Brief Introduction to Taiwan Social Innovation Policies

Brief Introduction to Taiwan Social Innovation Policies

2021/09/13

1. Introduction

The Millennium Development Goals (MDGs)[1] set forth by the United Nations in 2000 are carried out primarily by nations and international organizations. Subsequently, the Sustainable Development Goals (SDGs) set forth by the United Nations in 2015 started to delegate the functions to organizations of all levels. Presently, there is a global awareness of the importance of balancing “economic growth”, “social progress”, and “environmental protection” simultaneously during development. In the above context, many similar concepts have arisen worldwide, including social/solidarity economy, social entrepreneurship and social enterprise, and social innovation.

Generally, social innovation aims to alter the interactions between various groups in society through innovative applications of technology or business models, and to find new ways to solve social problems through such alterations. In other words, the goal is to use innovative methods to solve social problems. The difference between social innovation and social enterprise is that social enterprise combines commercial power to achieve its social mission under a specific perspective, while social innovation creates social value through cooperation with and coordination among technology, resources, and communities under a diversified nature.

2. Overview of Taiwan Social Enterprise Policy

To integrate into the global community and assist in the development of domestic social innovation, Taiwan’s Executive Yuan launched the “Social Enterprise Action Plan” in 2014, which is the first policy initiative to support social enterprises (from 2014 to 2016). Under this policy initiative, through consulting with various ministries and applying methods such as “amending regulations”, “building platforms”, and “raising funds”, the initiative set to create an environment with favorable conditions for social innovation and start-ups. At this stage, the initiative was adopted under the principle of “administrative guidance before legislation” in order to encourage private enterprise development without excessive burden, and avoid regulations restricting the development of social enterprises, such as excessive definition of social enterprises. Moreover, for preserving the original types of these enterprises, this Action Plan did not limit the types of social enterprises to companies, non-profit organizations, or other specific types of organizations.

To sustain the purpose of the Social Enterprise Action Plan and to echo and reflect the 17 sustainable development goals proposed in SDGs by the United Nations, the Executive Yuan launched the “Social Innovation Action Plan” (effective from 2018 to 2022) in 2018 to establish a friendly development environment for social innovation and to develop diversified social innovation models through the concept of “openness, gathering, practicality, and sustainability”. In this Action Plan, “social innovation” referred to “social innovation organizations” that solve social problems through technology or innovative business models. The balancing of the three managerial goals of society, environment value, and profitability is the best demonstration of the concept of social innovation.

3. Government’s Relevant Social Enterprise Policy and Resources

The ministries of the Taiwan Government have been promoting relevant policies in accordance with the Social Innovation Action Plan issued by the Executive Yuan in 2018, such as the “Registration System for Social Innovation Enterprises” (counseling of social enterprises), the “Buying Power - Social Innovation Products and Services Procurement”, the “Social Innovation Platform” established by the Ministry of Economic Affairs, the “Social Innovation Manager Training Courses”, the “Promoting Social Innovation and Employment Opportunities” administered by the Ministry of Labor, and the “University Social Responsibility Program” published by the Ministry of Education. Among the above policies stands out the measures adopted by the Ministry of Economic Affairs, and a brief introduction of those policies are as follows:

i. Social Innovation Platform

To connect all resources involved in social issues to promote social innovation development in Taiwan, the Ministry of Economic Affairs established the “Social Innovation Platform”.[2] With visibility through the Social Innovation Platform, it has become more efficient to search for targets in a public and transparent way and to assist with the input of resources originally belonging to different fields in order to expand social influence.

As a digital platform gathering “social innovation issues in Taiwan,” the Social Innovation Platform covers multiple and complete social innovation resources, which include the “SDGs Map” constructed on the Social Innovation Platform, by which we can better understand how county and city governments in Taiwan implement SDGs and Voluntary Local Review Reports, and which allow us to search the Social Innovation Database[3] and the registered organizations, by which citizens, enterprises, organizations, and even local governments concerned with local development can find their partners expediently as possible, establish service lines to proactively assist public or private entities with their needs/resources, and continue to enable the regional revitalization organizations, ministries, and enterprises to identify and put forward their needs for social innovation through the function of “Social Innovation Proposals”, which assist social innovation organizations with visibility while advancing cooperation and expanding social influence.

