Taiwan Intellectual Property Survey Report 2023

Taiwan Intellectual Property Survey Report 2023

2024/06/27

Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Institute for Information Industry has conducted the survey of “The Intellectual Property Survey Report” to listed companies since 2012. The Intellectual Property Survey Report 2023 on Taiwan's Listed and Over-the-Counter Companies was released in February 2024.

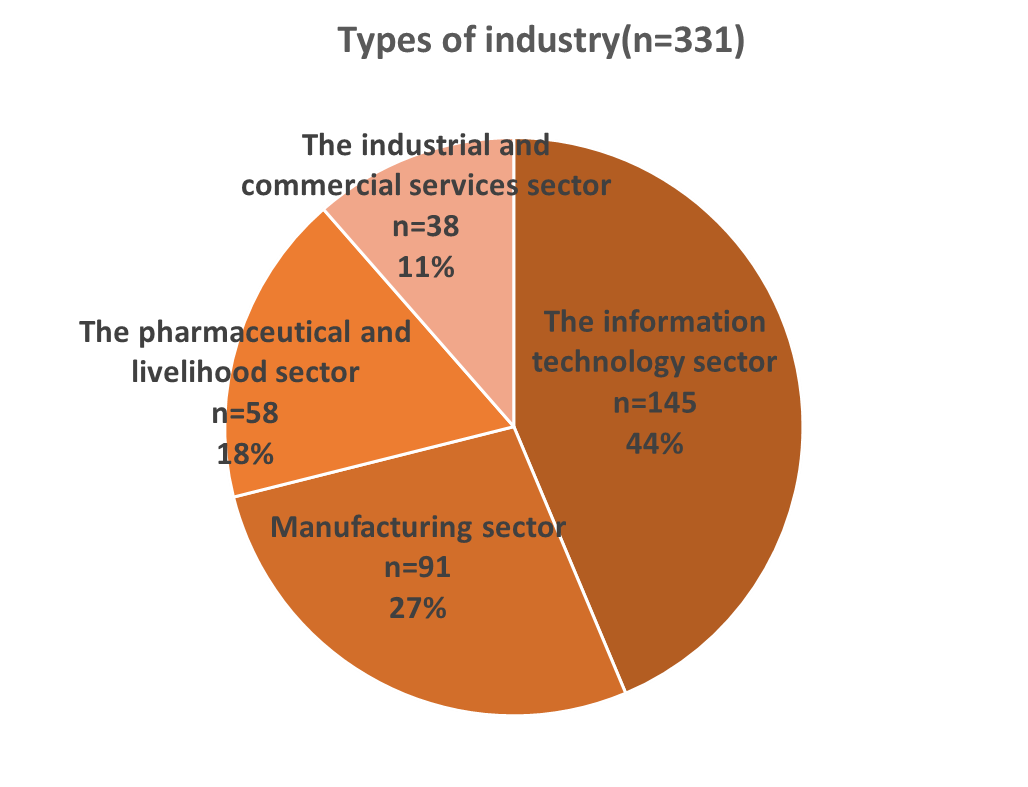

Among the 331 publicly listed companies surveyed in 2023, the information technology sector had the largest representation, accounting for 44% (145 companies). This was followed by the manufacturing sector at 27% (90 companies), the pharmaceutical and livelihood sector at 18% (58 companies), and the industrial and commercial services sector at 11% (38 companies).

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig. 1 types of industry

Based on the survey result, three trends of intellectual property management for Taiwanese enterprises have integrated with detail descriptions as below.

Trend 1: Positive Growth in Intellectual Property Awareness and Intellectual Property Dedicated Department/Personnel, Budget and Projects

1. Taiwanese enterprises believe that intellectual property plays an important role

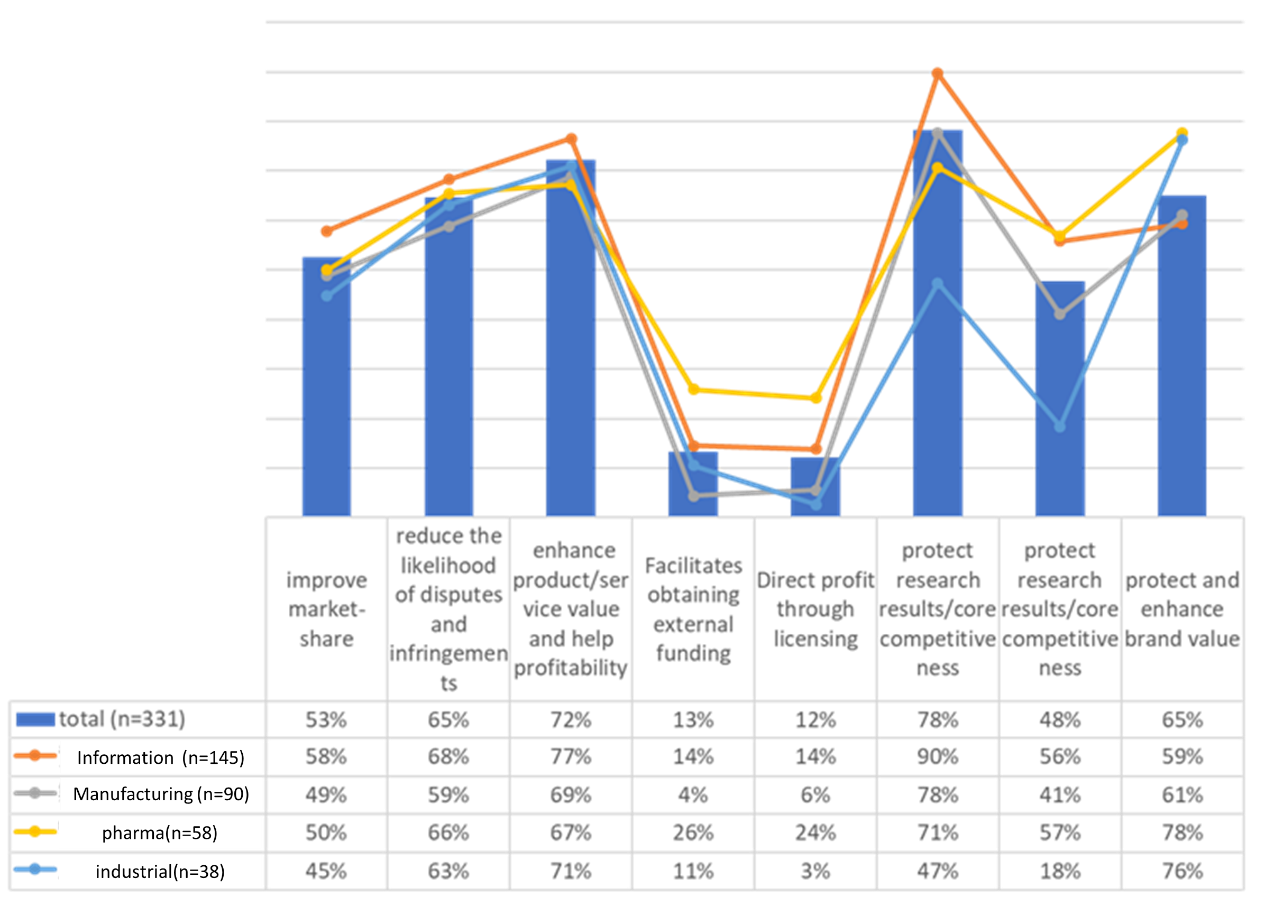

More than 70% of companies believe that intellectual property can enhance product/service value, help profitability, and protect research results/core competitiveness. Specifically, 72% believe that intellectual property can enhance product/service value and help profitability, and 78% believe it can protect research results/core competitiveness. Additionally, 65% of companies believe that intellectual property can protect and enhance brand value, and 65% believe it can reduce the likelihood of disputes and infringements with others.

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig.2 The benefit of intellectual property for the company

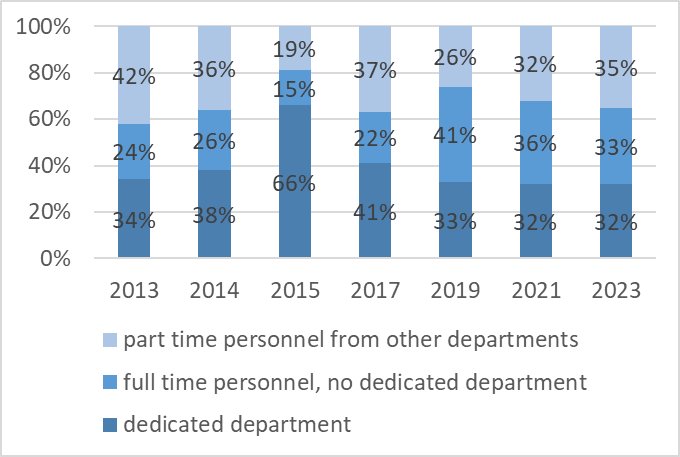

2.Taiwanese enterprises maintain investment in the dedicated department and full time personnel for intellectual property

33% of listed companies set up full time personnel for intellectual property and over 32% of those have established dedicated department to handle its business that is higher than 35% in 2023.

