming also ties up bandwidth which could be used for other purposes, and Distributed Denial of Service Attacks (DDOS) can make it difficult for ISPs to provide normal service to their customers. Governments throughout the world have begun to consider whether anti-spamming legislation may be necessary. In Taiwan draft legislation of this type has already been submitted to the Legislative Yuan. Taiwan's Anti-SPAM Act was drawn up with reference to the USA's CAN-SPAM Act of 2003, Japan's Law on Regulation of Transmission of Specified Electronic Mail, Australia's SPAM Act and the UK's Privacy and Electronic Communications (EC Directive) Regulations 2003. The draft SPAM Act contains 13 articles, with an emphasis on self-regulation, technology filtering and provision for seeking compensation through civil action. The Act provides for the use of an "opt-out" mechanism to regulate the behavior of e-mail senders, with the following obligations to be imposed on them. (1) The sender must specify in the "Subject" field of the e-mail whether it is a "business communication" or "advertising" to facilitate filtering by ISPs and to make clear to the recipient what type it is. (2) The sender must provide accurate information, including header, information on the sender's identity and the sender's e-mail address. (3) E-mails may not be sent if the sender knows or could be expected to know that the intended recipient has already expressed a wish not to receive e-mail from this source. E-mails may also not be sent if the sender knows or could be expected to know that the information in the "Subject" field is inaccurate or misleading. If the sender continues to send e-mails after the recipient has expressed a clear wish not to receive any more from the sender or if the sender falsifies the "Subject" or header information, then the sender may be required to pay compensation to the recipient at a rate of NT$500–2,000 per person per e-mail. With regard to the widespread practice whereby companies or advertising agencies commission third parties to send junk e-mail on their behalf, in cases where the commissioning party knows or could be expected to know that e-mail is being sent in violation of the above regulations, the commissioning party shall be held jointly liable with the party sending the e-mail. Through the implementation of this new law, the government hopes to establish a first-class Internet environment in Taiwan, putting an end to the current situation whereby large numbers of businesses are engaged in spamming. V. Conclusions Security is the biggest single factor affecting the implementation of e-government initiatives, e-business application adoption and Internet user confidence. Most people associate information security only with the purchasing of security hardware or software and the setting up of firewalls. While these products can indeed help to make the online environment more secure, Internet users should not allow themselves to be lulled into thinking that buying these products will in and of itself be sufficient to ensure security. "Security" is a fluid concept. Over time, the level of security that even a high-end product can provide will deteriorate; the fact that your system is secure now does not guarantee that it will remain secure in the future. Evidence that this is true is provided by the damage that is constantly being caused by viruses, by the need to constantly update security products and by the shift in emphasis away from virus prevention and firewalls towards preventing "backdoor" attacks and towards proactive intrusion detection. Furthermore, the information security risks that companies and organizations have to deal with are not limited to external threats; poor internal management may result in employees selling or leaking customer data or other company data, which can cause serious damage to the organization. Examination of information security theory and practice in Taiwan and overseas suggests that the establishment of effective information security measures embraces four main areas: the detection of cyber-crime, development of new information security technologies and formulation of standards, education and management of computer users and regulatory and policy issues. The most important of these is the education and management of computer users. Detection of cyber-crime is the next most important, while development of new technologies and standard setting and the regulatory and policy aspects play a supporting role. To create a genuinely secure online environment, attention must be paid to all of these. Today governments throughout the world are formulating new legislation to plug the gaps in the regulatory framework governing the online environment. Given the need to let the market mechanism operate freely and to refrain from measures that might retard industrial development, government interference in the Internet, with the exception of crime prevention activity, has generally been viewed as a last resort. Currently the government in Taiwan is still focusing mainly on self-regulation by Internet service providers and other types of business enterprise, and the government's role is still largely confined to formulating standards and assisting with the development of new security products. The area on which both the government and the private sector will need to concentrate in the future is educating and ensuring effective management of computer users.