In addition, the “Event Page” was established on the Social Innovation Platform and offers functions, such as the publishing, searching, and sorting of events in four major dimensions with respect to social innovation organization, governments, enterprises, and citizens; and encourages citizens, social innovation organizations, enterprises, and governments to devote themselves via open participation to continuously expande the influence of the (Civic Technology) Social Innovation Platform. The “Corporate Social Responsibility Report” collects the corporate social responsibility reports, observes the distribution of resources for sustainable development by corporations in Taiwan, offers filtering functions by regions, keyword, popular rankings, and or SDGs types, and provides contact information and a download function for previous years’ reports, in order to effectively assist social innovation organizations to obtain a more precise understanding of the status quo, needs, and trends with respect to their development of respective products and services.

Figure 1: SDGs Map

Reference: Social Innovation Platform (https://si.taiwan.gov.tw/)

Figure 2: Social Innovation Database

Reference: Social Innovation Platform (https://si.taiwan.gov.tw/)

Figure 3: Social Innovation Proposals

Reference: Social Innovation Platform (https://si.taiwan.gov.tw/)

Figure 4: Event Page

Reference: Social Innovation Platform (https://si.taiwan.gov.tw/)

Figure 5: Corporate Social Responsibility Report

Reference: Social Innovation Platform (https://si.taiwan.gov.tw/)

ii. Social Innovation Database

To encourage social innovation organizations to disclose their social missions, products and services, and to guide society to understand the content of social innovation, and to assist the administrative ministries to be able to utilize such information, the Ministry of Economic Affairs issued the “Principles of Registration of Social Innovation Organizations” to establish the “Social Innovation Database”.

Once a social innovation organization discloses the items, such as its social missions, business model, or social influence, it may obtain the relevant promotional assistance resources, including becoming a trade partner with Buying Power (Social Innovation Products and Services Procurement), receiving exclusive consultation and assistance from professionals for social innovation organizations, and becoming qualified to apply to entering into the Social Innovation Lab. Moreover, the Ministry of Economic Affairs is simultaneously consolidating, identifying, and designating the awards and grants offered by the various ministries, policies and measures in respect of investment, and financing and assistance, as resources made available to registered entities.

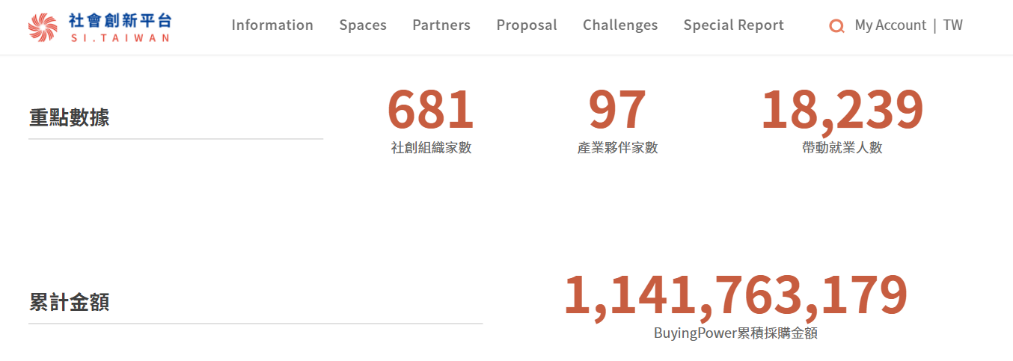

As of 25 May 2021, there were 658 registered social innovation organizations and 96 Social Innovation Partners (enterprises with CSR or ESG resources that recognize the cooperation with social innovation under the social innovation thinking model may be registered as a “Social Innovation Partner”). The public and enterprises can search for organizations registered in the Social Innovation Database through the above-said Social Innovation Platform, the search ability of which advances the exposure of and the opportunities for cooperation with social innovation organizations.