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig.3 Department or personnel for intellectual property by year

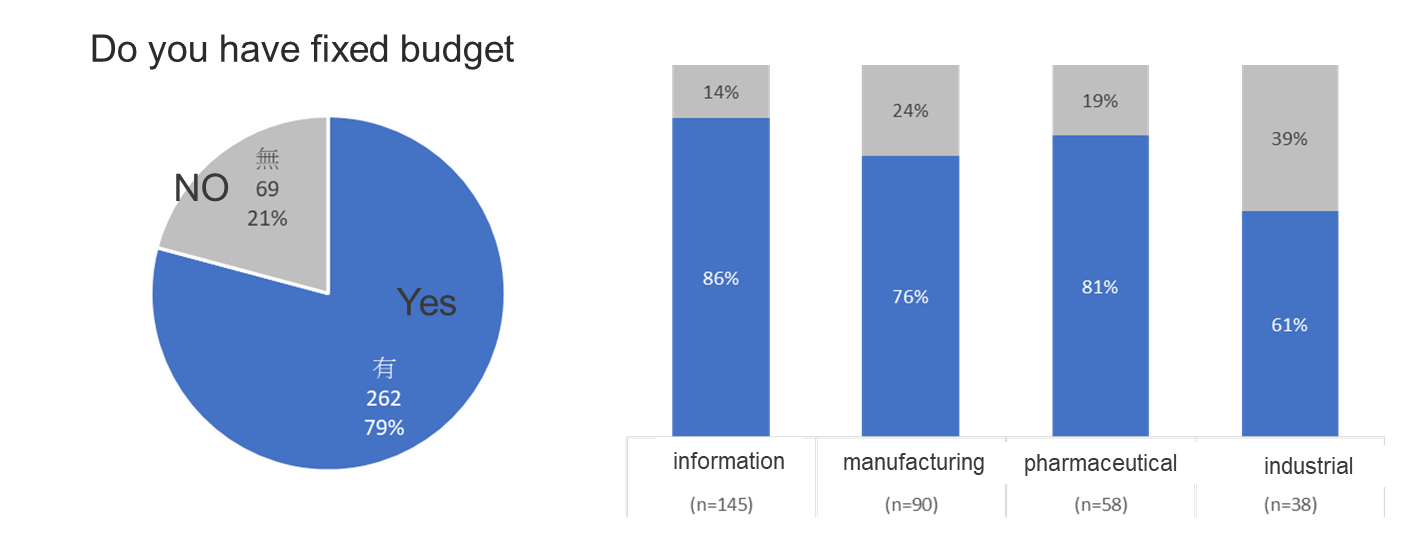

3. Taiwanese enterprises plan budget for intellectual property each year

79% of enterprises have invested a certain amount of funds this year in acquiring, maintaining, and managing intellectual property. By industry, the information technology and pharmaceutical/livelihood sectors have a higher proportion of investment in related expenses, both exceeding 80%

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig. 4 fixed budget for intellectual property each year

Trend 2: Taiwanese enterprises are willing to disclose their intellectual property information to the public, which can have a positive impact on the company.

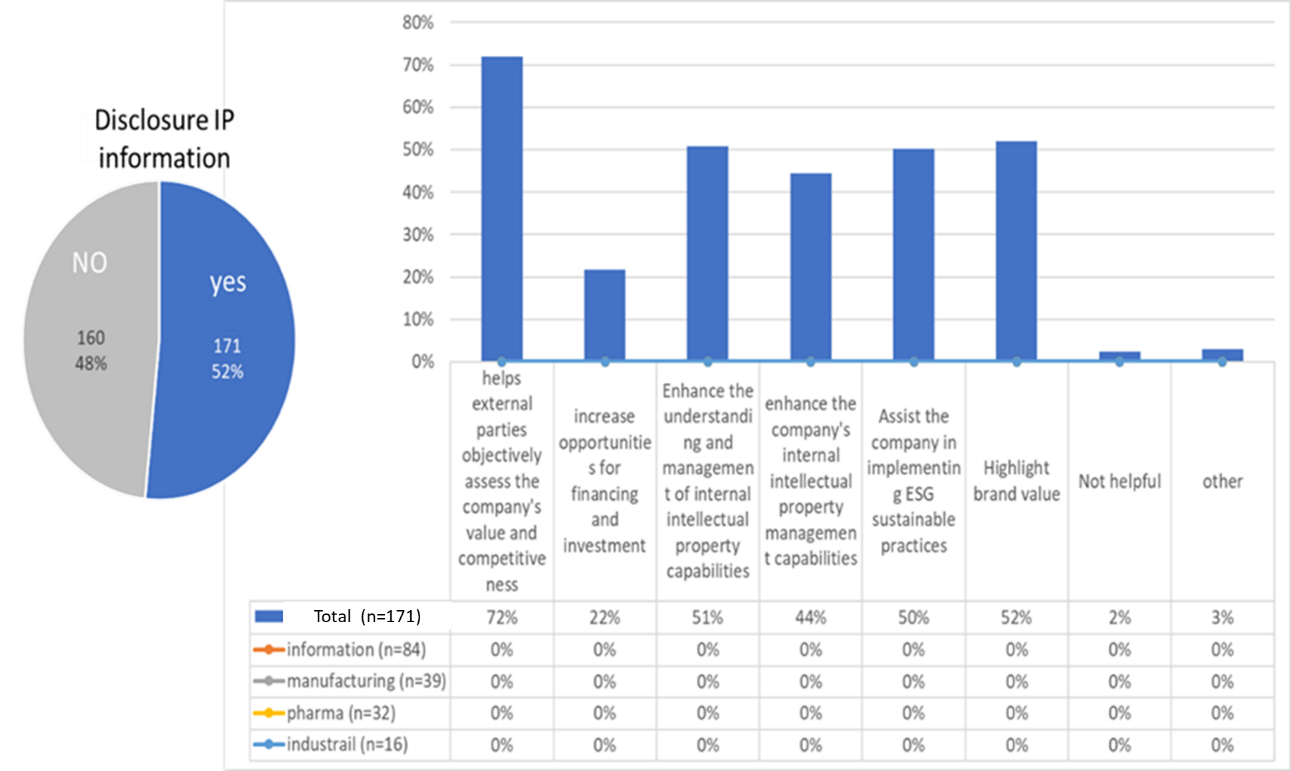

1. Enterprises have a positive attitude towards disclosing intellectual property information.

72% of enterprises believe that disclosing intellectual property helps external parties objectively assess the company's value and competitiveness. This is followed by highlighting brand value (52%) and improving the internal management and control of intellectual property.

By industry category, 77% of manufacturing companies believe it helps external parties objectively assess the company's value and competitiveness, which is higher than other industries. In the business services sector, 81% believe it helps highlight brand value, a significantly higher proportion.

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig. 5 Benefits of disclosing intellectual property management information for enterprises