The legal challenges of ubiquitous healthcareWhereas the burden of private nursing for the elderly is getting heavier, industrialized countries with an aging society are endeavoring to seek possibilities of reducing the unit healthcare cost, such as technology assistance, and even the introduction of the brand new care type or model, which is an emerging application field of increasing importance. The development of such kind of healthcare industry not only is suitable for aging societies but also coincides with the growing health management trend of modern people. Also, while the focus on acute diseases in the past has changed to chronic diseases which are common to most citizens, the measuring and monitoring of physiological indicators, such as blood pressure, pulse, blood sugar and uric acid have critical effects on condition control. However, it will mean huge financial and physical burdens to the elderly or suffering from chronic diseases if they need to travel to hospitals to measure these physiological indicators. At this moment, an economical, reliable and timely physiological information collection and transfer system will be technology with good potential. For this reason, the purpose of this study is to investigate the potential business opportunities by applying the emerging information technology (IT) to the healthcare industry and the derivative legal and regulatory issues, with a focus on the seamless healthcare industry. It is hoped that by assessing the opportunity and risk in terms of legal and strategic analysis, we can single out the potential imbalance of fitting seamless healthcare, an IT-enabled service (ITeS), in the conventional control framework, and thereby establish a legal environment more appropriate for the development of the seamless healthcare industry. Referring to the existing electronic healthcare classification, the industry is divided into the following four blocks: electronic content provider, electronic product provider, electronic linking service provider and electronic passport service provider. Also, by depicting the outlook of the industry, the mode of application and the potential and common or special legal problems of different products are clarified. Given that health information collected, stored and transferred by electronic means involves unprecedented risk in information privacy and security, and that the appropriate control of such risk will affect the consumer’s faith in and willingness to subscribe seamless healthcare services, this study analyzed the privacy framework of the USA, the EU and Taiwan. Results indicate that future privacy legislation in Taiwan should include the protection for non-computer-processed personal information, expand the scope and occupation of applications, reinforce control incentives, and optimize the privacy protection mechanism. Further, only when service providers have the correct and appropriate concept of privacy protection can the watch-and-wait attitude of consumers be eliminated. These can help to promote subsequent development of the industry in the future. Due to the booming international trade as a result of globalization, and the gradual opening of the domestic telecommunication and healthcare markets following Taiwan’s entry into the WTO, transnational distance healthcare will gradually become a reality. However, the determination of the qualifications of practitioners is the prerequisite of transnational healthcare services. Taiwan may also consider lowering the requirements for physicians to practice in other countries and thereby to enhance the export competitiveness of Taiwan’s healthcare industry by means of distance healthcare via endorsement or reciprocity. Lastly, whereas the risks distance healthcare involves are higher than conventional healthcare services, the sharing of burdens and disputes over applicable laws in case of damages are the gray areas for executive control or judicial practice intervention. For this reason, service providers are unwilling to enter the market because the risks are too unpredictable. Therefore, this study recommends that the insurance system for distance healthcare should be the focus of future studies in order to promote the development of the industry.

Legal issues of Third-Party Payment in TaiwanAlthough third-party payment is already one of the most popular ways to do the payment online in many countries, for example, Alipay of China and Paypal of USA, third-party payment in Taiwan is just about to start. For these days, the legislation of third-party payment has become a highly debated issue. However, due to many reasons, the legislation of third-party payment eventually has not been realized. And in fact, the third-party payment in Taiwan is not mature yet. A third-party payment system in Taiwan is unable to deposit stored value in advance. This is one of the basic functions of third-party payment system abroad, such as Alipay in China and Paypal in USA. Mainly, what third-party payment provides in Taiwan is money transmission based on real trade. 1. Latest progress of third-party payment in Taiwan. (1)Credit card payment for third-party payment system. Recently, third-party payment has a breakthrough development. According to the resolution of the meeting “Obstacles of using credit card in third party payment” held by Executive Yuan in September this year, Financial Supervisory Commission has made the commitment that the third party payment is allowed to be a “contracted merchant” under “Regulations Governing Institutions Engaging in Credit Card Business”, and personal entity or small business which is not provided with the qualification of “contracted merchant” are allowed to accept credit card payment though third party payment system. This is a very important progress in third-party payment in Taiwan. It means credit card payment is available for C2C transaction now. This will improve the safety of C2C transaction and reduce the quantity of fraud transaction. In other way, boost the prosperity of E-commerce. (2)Evaluation Requirements for Data Processing Services Industry Performing