Figure 6: Numbers of registered social innovation organizations and accumulated value of purchases under Buying Power

Reference: Social Innovation Platform(https://si.taiwan.gov.tw/)

iii. Buying Power - Social Innovation Products and Services Procurement

In order to continue increasing the awareness on social innovation organizations and related issues and promote responsible consumption and production in Taiwan, as well as to raise the attention of the commercial sector to the sustainability-driven procurement models, the Ministry of Economic Affairs held the first “Buying Power - Social Innovation Products and Services Procurement” event in 2017. Through the award system under the Buying Power, it continues to encourage the governments, state-owned enterprises, private enterprises, and organizations to take the lead in purchasing products or services from social innovation organizations, to provide the relevant resources so as to assist social innovation organizations to obtain resources and to explore business opportunities in the markets, to practice responsible consumption and production, and to promote innovative cooperation between all industries and commerce and social innovation organizations.

The aim of the implementation of the Buying Power is to encourage the central and local governments, state-owned enterprises, private enterprises, and non-governmental organizations to purchase products or services from organizations registered in the Social Innovation Database, while prizes will be awarded based on the purchase amounts accumulated during the calculation period. The winners can obtain priority in applying for membership in the Social Innovation Partner Group, with corresponding member services, in the future.

Under the Social Innovation Platform, both the amount of purchase awards and the number of applicants for special awards continue to increase. So far, purchases have accumulated to a value of more than NT$1.1 billion (see Figure 6), and more than 300 organizations have proactively participated.

iv. Social Innovation Mark

In order to promote public awareness of social innovation, the Ministry of Economic Affairs has been charged with the commissioned task of promoting the Social Innovation Mark, and issued “ The Small and Medium Enterprise Administration of the Ministry of Economic Affairs Directions for Authorization of the Social Innovation Mark” as the standard for the authorization of the Social Innovation Mark. Social innovation organizations can use the Mark, through obtaining authorization, to hold Social Innovation Summits or other social innovation activities for promoting social innovation concepts.

In order to build the Mark as a conceptual symbol of social innovation, the Ministry of Economic Affairs has been using the Social Innovation Mark in connection with various social innovation activities, such as the Social Innovation Platform, the Buying Power, and the annual Social Innovation Summit. Taking the selection of sponsors of the Social Innovation Summit in 2022 as an example[4], only organizations that have obtained authorization of the Social Innovation Mark can use the Mark to hold the Social Innovation Summit.

Figure 7: The Social Innovation Mark of the Small and Medium Enterprise Administration, Ministry of Economic Affairs

IV. Conclusion

The “Organization for Economic Cooperation and Development” (OECD) regards social innovation as a new strategy for solving future social problems and as an important method for youth entrepreneurship and social enterprise development. Taiwan’s social innovation energy has entered a stage of expansion and development. Through the promotion of the “Social Innovation Action Plan,” the resources from the central and local governments are integrated to establish the Social Innovation Platform, the Social Innovation Database, the Social Innovation Lab, and the Social Innovation Mark. In addition, incentives such as the Buying Power have been created, manifesting the positive influence of Taiwan’s social innovation.

[1] MDGs are put forward by the United Nations in 2000, and are also the goals requiring all the 191 member states and at least 22 international organizations of the United Nations to be committed to on their best endeavors, including: 1. eradicating extreme poverty and hunger, 2. applying universal primary education, 3. promoting gender equality and empowering women, 4. reducing child mortality rates, 5. improving maternal health, 6. combatting HIV/AIDS, malaria, and other diseases, 7. ensuring environmental sustainability, and 8. establishing a global partnership for development.

[2] Please refer to the Social Innovation Platform: https://si.taiwan.gov.tw/.