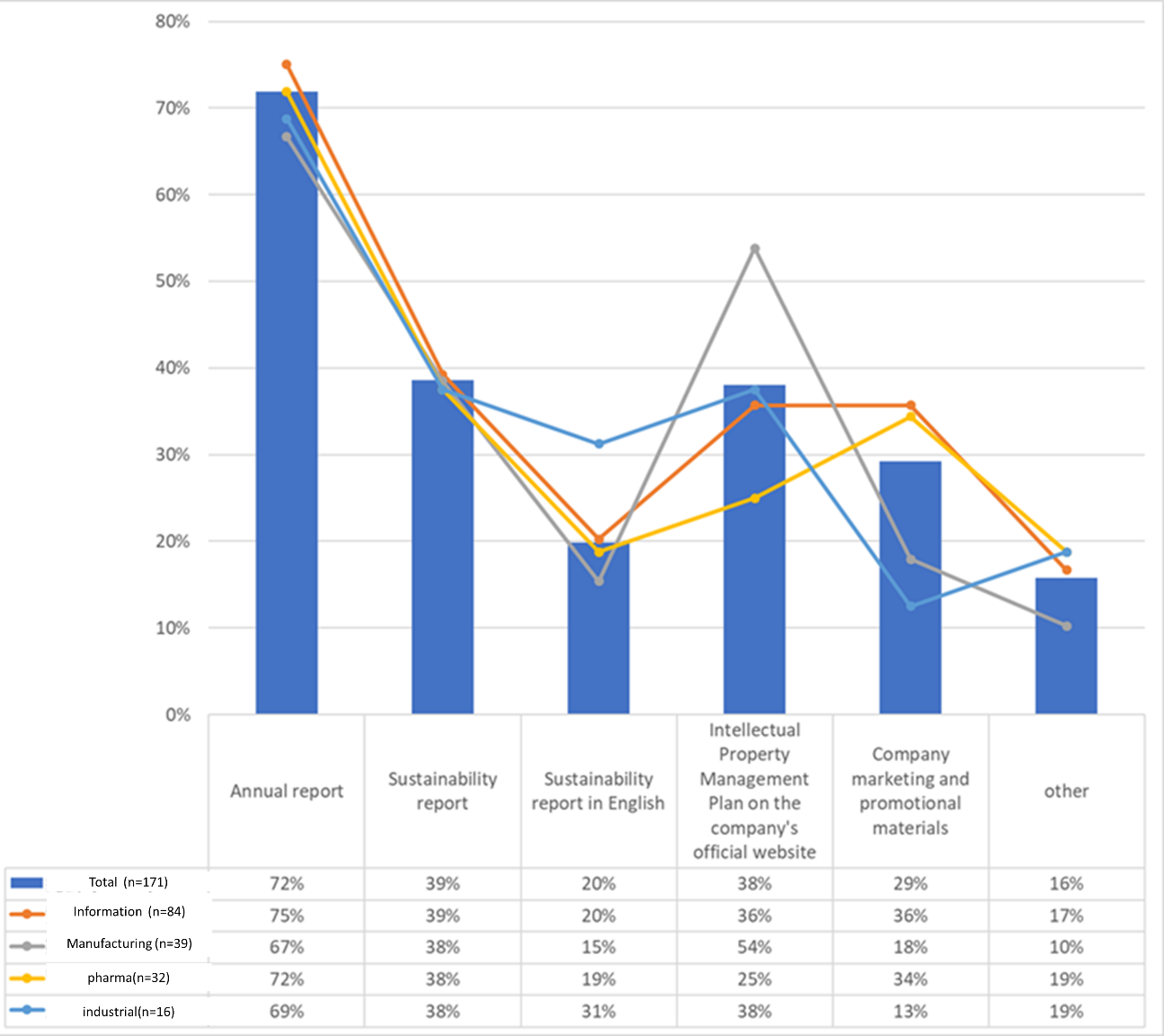

2. The main channels for public disclosure are company annual reports, sustainability reports, and intellectual property management plans

The proportion of companies disclosing intellectual property plans in annual reports reaches 72%. Additionally, approximately 39% and 38% disclose in sustainability reports or intellectual property management plans, respectively. The proportion disclosed in company marketing and promotional materials is 29%, while the proportion in English-language sustainability reports is 20%.

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig. 6 Channels for publicly disclosing corporate intellectual property management information

Trend 3: Taiwanese enterprises use various types of intellectual property rights to protect their core competitiveness.

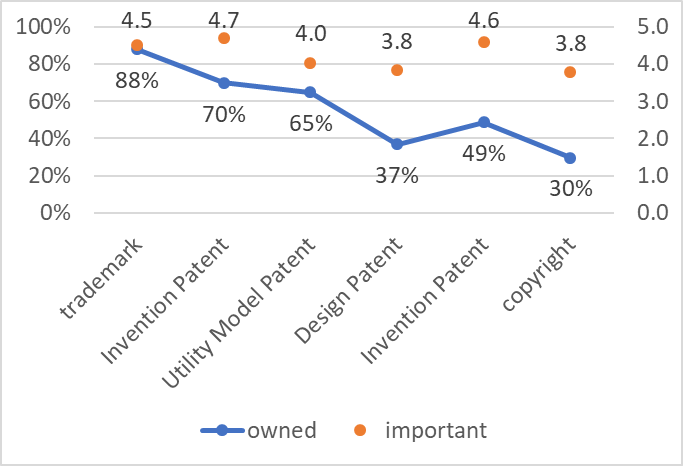

1. Trade secrets are considered crucial by enterprises but are less commonly owned forms of intellectual property

Enterprises consider trademark rights, invention patents, utility model patents, and trade secrets to be more important, each with an importance score above 4. Design patents and copyrights are considered somewhat less important, each with an importance score of 3.8. However, there is a gap between the importance and the ownership rates of some types of intellectual property. The importance and ownership rates are consistent for trademarks, with an importance score of 4.5 and an ownership rate of 88%. Patents have an importance score of 4.7 and an ownership rate of 70%. Trade secrets have an importance score of 4.6 and an ownership rate of 49%. Copyrights have an importance score of 3.8 and an ownership rate of 30%.

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig. 7 Owned and Importance of Various Intellectual Properties

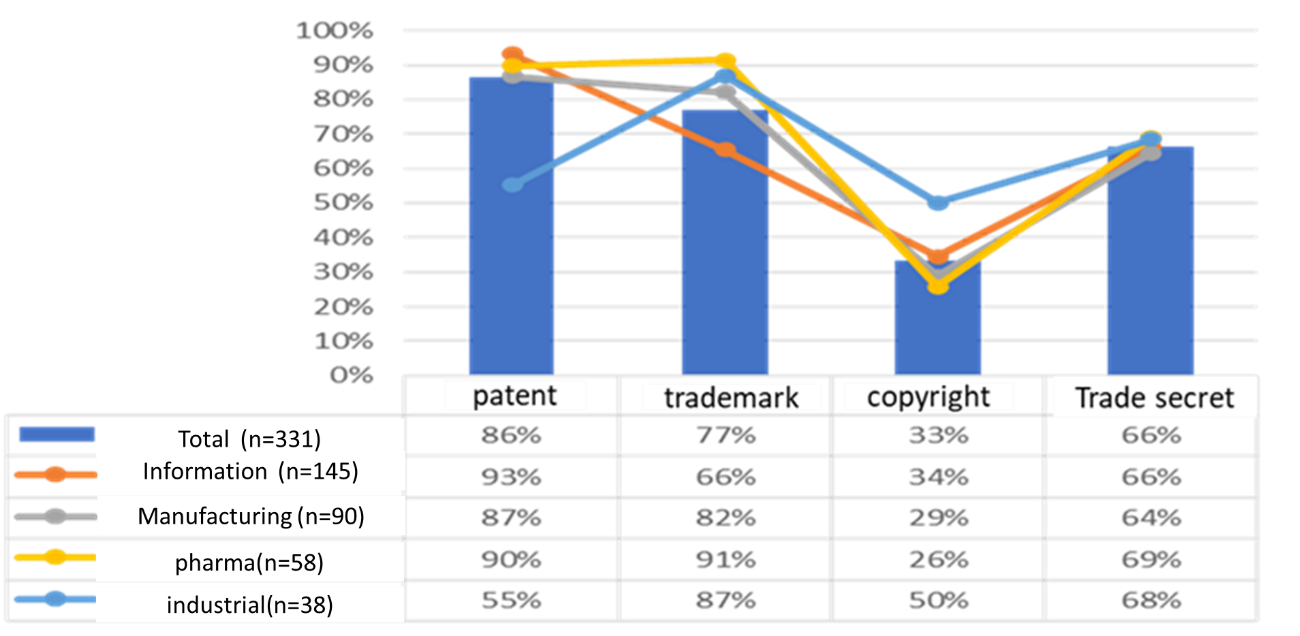

2. The priority of using intellectual property rights varies across different industries

Patents are used to protect important assets by the largest proportion of companies, about 86%. This is followed by trademarks at 77%, trade secrets at 66%, and copyrights at 33%.

By industry, the order is consistent in information services, manufacturing, and pharmaceutical/livelihood industries: patents, trademarks, trade secrets, and copyrights. In the business services sector, the order is trademarks, trade secrets, patents, and copyrights.

Data source: Innovation & Intellectual Property Center, Science & Technology Law Institute (STLI), Taiwan Intellectual Property Survey Report 2023.