Trans-border Internet Transaction. In response to the Central Bank’s request, MOEA (Ministry of Economic Affairs) approved and announced the “Evaluation Requirements for Data Processing Services Industry Performing Trans-border Internet Transaction” on October 3rd, 2012. Any Data Processing Services Industry Performing Trans-border Internet Transaction would like to obtain the qualification as a mandatory under Article 8 of “Regulations Governing the Declaration of Foreign Exchange Receipts and Disbursements or Transactions”, should pass the evaluation according to the “Evaluation Requirements for Data Processing Services Industry Performing Trans-border Internet Transaction”, and get the compliance certification. The “Evaluation Requirements for Data Processing Services Industry Performing Trans-border Internet Transaction” has set up several requirements for a business which would like to run the payment service for trans-border internet transaction. Mainly, basic requirements are as the followings. 1-2-1 The applying data processing service enterprise should be a limited company or a company limited by shares. 1-2-2 The applying data processing service enterprise should open a special purpose deposit account to deposit the entire transmitting amount received from consumers. And the transaction of this account should be only based on the consumers’ directions of money transmitting. 1-2-3 Users of the third-party payment service provided by the data processing service enterprise should register for the first time usage. And the user’s name, birth and ID number are required for registration. The applying data processing service enterprise has the liability to check the reality of the information provided. 1-2-4 The contract between the data processing service enterprise and the user should be in writing. If the contract is performed in electronic way, it should follow the requirement of “in writing” according to Article 4 of “Electronic Signatures Act”. In addition, the contract should contain the mandatory articles about foreign exchange declaration listed in the “Evaluation Requirements for Data Processing Services Industry Performing Trans-border Internet Transaction”. 1-2-5 The data processing service enterprise should be equipped with sound information security system and operating regulations, comply with “Personal Information Protection Act” and the related directives, join ECTSA (E-commerce Trust Security Alliance), and get the ISO27001 certificate or PCI-DSS validation. 1-2-6 The data processing service enterprise should keep detailed transaction information for at least 5 years. 1-2-7 The data processing service enterprise should set up money laundering prevention operating regulations, and provide money laundering prevention employee training annually. Once MOEA receives the application, MOEA will set up a special team, which assembles legal professionals, information engineering experts and financial experts, to conduct the evaluation. The compliance certification of the evaluation will be valid for 5 years. During these 5 years, the data processing enterprise has the duty to accept the annual examination and non-timed examination by MOEA. 2.Three-Party Legal Relationship under Third-Party Payment The nature of a third-party payment service is “service of payment collection and forwarding”. Generally, payment collection and forwarding refers to the transfer of a transaction payment performed by a third party in its role of assisting the buyer and the seller. The current practice in Taiwan of making payment to and collecting product from a convenient store pursuant to online transaction or of paying for product upon delivery by shipping company is a type of “payment collection and forwarding” business. In a relationship of payment collection and forwarding service, the legal relationship between the buyer and the payment collector/forwarder is a “contract of mandate” under Article 528 of the Civil Code. Refer to Article 8 of the Regulations Government the Use of Uniform Invoices: “When a business entity is engaged to handle collection and payment on behalf of another party, if there is no difference between the amount collected and the amount paid, and the purchaser specified on the payment receipt voucher is the engaging party, then the business entity may deliver the voucher to the engaging party and is exempt both from issuing a uniform invoice and from including the payment as a sales amount.”. Article 18-2 of the Profit Seeking Enterprise Income Tax Audit Standard also has similar stipulations. As to whether or not a contract of mandate is formed between the seller and the payment collector/forwarder, depends on the agreement between the parties. If it is agreed that the buyer has completed payment when the payment collector/forwarder receives the fund, then the payment collector/forwarder receives the fund on behalf of the seller and a contract of mandate is formed. Under the contract of mandate, the seller grants the payment collector/forwarder the right of agency and the right of processing. Generally speaking, it is deemed that when the buyer pays the fund to the payment collector/forwarder, the buyer has completed the obligation of payment. Therefore, both the buyer and the seller form a contract of mandate with the payment collector/forwarder and grant the right of agency under such contract of mandate. Diagram 1 Three-party relationship diagram under collection/forwarding of transaction payment Source: Prepared by author The payment collector/forwarder under online transaction acts as the agent of the buyer and the seller at the same time with regard to the act of payment and collection. This constitutes the legal issue of “acting as agent for both parties” under Article 106 of the Civil Code. However, the payment collector/forwarder performs the contract of sale and purchase for the buyer and the seller. Therefore the exception provided under Article 106 of the Civil Code is applicable. 