[3] Please refer to the Social Innovation Database: https://si.taiwan.gov.tw/Home/Org_list.

[4] Please refer to the guidelines for the selection of sponsors of the 2022 Social Innovation Summit: https://www.moeasmea.gov.tw/files/6221/4753E497-B422-4303-A8D4-35AE0B4043A9

Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”) I. Foreword We hereby aim to analyze and research the role played by The Finnish Innovation Fund (“Sitra”) in boosting the national innovation ability and propose the characteristics of its organization and operation which may afford to facilitate the deliberation on Taiwan’s legal system. Sitra is an independent organization which is used to reporting to the Finnish Parliament directly, dedicated to funding activities to boost sustainable development as its ultimate goal and oriented toward the needs for social change. As of 2004, it promoted the fixed-term program. Until 2012, it, in turn, primarily engaged in 3-year program for ecological sustainable development and enhancement of society in 2012. The former aimed at the sustainable use of natural resources to develop new structures and business models and to boost the development of a bioeconomy and low-carbon society, while the latter aimed to create a more well-being-oriented public administrative environment to upgrade various public sectors’ leadership and decision-making ability to introduce nationals’ opinion to policies and the potential of building new business models and venture capital businesses[1]. II. Standing and Operating Instrument of Sitra 1. Sitra Standing in Boosting of Finnish Innovation Policies (1) Positive Impact from Support of Innovation R&D Activities by Public Sector Utilization of public sector’s resources to facilitate and boost industrial innovation R&D ability is commonly applied in various countries in the world. Notwithstanding, the impact of the public sector’s investment of resources produced to the technical R&D and the entire society remains explorable[2]. Most studies still indicate positive impact, primarily as a result of the market failure. Some studies indicate that the impact of the public sector’s investment of resources may be observable at least from several points of view, including: 1. The direct output of the investment per se and the corresponding R&D investment potentially derived from investees; 2. R&D of outputs derived from the R&D investment, e.g., products, services and production methods, etc.; 3. direct impact derived from the R&D scope, e.g., development of a new business, or new business and service models, etc.; 4. impact to national and social economies, e.g., change of industrial structures and improvement of employment environment, etc. Most studies indicate that from the various points of view, the investment by public sector all produced positive impacts and, therefore, such investment is needed definitely[3]. The public sector may invest in R&D in diversified manners. Sitra invests in the “market” as an investor of corporate venture investment market, which plays a role different from the Finnish Funding Agency for Technology and Innovation (“Tekes”), which is more like a governmental subsidizer. Nevertheless, Finland’s characteristics reside in the combination of multiple funding and promotion models. Above all, due to the different behavior model, the role played by the former is also held different from those played by the general public sectors. This is why we choose the former as the subject to be studied herein. Data source: Jari Hyvärinen & Anna-Maija Rautiainen, Measuring additionality and systemic impacts of public research and development funding – the case of TEKES, FINLAND, RESEARCH EVALUATION, 16(3), 205, 206 (2007). Fig. 1 Phased Efforts of Resources Invested in R&D by Public Sector (2) Two Sided f Role Played by Sitra in Boosting of Finnish Innovation Policies Sitra has a very special position in Finland’s national innovation policies, as it not only helps successful implementation of the innovation policies but also acts an intermediary among the relevant entities. Sitra was founded in 1967 under supervision of the Bank of Finland before 1991, but was transformed into an independent foundation under the direction of the Finnish Parliament[4]. Though Sitra is a public foundation, its operation will not be intervened or restricted by the government. Sitra may initiate any innovation activities for its new organization or system, playing a role dedicated to funding technical R&D or promoting venture capital business. Meanwhile, Sitra also assumes some special function dedicated to decision-makers’ training and organizing decision-maker network to boost structural change. Therefore, Sitra may be identified as a special organization which may act flexibly and possess resources at the same time and, therefore, may initiate various