Fig.8 which type of intellectual property rights do companies use to protect important assets

The complete survey report can be accessed in the Taiwan Intellectual Property Management System (TIPS) website. The download link is https://www.tips.org.tw/body.asp?sno=BGCHDC#460

Chen Yi-Chih, Chen Hung-Chih 2 I. Foreword Intellectual Property (IP) Management is a subject of recent focus in Taiwan . More than 1 million patents have been filed in Taiwan and each year, Taiwan dedicates NT $80 3 trillion in research and development. The estimated cost for IP prosecution, maintenance, litigation, conciliation, compensation and authorization amounts to NT $200 trillion (U.S.$6.5 trillion) 4. Even though many enterprises have gradually recognized the importance of intellectual property, the situation has not significantly improved based on the statistics stated above. Observation shows that only few enterprises in Taiwan have taken active steps to manage their IP and it was only after facing infringement lawsuits and tremendous amount of loyalty payments, most companies started to realize the important of IP management. Two main causes are believed to have negative impact on the lacking and ineffectiveness of most Taiwanese enterprises' IP management: Taiwanese enterprises have not taken proactive measures to handle IP management issues and IP management is only viewed as a mechanism to prevent IP infringement. Taiwanese enterprises have not sought ways to proactively and strategically use their intellectual property as a tool to yield profit. Due to limited professional knowledge and resources, Taiwanese enterprises do not know how to manage and exploit IP generated within their companies . Therefore, it is critical to assist these enterprises to develop and implement an effective IP management strategy under which the full potential of their IP can be utilized and the maximum value of the enterprises' IP can be realized. The Intellectual Property Office of the Ministry of Economic Affairs recognized the importance of governmental role to address this issue. Since 2003, it has collaborated with the Institute of Information Industry to work on a project for developing a standardized IP management system. In 2005, the project was handed over to the Industrial Development Bureau which then carried on the development and promotion of the Taiwanese Intellectual Property Management System (TIPS). Taiwanese enterprises 5 are able to use TIPS as a basis to establish their own comprehensive IP management systems. Based on our experiences in promoting TIPS and the feedbacks from those enterprises which have followed the TIPS's guidance to establish their IP management systems, we are pleased to find that TIPS is capable of assisting enterprises to develop a comprehensive IP management system. The system no only meets an enterprise's operational needs but also can be continuously improved owing to its adoption of the PDCA management cycle 6. II. The Introduction of TIPS A. The Origin and Overview of TIPS On December 9, 2004, The Ministry of Economics, in recognition of the needs to assist Taiwanese enterprises to better manage and more fully utilize their intellectual property, organized a “Taiwanese IP Management Standardization and Promotion Summit”. In order to establish a consensus on IP management among Taiwanese enterprises and to encourage the enterprises to implement an internal IP management system, the Taiwanese government positioned TIPS as an industry standard. In 2006, The Industrial Development Bureau (IDB) of the Ministry of Economic Affairs (MEA) established a TIPS promotion program and revised the 2004 draft of the Intellectual Property Management System Standard to become the Taiwan Intellectual Property Management System (TIPS). The industrial experts' opinions and comments were gathered and used to amend the draft, TIPS was then formally announced 7 on March 23, 2007 and consequently promoted. In hopes to protect Taiwanese enterprises and to improve their market competitiveness, IDB initiated extensive promotion program, encouraging Taiwanese enterprises and organizations to establish a convenient, efficient, and low-cost IP management system by following the TIPS's guidance The main characteristic of TIPS is the incorporation of the PDCA (Plan-Do-Check-Action) model from the ISO 9001:2000 Quality Management System. By adopting this model, not only the challenges of IP management can be resolved, but the whole system can also be continuously improved. Since TIPS shares the ISO's characteristics of being credible, comprehensive, and easily adaptable, TIPS and be easily integrated into the ISO standards within an enterprise such that the conflicts between these two systems will be minimized and it will only require minimum organizational structural changes and implementation costs. If an enterprise has already implemented ISO, implementing TIPS becomes more easily and efficient. In addition, TIPS emphasizes the concepts of using “process-oriented approach” and “systematic management” 8. Enterprises can merge their existing infrastructures and TIPS to establish a convenient, effective and efficient IP management system to reduce losses caused by IP infringement. Enterprises may also strengthen their market competitiveness and increase profits through royalty income. TIPS includes nine chapters. The first four chapters cover Summary, which describes the background of TIPS; Scope of Application and Terminologies. Clause 0.3.1 9 of TIPS states that the purpose of TIPS is to promote the utilization of IP management as one of the means to maximize an enterprise's profits. Rather than an individual or a specific department, protecting IP assets is the responsibility of all employees within the enterprises. In addition, the establishment of an IP management system is essential regardless of the scale, product or service provided by an enterprise. Clause 1.2 of TIPS clearly provides that TIPS is applicable to all enterprises, despite their types, scales, products and services provided. Therefore, TIPS is not designed solely for large enterprises. It can be applied to all kinds of organizations which include but not limit to a company, a specific department/division within a company, a laboratory or a project team. B. The Foundation of TIPS Before establishing TIPS, the government recognized that an enormous amount of resources is required to establish an IP management system. Therefore, the ISO9001:2000 quality management framework was adopted and TIPS was developed based upon the ISO's management principles. By incorporating IP managing strategies into an enterprise's operation goals and internal activities, the IP management system is no longer just a risk management system but a system that is closely aligning to the overall operations of an enterprise. Since it was found that many domestic companies implemented ISO9001:2000 Quality Management System solely for compliance purposes, people are skeptical about its effectiveness. In fact, if one understands the rigorous formulation processes behind the quality management system and its principles, one would recognize that an enterprise's IP management system can be significantly improved by adopting the management characteristics of ISO Quality Management System. The main characteristics shared between TIPS and ISO are outlined as follows: The effectiveness of an IP management system can be evaluated through clear policies and goals Chapter 5 of ISO 9001 : 2000 discusses Management's Responsibility. It states that top management should establish an enterprise's mission, vision, policies and goals, otherwise known as Visionary Leadership. An enterprise should consider its stakeholder's needs, understand the gap between its current status and the ideal state when setting its mission, vision, policies and goals. It should also decide its operational goals by considering available resources and the external environment. Traditional way of IP management only focuses on the operational and managerial processes. Strategic issues such as strategic planning and mission/vision planning are often forgotten, which often leads to a disconnection between strategy and actual operations. The concept of setting clear policies and goals used in ISO Quality Management shall be adopted to manage IP. That is to say, clear policies and objectives should be defined by the top management followed by detailed processes and steps required to realize the goals. Clear operational processes and responsibility help to achieve IP management goals ISO9001:2000 states that quality issues are caused by process, not product and process issues are caused by management since processes are carried out by people. Therefore, all personnel who is involved in carrying out the processes (in other word, all the employees within an organization) shall have the responsibility to improve quality. This concept applies to IP management as well. It is an incorrect general belief that IP management is merely for damage control or risk prevention. It is also an incorrect belief that an IP management is the sole responsibility of the legal department that other departments have no roles to play in enhancing the added-value of IP. For enterprises intending to utilize IP to enhance its competitiveness, some suggestions as listed below should be taken into account when planning their IP strategies: Set IP management as one of the company's operational goals. Organize a team to implement the IP strategy and to determine the processes required to achieve the IP goals. Clearly identify roles and responsibilities for personnel involved in all levels of IP management. Identify tasks required to be documented. Ensure the employees understand the linkage between their assigned tasks and the corresponding organizational goals. Through careful considerations of planning the organizational goals, processes and the expected outputs derived thereupon, enterprises can determine whether the processes so planned are necessary, appropriate, and effective . Consequently, minimizing the resources required to be invested into IP management. Monitoring, evaluation, and corrective actions can help to ensure the effectiveness of an organization's IP management processes Clause 8.2.1 of ISO9001:2000, “customer satisfaction”, emphasizes that customers own the right to evaluate. In the case of IP management, customers are basically the enterprise itself, therefore the performance is evaluated based on whether the set organizational goals can be achieved. It has been observed that many companies implemented the ISO Standards purely for the purpose of obtaining ISO's certification and do not consider whether the processes implemented are, in the practical sense, effective or efficient. Under this circumstance, the enterprises would not gain any actual benefits, despite that the requirements of ISO standards are met. The goal of process management is to improve the process efficiency, effectiveness and adaptability. Clause 8.2.3 of the ISO9001:2000 discusses Monitoring and Measurement of Process and Clause 8.2.4 talks about Monitoring and Measurement of Product. They state that an organization should establish a mechanism to monitor, evaluate, and understand the organization's internal and external customers' needs. This mechanism can also help to determine whether the organization can meet or exceed the expectation of its customers (in terms of processes, products, and/or services), which is also a critical element in establishing a systematic IP management system. If the result of evaluation does not meet expectation, there is a problem. In order to prevent the problem from reoccurring, prevention is the best. The concept of prevention is to design measures to avoid the occurrence of hidden problems. Unexpected problems are inevitable to occur even if preventive measures have been taken. We should analyze the impact of the problems occurred and propose counter measures to minimize their impact. The efficiency of IP Management relies on continuous improvement There are always opportunities to improve any process. Clause 8 of the ISO9001:2000 discusses Measurement, Analysis and Improvement which includes continuous improvement processes. Clause 8.2 Monitoring and Measurement, Clause 8.3 Control of Nonconformity, and Clause 8.4 Analysis of Data discuss the issues surrounding monitoring, measurement, analysis and control of nonconformity. Clause 8.5 discusses Improvement, which covers action taken to address the causes of identified issues. There are many issues that may be identified after analysis which cannot be resolved at once. Clause 5.1 of ISO 9001:2000 Management Commitment requests that the top management team be responsible for setting policy and goals, and providing resources needed to achieve the goals. By introducing ISO9001:2000 measurement, analysis, and improvement methodologies into the IP management system, it is believed that enterprises can thus effectively manage their IP and achieve a win-win scenario with their customers. C. The expected benefits of Implementing TIPS Since TIPS shares the above mentioned characteristics of the ISO Quality Management System, it not only can reduce the