3.Payment Custody Mechanism under Third-Party Payment (1)Overview The important value of a third-party payment mechanism is that it provides a credit guarantee between the buyer and seller. Through a third-party payment organization, the buyer receives the merchandize and then sends an instruction to the third party payer for the price previously provided to the third party payer to be forwarded to the seller. Although the buyer and the seller cannot verify each other’s creditworthiness and the quality of the merchandize face-to-face, through third party payment, the buyer can be assured that the merchandize will be received after the price is paid. The buyer can even be assured that he/she will receive the merchandize that he/she is satisfied with. For example, in “Alipay”, the after shopping, the consumer pays the transaction price to Alipay. Only when the consumer replies with “production received” will Alipay forward the money to the seller. So “third-party payment service” helps activate E-commerce and is especially helpful in C2C transactions. This is one of the important features that differentiate “third-party payment service” from “Internet banking”. Therefore, although the Central Bank of Mainland China introduced the function of “Super Internet Bank” in 2009, consolidating the consultation and account transfer systems of many banks, it is generally considered that this did not have a strong impact on the third-party payment service industry which is already flourishing in Mainland China, because it does not provide value-added services, such as a guarantee and delayed payment provided by third-party payment service. Although third-party payment service provides account transfer service, absorbing part of the functions of Internet banking, it also created new business opportunities for the banks. In reference to the experience of Mainland China, the tasks are divided between third-party payers and banks as follows: Source: Xi-Song Zhang, Choice of Development Model for Third-Party Payment in China – From the Perspective of Full Intervention by Commercial Banks, Review by Xi’An University of Finance and Economics, Volume 22, Book 2, Page 46 (March 2009). So the service provided by third-party payment and the service provided by Internet banking overlap to a certain degree. Both perform the function of fund transmission. However, instead of thinking that the two as competitors, it is better to think of them as a cooperative. (2)Relevant Legal System in Taiwan The feature of the above-described third-party payment is that the third party holds the property for the benefit for others until the satisfaction of certain conditions. A similar legal system in Taiwan is “trust”. In accordance with Article 1 of the Trust Act: “For the purposes of this Law, the term "trust" refers to the legal relationship in which the settler transfers or disposes of a right of property and causes the trustee to administer or dispose of the trust property according to the stated purposes of the trust for the benefit of a beneficiary or for a specified purpose.”. However, in accordance with Article 2 of the Trust Act, a trust must be done through a contract of trust. What is different from the contract of mandate formed under the payment collection/forwarding described above is that, in a contract of trust, the parties must specify the purpose of the trust in the contract. Otherwise, the contract of a trust is not formed. An exception is trust by declaration for the purpose of public interest under Article 71 of the Trust Act. Below we discuss the structure and feasibility of providing third-party payment service through trust. 3-2-1Third-Party Payer Acts as Trustee When a third-party payer acts as the trustee of under the contract of trust and the buyer that pays the price under an Internet transaction designates it as the principal and the beneficiary, a trust for self benefit is formed. It is a trust with a purpose. The purpose of the trust is to transfer the price of sale and purchase. The seller is also the beneficiary. According to the “principle of identified beneficiary” under the laws of Taiwan as long as the beneficiary is identifiable, even though many transactions may be formed with many sellers after the buyer registers to use third-party payment service, a contract of trust can still be formed. However, in accordance with Article 2 of the Trust Act, unless the principal has reservations in the contract of trust, the termination of a trust for the benefit of others is subject to the consent of the beneficiary. So it is simpler to process under a trust for one’s own benefit. Diagram 2 Diagram of trust relationship under third-party payment (where the third-party payer is the trustee) Source: Prepared by author To form a contract of trust, in accordance with Articles 9 to 12 of the Trust Act, the fund entrusted by the service user to the third party to be forwarded becomes trust property and can be effectively segregated from bankruptcy. If the trustee is bankrupt, the trust property will not be included in the bankruptcy property, and the creditors of the trustee cannot enforce upon the trust property, providing more protection for the user of third-party payment service. Also, in accordance with Article 24, the principal shall manage the trust property and the principal’s own property separately. A monetary trust can be managed by keeping separate accounts. So if a contract of trust is formed under a contract of third-party payment service, it can ensure proper accounting of trust property by the service provider. Also, in accordance with Paragraph 2, Article 9, property right acquired by the trustee through the management, disposal, loss, destruction or other event of the trust property remains part of the trust property. Therefore, proceeds received from the deposit by third-party payer with the bank of any fund before it is forwarded become part of trust property and belong to the buyer, i.e., the principal and beneficiary. Certain doubts as to whether the Trust Enterprise Act is applicable to third-party payment service provider. In accordance with Article 2 of the Trust Enterprise Act, “trust enterprise” referred to in this Act means an organization