risks of infringing the IP rights of the others, but also can assist an organization to achieve its operational goals provided that the organization has designed relevant processes pursuant to the requirements of TIPS and has thoroughly implemented the designed processes. Using TIPS's external evaluation mechanism 10, enterprises implementing with TIPS can prove to their customers and external stakeholders that they have the capability to manage and maintain their IP. If an enterprise follows TIPS to establish its IP management system, its expected benefits include the followings: Enhancing market competiveness and increasing the added-value of an organization An IP management system that is designed to meet the specific needs of an organization shall play a significant role in achieving the organization's operational goals. Take a fitness equipment or an automobile parts manufacturer as an example, if the manufacturer owns the IP rights (ex: new design patent or trademark) embodied within the products, it is expected that the manufacturer can profit more than a purely OEM company which does not own its own brand. This is because the IP rights embodied within the products could provide significant added-value beyond what an OEM company can offer. Increasing customer's ordering intent The guidelines of TIPS also serve as the requirements for certification purpose. A government certified IP management system will ease concerns over trade secret protection and thereby promote cooperation and trusting relationships between the suppliers and the buyers and between research collaborations which consequently would foster better research results and potentially more purchasing orders. Minimizing resource wasting and actively creating profits Most small and medium enterprises in Taiwan do not have adequate labor and financial resources to develop a comprehensive IP management system. It is the hope of the government that a simple, effective, and low-cost IP management system can be established which tailors to the specific needs of every enterprise by adopting the TIPS framework. Once enterprises are capable of systematically manage their IP, it is expected that the IP generated and their exploitation can really match the enterprises' requirements and expectations, so that no resource is wasted to produce unwantable IP. The enterprises may further increase their profits by licensing or assigning their IP rights. Fostering an organizational culture that values the importance of intellectual property and the ability to continuous improve Establishing IP management policies, coupled with ongoing IP management seminars and education and training programs for new employee would enhance the awareness of the importance of IP management to the organization among the employees. The employees may further change their attitudes from passively complying with the policies to actively participate the system such as paying particular attention to potential IP risks and offer suggestions for process improvement. One company which implemented TIPS commented that the regular and ad hoc audits requirement and the necessity of assigning roles and responsibilities as required by TIPS assist it to identify problems concerning management issues. Corrective and preventive actions can be rapidly taken to address the problems identified, allocate the liabilities and improve the whole system. As a consequence, the IP management system can be effectively carried out to ensure that the planned objectives are met. It was found that most companies do not have internal audit and continual improvement programs to detect the hidden problems concerning management. Enhancing risk management and the capability to respond Currently, the fundamental and most important goal for an enterprise's IP management is to reduce the risks of infringement. Enterprises which have implemented TIPS found that TIPS is capable of enhancing data sharing across the departments which allows the IP department to detect potential risks at the earliest time. Further, the establishment of risk management mechanism and processes in response to infringement allegations as required by TIPS helps to institutionalize an enterprise's management system in handing legal risks. III. A holistic approach to IP management The Taiwanese government hopes that enterprises can systematically manage their IP through the implementation of TIPS. In other words, following TIPS's guidance, the Taiwanese enterprises should establish an IP management system that incorporates the usage of the PDCA management cycle (Plan-Do-Check-Action) and process management approach and such system must be built by taking into account the enterprise's business operation strategies and objectives. Enterprises should have clear processes and related rules for handling all IP related issues. For example, prior to filing a patent application, there should be a plan for the ways to acquire the targeted IP and prior art research shall be conducted. Based on the search results, enterprises can then decide whether they would like to internally develop the targeted IP or to seek licensing opportunities. Effective IP management processes shall be able to answer the following questions: Whether records are stored property? Who should conduct the audit? Whether the current system meets the IP management policy or goals? What are the roles and responsibilities? The following section aims to explain how Taiwanese enterprises can establish or modify their current IP management system to achieve its full potential: A. Roles and Responsibilities for Implementation All employees within an organization shall participate in order to realize the most benefits out of the IP management system. Leadership responsibilities, roles and responsibilities allocation, training and education programs and the subsequent auditing processes on the performance of operation shall be clearly defined and planned. Establishing a successful IP management system shall not be the sole responsibility of the legal department. During the implementation stage, the following personnel should participate and complete the related tasks: Executive management team (Management executives, ex. CEO, President, COO) a. Establish IP management policy and goals; b. Communicate the importance of compliance to the IP management policy; c. Evaluate and review the effectiveness of the IP management system; and d. Ensure the readiness of the resources available for establishing the IP management system. IP Management System Representatives (Managers who have decision-making authority, ex. EVP, VP) a. Ensure that the required processes for the IP management system are established, implemented, and maintained; b. Report to the executive management team on the performance and improvement needs for the existing system; and c. Ensure employees understand the IP management policy and goals. Department Representatives (All department representatives) a. Execute tasks assigned by the IP management system representatives; b. Execute action items reached by the steering committee meetings; c. Ensure the achievement of IP management goals, and d. Responsible for the Maintaining and improving the IP management system. B. Steps of Implementation Plan Establishing a systematic IP management system requires the participation of all employees and it requires reengineering of the existing processes. It is not an easy task to be established and planned solely by the legal department. All other departments within an enterprise shall participate and offer their suggestions. The followings are the recommended stages for implementing an IP management system: Stage Tasks Description Responsibility Remark 1. Preparation 1). Review of current status Understand resources available and the status of operation Data collection; define roles and responsibilities 2). Establish implementation team Identify team members and team leader Confirm organizational structure for implementation 3). Set goals and establish all management programs Evaluate current situation to formulate IP management policy, and define measurable goals. Processes planning shall be made by taking into account the management responsibility, resource management, product development, and performance analysis and improvement. This helps to identify the position of a process within the overall IP management system and its inter-relationships between the processes themselves. Provide evaluation report; organize IP management deployment document Documentation: IP Management Manual à Procedures à Guidelines à Records 2. Training and Education & System Integration 4). Relevant training and education Understand the direction, method, and spirit of standardization. Participated by the implementation team and management representatives. 5).Drafting documentation Decide documentation framework, format, table of contents, numbering principles, and appoint editors and the completion date. Management team assigns tasks 6). Establishing documentation Drafting and revising procedural documentation Internal discussion and review IP management principles (refer to prior text) Define the scope and content of standard format. Appoint editors and the completion date. Establish standard format as an example before documenting Prepared IP management manual to aid employees and customers to understand the organization's IP management system Implementation team and management team 3.Implementation 7). Provide training & education specifically for the internal audit personnel Explain the purpose of auditing and execution details Participated by Internal audit committee Prepare checklist for auditing to be used by auditing personnel 8). Conduct system implementation and internal audits Execute documentation processes for the management system and conduct internal audits and review the performance Implementation, review, correction and prevention. Participated by all employees 9). Conduct overall examination of the intellectual property management system Implement IP management system Participated by all members of the implementation team C. Implementation Chapter five through chapter eight of TIPS define the core of the guidelines which cover the basic requirements of IP management requirements; top management's responsibilities; resource management; the acquisition, protection, maintenance and exploitation of IP, as well as performance evaluation and improvement. To facilitate Taiwanese enterprises' understanding of TIPS and how to use it to establish a comprehensive IP Management system, we provide the following main steps of establishing an IP management system based on the TIPS's requirements: Define the company's IP management goals Enterprises that would like to establish an IP Management system have to understand their unique features and future operation strategies to evaluate the needs for managing their IP. Clauses 4.1, 5.2, and 5.3.1 of TIPS stipulate that the management team has the responsibility to set clear IP management policy and goals. For example, one policy can be to increase R&D efficiency and the goal can be to reduce the product development cycle by 10%. Defining appropriate IP Management policies can help to establish a IP management system that meets an enterprise's practical needs. It can also be used as basic principles for formulating IP strategies and subsequently the implementation processes of IP management system. The management team should utilize intranet or bulletin boards to inform its employees of the organization's IP management policies, goals, and relevant responsibilities assigned to each department. This will help employees to understand their roles and responsibilities and the importance of their participation in achieving the organization's goals. Develop required processes for achieving enterprise's IP management goals The ultimate purpose of establishing an IP management system is to maximize profits and to minimize losses. To ensure successful acquisition of targeted IP, companies should plan and develop processes and operating procedures based on their needs and business development strategies. During this stage, companies should focus on the followings in order to meet TIPS's requirements: Understand statutory and regulatory requirements concerning IP The management target of TIPS is intellectual property, which includes trademark, patent, copyright, trade secrets and etc. Different IP acquisition approaches apply to different IP targets. Complying with Clause 7.1, companies must firstly understand all the statutory and regulatory requirements before a plan is made for the acquisition of targeted IP. For example, according to the relevant legislations in Taiwan, once a work is created, the authors obtain the copyright in the work. However, the right to patent or trademark can only be acquired through registration. Evaluate options for acquiring the targeted IP Enterprises shall evaluate different options (i.e. self-development, purchase or outsourcing) for acquiring their targeted IP by taking into account of their business operation objectives and the characteristics of their products as the methods of acquiring IP will influence the subsequent processes concerning the protection, maintenance and exploitation of the acquired IP. Clause 7.2 of TIPS requires enterprises to implement processes regarding to the evaluation of the options for acquiring the targeted IP. Clause 7.3.5 further requires enterprises to set up an assessment procedure for every IP application and suggests to incorporate an invention incentive program. Define roles and responsibilities After completing the feasibility study concerning various options to acquire the targeted IP, enterprises have to decide whether to establish an IP management specialized department (ex. legal or IP department) and to define clear roles and responsibilities based on the company's scale and resource available. Companies should pay particular attention on preparation work, such as conducting patent or trademark prior art search, to avoid wasting of resources and voided applications. If enterprises outsource IP management related activities to external bodies, Clause 7.4.1 of TIPS requires them to have a clear knowledge of the service quality provided by the outsourcing bodies and to establish a controlling mechanism over the outsourcing activities (ex. evaluation → outsourcing → contract → periodic evaluation…etc.). Special attention has to be paid to the contractual terms concerning obligations and ownership of IP. Determine Resources Required Enterprises that would like to establish an IP management system not only have to ensure that they have enough resources, but also need to ensure that the resources can be utilized in an effective way. The management team, in accordance of the requirements for Clauses 5.4.2 a nd 6.1 of TIPS, should provide resources (including labor and equipment) required for the implementation of the IP management system. Examples include the continual recruitment of manpower and the purchasing of computer software and hardware equipments and etc. As far as labor is concerned, enterprises, in accordance with Clause 6.2.1 , have to ensure that their employees have adequate abilities to assume their responsibility. Clause 6.2.1 states that companies should provide basic IP education and training to equip the employees with necessary knowledge. Pursuant to Clause 6.2.3, enterprises should provide their patent engineers and legal staff with advanced training, such as intellectual property litigation and arbitration, intellectual property licensing and contracts, techniques for patent design around, IP valuation and so on. In summary, enterprises should enhance the employees' (both new and existing employees) awareness of IP, the importance of complying with statutory requirements and the enterprises' internal IP policies and goals through education and training. Establish an IP Management System After determining the resources required, enterprises need to establish a basic system to manage their IP. The system shall include a documentation control system, an audit program, an internal communication channel and so on. We provide a summary explaining the details of each program required to establish a basic IP management system: Basic IP Management System (1) Documentation Control System: Enterprises should establish a systematic documentation control system based on their IP management policies and goals, such as document control procedures, internal audit process and etc. Among those, the most important one is an IP management manual. Clause 4.3 of TIPS requires the enterprises to state all the following items in their IP management manual: IP management policies and goals; roles and responsibilities; processes and procedures; and flow charts or grid charts to explain the interrelationships between the processes and procedures. Further, Clause 4.4 also states that all documents, no matter whether they are internally generated or externally acquired (ex. court notice, invitation to tender, official documents) should be properly managed. The source, level of confidence, method of management should be clearly labeled for future purposes. (2) Audit Program: Clause 5.4.2 states that top management has to be responsible or otherwise shall designate a management representative (the most senior staff that is responsible for intellectual property matters, such as vice president or director of IP management department) to manage a company's IP related issues. The top management team is also in charge of establishing a management review meeting, and setting agenda for each meeting such as discussing or revising the IP management policies and goals. Through management review meeting, pursuant to Clause 5.5, management representative must confirm that the set IP goals are met or if not, whether to revise the original policies or goals. All departments or responsible personnel (ex. legal, IP, general administration, accounting, human resource) shall participate the management review meeting. (3) Confidentiality Control Program: Enterprises in accordance with Clauses 4.4.1 a nd 7.4.4, should enhance feasible safety controls to protect their IP, such as setting document confidential criteria, physical access control, and control over replication of confidential documentation to limit exposure of important data. Supplemental IP Management System In addition to the above mentioned programs, supplemental IP management programs are required to assist in establishing an effective IP management system. They are outlined as follows: (1) Outsourcing Program: Due to cost or resource concerns, enterprises may outsource its R&D or IP prosecution activities to external professional agencies. Clauses 4.1 and 7.4.1 of TIPS require that the contracts entered into must clearly identify the ownership of IP involved and include a term of confidentiality obligation. This is to ensure that the outsourcing activities can be properly monitored and to prevent the leakage of important data. (2) Contract Review and Human Resource Management Programs: In order to prevent and avoid intellectual property infringement, in accordance with Clause 7.4.6 , enterprises should review all contractual terms of their contracts. As far as human resource management is concerned, in accordance with Clause 7.4.3, enterprises shall require new employees to sign an employment contract . Such contract shall include a term of confidentiality obligation and a non-competing clause may be included if necessary. (3) Internal Consulting and Communication Channel: During the period of establishing an IP management system, enterprises in accordance with Clause 5.5.2 must request relevant departments (ex. legal, sales, finance and accounting) to provide useful information concerning IP management. According to Clause 5.4.3, enterprises must establish communication channels (ex. dedicated mailbox, email) which is used to understand the feelings and to know the difficulties faced by the employees as it is inevitable to face challenges when a new system is being implemented, consistent communication and coordination is the only way to overcome these challenges. Ensure that Auditing and Preventive and Corrective Measures have been Taken Pursuant to Clauses 8.1 and 8.2, enterprises with IP management systems need to establish internal audit plans (including audit frequency, time, or method) to ensure that their IP management policies or goals are being met. Enterprises should ensure that their internal auditors are qualified i.e. have obtained the relevant professional certification, before conducting the internal audits. If nonconformities have been found through internal audits, corrective or preventive measures should be taken pursuant to Clauses 8.4.2 a nd 8.4.3. For instance, if the result of internal audit reveals that the R&D staff failed to keep their R&D records in accordance with the set rules and requirements, companies shall find out the causes (i.e. the reasons of the nonconformity) and then take appropriate corrective or preventive measures. An example of corrective measure can be to increase the frequency of checking the relevant records. And an example of preventive measure can be to provide incentive program to encourage the compliance of the relevant rules and regulations. Pursuant to the requirements of Clause 8.3, enterprises should collect and analyze relevant information, such as the internal audit reports, results of the corrective measures taken, and the results of market/competitors analysis. The above information can be used as input information during management review (Clause 5.5.2 ) to decide whether it is required to amend or set new intellectual property management policies and objectives. Through continual auditing and revising, a systematic IP management system can be established. IV Conclusion In the era of knowledge economy, the abilities of most domestic enterprises to manage tangible assets have gradually matured (ex. ERP system). However, the abilities to manage intangible assets which include intellectual property have yet to be developed. Management systems in most domestic enterprises are fragmented. For example, legal departments are only responsible for contract reviewing tasks; R&D staff has limited IP knowledge. The importance of IP is often overlooked and most enterprises do not see that intellectual property management is the responsibility of every employee. As a consequence, the Taiwanese government establishes and promotes TIPS to encourage domestic enterprises to adopt a systemic approach of managing their intellectual property and TIPS is also provided as a tool to assist enterprises to establish a sound intellectual property management system. The purpose of implementing TIPS is not to request enterprises to establish a separate management system. In order to maintain efficiency and competitiveness, an enterprise has to have an integrated management system to support its core operations and also to meet the requirements of different management system standards. Eliminating overlaps of the requirements between different quality management systems is an inevitable trend. TIPS incorporates IP management with the ISO 9000 quality management system, which is capable of simplifying the complicated IP management tasks into an effective and standardized IP management system. TIPS helps an enterprise to establish a systematic process for managing its IP. Through competitive analysis, market trend analysis, and periodic IP management operations review, a company can revise and amend its IP management policies and goals and continually improve its IP management system. For example, sales departments shall collect market trends, competitive information and shall also consciously avoid acquiring materials that may raise infringement concerns. Human resource departments shall focus their efforts in providing IP education and training. Finance departments shall evaluate the costs required for maintaining the existing IP rights and inform the R&D departments to conduct relevant review at the appropriate time. R&D departments shall conduct prior art search before a new research project is commenced. TIPS offers a simple, efficient, and low-cost management system which assists an enterprise to establish an IP management system that aligns to its business goals and operation activities. We hope that by promoting and encouraging domestic enterprises to adopt and implement TIPS, Taiwan can strengthen its international competitiveness and sustain the growth of its economy and the whole society. 1.Taiwan Intellectual Property Management System (TIPS). The Ministry of Economics Affairs combined the IP management principles and the PDCA (Plan-Do-Check-Action) model used in ISO9001:2000 quality management system to create TIPS. The adoption of PDCA model helps organizations to establish a systematic and effective IP management system which can be continuously improved. 2. Chen Yi-Chih is a Section Manager at the Science and Technology Law Center ; Chen Hung-Chih is a legal Researcher at the Science and Technology Law Center . 3. Data Source: http://www.atmt.org.tw/html/modules/news/article.php?storyid=135&PHPSESSID=cab6428078a0435c5af1b2e7bbe2b121 (last visited: 08/11/2007 ) 4. Data Source: http://www.cyberone.com.tw/ItemDetailPage/PDAFormat/PDAFContent.asp?MMContentNoID=36372(last visited: 08/11/2007 ) 5. “Enterprise” as defined in TIPS includes company, corporate, school, research institute, a specific department or a project team is also included. 6. TIPS was developed based on the PDCA (Plan-Do-Check Action) model, a typical ISO management process which requires continuously monitoring, evaluating, analyzing and improving the whole system. 7. The TIPS guidelines can be found at: http://www.tips.org.tw/public/public.asp?selno=236&relno=236 8. Refer to article: New Philosophy of Intellectual Property – Use ISO Quality Management to establish a systematic IP management in Intellectual Property Journal, issue 74, 02/2005. 9. http://www.tips.org.tw/public/public.asp?selno=236&relno=236 (last visited: 08/12/2007 ) 10. The guidelines of TIPS also serve as the requirements for certification purpose. The Industrial Development Bureau of the Ministry of Economic Affairs will issue a certificate to an organization if such organization has implemented an IP management system satisfying the requirements of TIPS.