approved by the competent authority in accordance with this Act to operate trust activities. There are 4 targets regulated by the Trust Enterprise Act: Trust companies that operate trust activities with approval by the competent authority, banks they also operate trust activities, securities investment trusts, investment consulting businesses and securities dealers that also operate trust activities and trust investment companies. A third-party payer is not a trust enterprise approved by the Banking Bureau of the Financial Supervisory Commission. Therefore, the contract of trust formed under third-party payment service is a general trust under civil law and is subject to supervision by the court in accordance with Article 60 of the Trust Act. The court may select an inspector and impose other necessary disposition by order pursuant to the petition for inspection on trust activities filed by an interested party or a prosecutor. However, the court has a role of passive supervision and does not have the general authority of supervision and management by the Bureau of Banking. Third-party payment is a service provided to unidentified members of the society. Including third-party payers into the system of financial supervision for trust will provide better protection for interest of the general public. Also, in accordance with Article 34 of the Trust Act, trust enterprises have the obligation of provisioning compensation reserves. No such obligation is imposed under general civil-law trust. So if third-party payers are included as trust enterprises, better protection will be available to the consumers. Also in accordance with Article 19 of the Trust Enterprise Act, a trust contract must be done in writing. In case of an electronic document, requirements under Article 4 of the Electronic Signature Act must be met: “the content of the information can be presented in its integrity and remains accessible for subsequent reference, with the consent of the other party”. Under third-party payment service, the third-party payer must make payment in accordance with the user’s instructions. So the trust that is formed is “a trust where the trustee does not have discretion over utilization of trust property”, as referred to under Paragraph 2, Article 7 of the Enforcement Rules for Trust Enterprise Act. It is also “a monetary trust under specific centralized management and utilization” under Article 8 of the Enforcement Rules for Trust Enterprise Act. However, in accordance with Article 9 of the Trust Enterprise Act: “A trust enterprise's name shall indicate the word, ‘trust.’ This rule does not apply to an entity which conducts a trust business concurrently with the approval of the Competent Authority.” If the third party payer adds the word “trust” in the company name, it will create a difference from the scope of business of third-party payment service. So an approval from the competent authority, the Bureau of Banking of the Financial Supervisory Commission, allowing third party payers to also operate the trust activity, seems to be a better solution. 3-2-2Bank Acts as Trustee As mentioned above, in a payment collection/forwarding relationship, the underlying legal relationship between the third-party payer and buyer is a “mandate”. Under a separate relationship of mandate, the buyer can grant the third-party payer the right of agency to sign a contract of trust with the bank on behalf of the buyer. The bank will act as the trustee and the buyer will act as the principal and beneficiary. The third-party payer will be the agent of the principal. Same as above, the beneficiary can also be the seller here. Under the current structure of the Trust Act of Taiwan, almost all rights that can be exercised by a principal can also be exercised by a beneficiary, including the rights under Articles 23, 24, 32, 35 and 65. Therefore, it is more convenient for a bank, with the qualification of trust enterprise, to serve as the trustee. However, trust related fees may be payable to the bank, raising the cost of third-party payment service. The relevant cost will most likely be transferred to the user of third-party payment service. The third-party payment service fee is generally paid by the seller, i.e., the payee. Under the structure where the third-party payer acts as the trustee, the relationship between the third-party payer and the bank is solely one between a depositor and a depository account. Therefore the third-party service provider does not need to pay any fee to the bank. It may even receive interest from the deposit, constituting proceeds from trust property which belong to the principal. So if the bank acts as the trustee, the cost of transaction flow is higher. On the other hand, it may obstruct the development of the industry. However, it is more consistent with the model of trust management. Diagram 3 Diagram of trust relationship under third-party payment (bank being the trustee) Source: Prepared by author 4.Conclusion There is currently no legal restriction against simple payment collection and forwarding. The contract of mandate under the Civil Code can process the tri-party legal relationship (buyer, seller and payment collector/forwarder). The transaction guarantee for third-party payment and the mechanism of custody and delayed payment of price can be processed with the structure of trust. As mentioned above, under the structure of a trust, the third-party payer can act as the trustee and the bank can act as the principal (at which time the third-party payer represents the principal and signs a contract of trust with the bank on behalf of the buyer). The formation of trust ensures account management, avoiding improper utilization of the transaction price under custody. When the third-party payer is the trustee, a general civil-code trust is formed, which is only subject to inspection by court pursuant to petition by interested party or the judge. The supervision and management are more relaxed. However, third-party payment serves an unidentified public of society and has an extensive impact. It is suggested that the competent authority, the Financial Supervisory Commission, allows third-party payers to also operate the business of trust and include third-party payers into the scope of financial supervision. When the bank acts as the trustee, the transaction cost is higher. However, the supervision and management of its business activities under the current legal system is more complete. Currently, a more feasible way is when the bank serves as the trustee and the third-party payer serves as the agent of the principal. In the long term, it can be studied to open up for third-party payers to also operate Internet transaction trust business, acting as the trustee. Third-party payment replaces bank’s fund settlement function to a certain extent. Contrary to the traditional industry of payment collection and forwarding, third-party payment provides the convenience of fund collection/payment function and can fall prey to money laundering criminal activities. For the purpose of protecting the consumers and prevention of money laundering crimes, it is indeed necessary to include third-party payment into legislative management. The priority focus of such control is to require that the operator possesses a sound corporate structure and financial status. The requirement regarding capital is different depending on the country. The flexible requirement of capital amount in the EU can be used as a reference. For smaller operators with lower transaction volumes, a lower capital amount should be required under flexibility. In 2011, the Internet shopping market in China was 773.5 billion CNY. The amount of Internet payment was approximately 70 billion CNY. In 2011, the Internet shopping market in Taiwan was only 562.7 billion NT Dollars. If the minimum capital amount required of third-party payment operators in China is applied to third-party payment operators in Taiwan, it would not be reasonable. We can refer to the US method and ask operators to take out insurance to lower the risk and avoid market monopoly or oligopoly due to high capital amount barrier, blocking full competition. With the capital amount requirement, it is highly possible that the operators will increase the amount of transaction processed in accordance with the development of E-commerce, creating the necessity to increase the capital. It is best to choose the form of limited stock companies in order to answer to capital placement requirement swiftly. Regarding the issue of money laundering prevention, third-party payment institutions are currently not the “financial institutions” under Article 5 of the Money Laundering Prevention Act of Taiwan. However, it should be a “payment tool” under Article 9, with only an obligation to freeze the payment account and cooperate with investigation as required by prosecutors. At the same time of developing third-party payment services, the Bureau of Investigation of the Ministry of Justice should also develop a money laundering prevention reporting system for third-party payment services. In reference to the US legal system, third-party payers should be included into the network of money laundering crime prevention of Taiwan for management. In addition, third-party payment services should be performed on real-name basis. The general public should be required to register and use third-party payment services with their true identities. As for verification of identity, the so-called KYC process, the banks’ KYC can be relied upon to a certain degree, such as comparison of account name information of the credit card holder or the deposit account. In reference to the legal system of different countries and the current financial legal system of Taiwan, third-party payment operators should have the obligation to maintain payment transaction information in order to facilitate criminal investigation. To protect consumers, the rights and obligations between the consumers and the third-party payers should be specified in a written contract. If it is displayed in electronic form, the written requirement should be consistent with Article 4 of the Electronic Signature Act of Taiwan. In addition, the consumers’ funds should only be used in accordance with the consumers’ payment instructions. To avoid other uses by the operators, there should be a requirement to deposit into special bank accounts to provide clear trace of transaction history. In reference to Article 24 of the Trust Act, separate account management is required under trust. So if a trust is formed, then the requirement for special deposit account can be waived. Furthermore, to avoid insolvency by the operators, operators can be required to take out insurance and acquire full performance guarantee. Prevention is better than a cure. We should take precautions about possible issues that may arise from third-party payment. In addition, clear rules of the game will encourage industry development. On the other hand, with the new type of money flow payment activities in the Internet era, traditional financial industries should see it as a new opportunity of business development, and not a threat. What third-party payment system processes is information flow; the actual flow of funds is still dependent on the banking system. Internet payment operators are still dependent upon the finance industry to provide financial planning and new types of financial products (such as trust and insurance) in order to promote their business. Building a sound Internet payment system indeed requires contributions from the information industry, the finance industry and the legal industry.

- Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

- The Demand of Intellectual Property Management for Taiwanese Enterprises

- Blockchain in Intellectual Property Protection

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

- Recent Federal Decisions and Emerging Trends in U.S. Defend Trade Secrets Act Litigation

- The effective and innovative way to use the spectrum: focus on the development of the "interleaved/white space"

- Copyright Ownership for Outputs by Artificial Intelligence

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System