Korea “Strategies for an Intellectual Property Powerhouse to Realize a Creative Economy” OverviewBackground Since 1990, many countries like United States, Japan and EU understand that intellectual properties create higher value added than tangible assets do so these countries respectively transformed their economic types to knowledge-based economy so as to boost economic growth and competitiveness. For example, Japan has legislated “Intellectual Property Basic Act” in 2002 and established “the Intellectual Property Strategy Headquarters” in 2003. United States legislated “Prioritizing Resources and Organization for Intellectual Property Act (PRO-IP Act)” in 2008. China also announced “National Intellectual Property Strategic Principles” in June, 2008. Following the above international tendency of protecting intellectual properties, Korea government has promoted intellectual property related policies and legislated related acts since 2000, such as “Technology Transfer Promotion Act” in 2000, policy of supporting patent disputes settlements and shortened the length of patent examination procedure in 2004. Besides, on June 27, 2006, the Presidential Advisory Council on Education, Science and Technology (PACEST) announced “Strategy for Intellectual Property System Constructing Plan.” However, these policies or acts mainly focus on the protection and application of patent rights, not relate to other kinds of intellectual property rights such as trademark right, copyright etc. Until 2008, in order to advance the ability of national competition, Lee Myung-bak government had established “Presidential Council on National Competitiveness (PCNC)”. For the vision of transforming to the intellectual property based economy, the PCNC held its 15th meeting on July 29, 2009. The meeting, held at the Blue House, was attended by the president, the Chairman, and members of the Council. One of the agenda of the meeting is strategies for an intellectual property (IP) powerhouse to realize a creative economy. Three goals of the strategies includes being IP Top 5 nations (U.S., Japan, EU, Korea and China), improving technology balance of payments deficits, and enhancing the scale of copyright industry. Next, this study will introduce details of Korea IP related strategies for our nation’s reference. Introduction Korea IP strategy consists of 3 aspects (creation and application, law and regulation, infrastructure) and 11 missions. And the contents of 11 missions cover the creation, protection and application of intellectual property rights (patent, copyright, trademark, plant variety etc), namely the whole life cycle of intellectual property rights. Through announcement of IP Strategies, Korea hopes to protect intellectual property rights from every aspect and makes IP as essential driving force for national economic growth. 1. Creation and Application Aspect First, although the quantity of intellectual property rights (IPRs) of Korea is rapidly increased in recent years, the quality of intellectual property rights is not increased equally. Also, most of researchers do not receive appropriate rewards from R&D institutions, and then it might reduce further innovation. As above reasons, Korea IP strategy indicated that the government will raise “invention capital” to exploit, buy researchers’ new ideas, and make those ideas get legal protection. That is, the government will set up non-practicing entities (NPEs) with private business. The NPEs would buy intellectual properties from R&D institutions or researchers, and then license to enterprises who have need. After licensing, NPEs will share royalty which obtained from enterprises (licensees) with researchers appropriately. Besides, in order to encourage university, public R&D institutions to set up “technology holdings”, Korea government had amended “Industry Education and Corporation of Industry, Academic and Research Promotion Act”. The amendments are loosening establishment conditions of technology holdings, such as minimum portion of investment in technology has been lowered from 50% to 30%, and broadening the scope of business of technology holdings. 2. Law and Regulation Aspect Secondly, in aspect of law and regulation, in addition to encouraging creation of good quality of IP, Korea considers that intellectual property rights are needed to be protected legally. Therefore, the IP strategy especially pointed out that Korea would follow the example of Japan to legislate their own “Intellectual Property Basic Act”. According to Korea “Intellectual Property Basic Act”, it should establish a “Presidential Council on Intellectual Property”. The main work of this Council is planning and promoting intellectual property related policies. There are 5 chapters and 41 articles in Korea “Intellectual Property Basic Act”. The Act like Korea IP strategy is divided into three parts, that is, “creation and application”, “protection” and “infrastructure”. In fact, the legislation of Korea “Intellectual Property Basic Act” embodies the policies of IP strategy. Further, according to Korea “Intellectual Property Basic Act”, “Presidential Council on Intellectual Property” is to integrate IP related affairs of the administrations into one action plan and promote it. Moreover, according to Korea “Intellectual Property Basic Act”, the government should make medium-term and long-term policies and basic plans for the promotion of intellectual properties every 5 years and adjusts policies and plans periodically as well. Through framing, enacting and adjusting policies and plans, Korea expects to create a well-living environment for the development of intellectual property. 3. Infrastructure Aspect Thirdly, even if good laws and regulations are already made and more government budget and human resource are invested, Korea is still deficient in well-prepared social infrastructure and leads to the situation that any promoting means of intellectual properties will be in vain. With regard to one of visions of Korea IP strategy,” being IP Top 5 power (U.S., Japan, EU, Korea and China)”, on the one hand, Korea domestic patent system should harmonize with international intellectual property regulations that includes loosening the conditions of application and renewal of patent and trademark. On the other hand, the procedure of patent application conforms to the international standard, that is, the written form of USA patent application becomes similar to the forms of world IP Top 3 power (U.S., Japan and EU) and member states of Paten Law Treaty (PLT). At the same time, Korea would join “Patent Prosecution Highway (PPH)” to enable Korea enterprises to acquire protection of patent rights around the world more rapidly. In addition, about the investigation of infringement of intellectual property rights, Korea IP strategy stated that it would strengthen control measures on nation border and broaden IP protection scope from only patent to trademark, copyright and geographical indications. Besides, Korea uses network technology to develop a 24-hour online monitoring system to track fakes and illegal copies. In addition to domestic IP protection, Korea enterprises may face IP infringement at overseas market, thus Korea government has provided supports for intellectual property rights disputes. For this sake, Korea choose overseas market such as Southeast Asia, China, and North America etc to establish “IP Desk” and “Copyright Center” for providing IP legal consultation, support of dispute-resolving expenses and information services for Korea enterprises. Korea IP strategy partially emphasizes on the copyright trading system As mentioned above, one of visions of Korea IP strategy is “enhancing the development of copyright industry”. It’s well-known that Korea culture industries like music, movie, TV, online game industries are vigorous in recent years. Those culture industries are closely connected to copyright, so development of copyright industry is set as priority policy of Korea. In order to enhance the development of Korea copyright industry, a well-trading environment or platform is necessary so as to make more copyrighted works to be exploited. Therefore, Korea Copyright Commission has developed “Integrated Copyright Number (ICN)” that is identification number for digital copyrighted work. Author or copyright owners register copyright related information on “Copyright Integrated Management System (CIMS)” which manages information of copyrighted works provided by the authors or copyright owners, and CIMS would give an ICN number for the copyrighted work, so that users could through the ICN get license easily on “Copyright License Management System (CLMS)” which makes transactions between licensors and licensees. By distributing ICN to copyrighted works, not only the licensee knows whom the copyright belongs to, but the CLMS would preserve license contracts to ensure legality of the licensee’s copyright. After copyright licensing, because of characteristic of digital and Internet, it makes illegal reproductions of copyrighted works easily and copyright owners are subject to significant damages. For this reason, Korea Ministry of Culture, Sports and Tourism (MCST) and Korea Intellectual property Office (KIPO) have respectively developed online intellectual property (copyright and trademark) monitoring system. The main purpose of these two systems is assisting copyright and trademark owners to protect their interests by collecting and analyzing infringement data, and then handing over these data to the judiciary. Conclusion Korea IP strategy has covered all types of intellectual properties clearly. The strategy does not emphasize only on patent, it also includes copyright, trademark etc. If Taiwan wants to transform the economic type to IP-based economy, like Korea, offering protection to other intellectual property rights should not be ignored, too. As Taiwan intends to promote cultural and creative industry and shows soft power of Taiwan around the world, the IP strategy of Taiwan should be planned more comprehensively in the future. In addition to protecting copyrights by laws and regulations, for cultural and creative industry, trading of copyrights is equally important. The remarkable part of Korea IP strategy is the construction of copyright online trading platform. Accordingly, Taiwan should establish our own copyright online trading platform combining copyright registration and source identification system, and seriously consider the feasibility of giving registered copyright legal effects. A well-trading platform integrating registration and source identification system might decrease risks during the process of licensing the copyright. At the same time, many infringements of copyrights are caused because of the nature of the modern network technology. In order to track illegal copies on the internet, Taiwan also should develop online monitoring system to help copyright owners to collect and preserve infringement evidences. In sum, a copyright trading system (including ICN and online intellectual property monitoring system) could reinforce soft power of Taiwan cultural and creative industry well.

The Introduction to the Trade Secret Management GuidelinesThe Introduction to the Trade Secret Management Guidelines 2024/09/09 Due to an open, collaborative culture and the need to balance knowledge sharing with protection, research academic institutions always face unique challenges in managing confidential information. However, trade secret protection is still essential for research academic institutions in order to safeguard their competitive advantages and valuable research results. Accordingly, the “Trade Secret Management Guidelines”, released by the Taiwan Intellectual Property Office (TIPO) on May 27, 2024, is specifically tailored for the trade secret protection in the research and academic circumstance. Taking into account the essential differences between research academic institutions and enterprises, these guidelines use a phased and scalable approach to implement trade secret protection measures. With these guidelines, each research academic institution can evaluate its own size, research field, available resources, etc., and establish an appropriate trade secret management system to effectively identify, protect and manage its trade secrets. The Trade Secret Management guidelines outline 13 measures for managing trade secrets, covering the entire life cycle of trade secret protection. In addition, these guidelines recommends that research academic institutions adopt a phased implementation strategy, starting from the "entry-level" stage focusing on basic measures, and gradually entering the "basic" and "enhanced" stages to improve each management measure. The following is an overview of each measure: 1.Distinguishing Trade Secrets In order to facilitate the protection of trade secrets, institutions should distinguish what is trade secret information at the entry stage, whether it is self-developed or obtained from others. As progressing to the basic stage, institutions should define and provide examples of trade secrets they produce or acquire. When entering the enhanced stage, institutions should develop a process for identifying whether an information is a trade secret. 2.Access Control To prevent unauthorized disclosure, institutions should control access to trade secrets. At the entry stage, institutions must set access permissions for trade secrets. As progressing to the basic stage, access should be granted based on the need for the information. When entering the enhanced stage, institutions need to adjust access permissions in response to job changes and personnel turnover. 3.Identification Identifying trade secrets helps ensure that those accessing the information are aware of its confidentiality. At the entry stage, institutions need to identify information considered to be trade secrets, but there are no restrictions on the identification method. As progressing to the basic stage, institutions need to clearly define how trade secrets will be identified. When entering the enhanced stage, the key is to ensure that all contacts know that the information they come into contact with is a trade secret. 4.External Disclosure Review In order not to affect subsequent research or applications, institutions should review the information that will be disclosed to the public. At the entry stage, institutions should ensure that information is reviewed by responsible personnel before it is disclosed to the public. As progressing to the basic stage, institutions need to identify which items should be reviewed. When entering the enhanced stage, institutions shall distinguish what should be reviewed based on the nature of the information disclosed to the public. 5.Circulation Control Controlling the circulation of trade secrets can prevent them from being arbitrarily disclosed. At the entry stage, institutions should ensure that responsible personnel have consent to the circulation of trade secrets. As progressing to the basic stage, the key is whether the behavior of circulating trade secrets is recorded. When entering the enhanced stage, institutions should take countermeasures to prevent trade secrets from being leaked during the circulation process. 6.Reproduction Control Controlling the reproduction of trade secrets can ensure that the use of trade secrets is limited to a controllable scope. At the entry stage, institutions should limit the reproduction of trade secrets. As progressing to the basic stage, the key is whether the behavior of reproducing trade secrets is recorded. When entering the enhanced stage, institutions should take measures to avoid the increased risk of leakage of trade secrets after the reproduction behavior. 7.Destruction At the entry stage, institutions should ensure that the consent of the responsible personnel is obtained when destroying trade secret. As progressing to the basic stage, institutions should consider the impact of destruction before destroying trade secrets and ensure that records of destruction are retained. When entering the enhanced stage, the key is whether the trade secrets are destroyed in an irrecoverable way. 8.Usage record retention Keeping the usage record of trade secrets can help provide evidence in litigation. At the entry stage, institutions should keep records of access and use of trade secrets. As progressing to the basic stage, institutions should further specify the items that need to be retained in the records. When entering the enhanced stage, institutions should ensure that the records retained are authentic and will not be arbitrarily tampered with. Therefore, if necessary, a third party agency can be entrusted with the preservation of evidence. 9.Designating Responsibility for Implementation Setting up responsible personnel can help ensure that the trade secret management mechanism is effectively implemented. At the entry stage, institutions simply need to ensure there is someone responsible for driving trade secret management. As progressing to the basic stage, institutions shall assign dedicated personnel to be responsible for trade secret management. When entering the enhanced stage, institutions must establish a dedicated unit to coordinate the protection of trade secrets through a clear division of powers and responsibilities. 10.Confidentiality and Ownership Arrangements Signing confidentiality and ownership agreements can ensure that internal personnel who may have access to trade secrets understand their confidentiality obligations. At the entry stage, institutions only need to sign a written confidentiality agreement with those who may have access to trade secrets. As progressing to the basic stage, institutions shall clearly define the items that must be included in the confidentiality and ownership agreement. When entering the enhanced stage, institutions need to further evaluate whether to adjust the contents of confidentiality and ownership agreements in response to job changes and personnel turnover. 11.Promotion and Training Through promotion and training, institutions can gradually improve personnel's awareness of confidentiality and help them understand the key points of trade secret management. At the entry stage, institutions can promote the importance of trade secret management and provide appropriate training to all personnel. As progressing to the basic stage, institutions should establish promotional materials, explain the management objectives and specific practices in the training, and conduct an evaluation of effectiveness. When entering the enhanced stage, institutions need to adjust the content required for training based on differences in units, objects, trade secret characteristics, etc. 12.Departure Management At the entry stage, institutions should remind departing personnel of their confidentiality obligations. As progressing to the basic stage, institutions shall further require the departing personnel to hand over the trade secrets they held during their tenure. When entering the enhanced stage, institutions need to conduct exit interviews with important departing personnel to ensure that they clearly understand their confidentiality obligations. 13.Confidentiality and Ownership Arrangements with External Parties Signing confidentiality and ownership agreements with external parties can help prevent institutions mired in unnecessary controversies. At the entry stage, institutions only need to sign confidentiality agreement with external parties before providing trade secrets to them. As progressing to the basic stage, institutions shall clearly define the items that must be included in the confidentiality and ownership agreement. When entering the enhanced stage, institutions needs to confirm with external parties and reach a consensus on the management measures that both parties need to take. The Trade Secret Management guidelines provide a comprehensive framework for research academic institutions in Taiwan to protect their trade secrets. Regardless of the size of the research academic institutions or the field it focuses on, as long as they follow the above-mentioned 13 measures and adjusts according to their current management situations, they can gradually establish a trade secret management system that meets their own needs.