innovation activities rapidly[5]. Sitra is authorized to boost the development of innovation activities in said flexible and characteristic manner in accordance with the Finland Innovation Fund Act (Laki Suomen itsenäisyyden juhlarahastosta). According to the Act, Finland established Sitra in 1967 and Sitra was under supervision of Bank of Finland (Article 1). Sitra was established in order to boost the stable growth of Finland’s economy via the national instrument’s support of R&D and education or other development instruments (Article 2). The policies which Sitra may adopt include loaning or funding, guarantee, marketable securities, participation in cooperative programs, partnership or equity investment (Article 3). If necessary, Sitra may collect the title of real estate or corporate shares (Article 7). Data source: Finnish innovation system, Research.fi, http://www.research.fi/en/innovationsystem.html (last visited Mar. 15, 2013). Fig. 2 Finnish Scientific Research Organization Chart Sitra's innovation role has been evolved through two changes. Specifically, Sitra was primarily dedicated to funding technical R&D among the public sectors in Finland, and the funding model applied by Sitra prior to the changes initiated the technical R&D promotion by Tekes, which was established in 1983. The first change of Sitra took place in 1987. After that, Sitra turned to focus on the business development and venture capital invested in technology business and led the venture capital investment. Meanwhile, it became a partner of private investment funds and thereby boosted the growth of venture capital investments in Finland in 1990. In 2000, the second change of Sitra took place and Sitra’s organization orientation was changed again. It achieved the new goal for structural change step by step by boosting the experimental social innovation activities. Sitra believed that it should play the role contributing to procedural change and reducing systematic obstacles, e.g., various organizational or institutional deadlocks[6]. Among the innovation policies boosted by the Finnish Government, the support of Start-Ups via governmental power has always been the most important one. Therefore, the Finnish Government is used to playing a positive role in the process of developing the venture capital investment market. In 1967, the Government established a venture capital company named Sponsor Oy with the support from Bank of Finland, and Sponsor Oy was privatized after 1983. Finland Government also established Kera Innovation Fund (now known as Finnvera[7]) in 1971, which was dedicated to boosting the booming of Start-Ups in Finland jointly with Finnish Industry Investment Ltd. (“FII”) established by the Government in 1994, and Sitra, so as to make the “innovation” become the main development force of the country[8] . Sitra plays a very important role in the foundation and development of venture capital market in Finland and is critical to the Finnish Venture Capital Association established in 1990. After Bank of Finland was under supervision of Finnish Parliament in 1991, Sitra became on the most important venture capital investors. Now, a large portion of private venture capital funds are provided by Sitra[9]. Since Sitra launched the new strategic program in 2004, it has turned to apply smaller sized strategic programs when investing young innovation companies, some of which involved venture capital investment. The mapping of young innovation entrepreneurs and angel investors started as of 1996[10]. In addition to being an important innovation R&D promoter in Finland, Sitra is also an excellent organization which is financially self-sufficient and tends to gain profit no less than that to be generated by a private enterprise. As an organization subordinated to the Finnish Parliament immediately, all of Sitra’s decisions are directly reported to the Parliament (public opinion). Chairman of Board, Board of Directors and supervisors of Sitra are all appointed by the Parliament directly[11]. Its working funds are generated from interest accruing from the Fund and investment income from the Fund, not tax revenue or budget prepared by the Government any longer. The total fund initially founded by Bank of Finland amounted to DEM100,000,000 (approximately EUR17,000,000), and was accumulated to DEM500,000,000 (approximately EUR84,000,000) from 1972 to 1992. After that, following the increase in market value, its nominal capital amounted to DEM1,400,000,000 (approximately EUR235,000,000) from 1993 to 2001. Obviously, Sitra generated high investment income. Until 2010, it has generated the investment income amounting to EUR697,000,000 . In fact, Sitra’s concern about venture capital investment is identified as one of the important changes in Finland's national technical R&D polices after 1990[13]. Sitra is used to funding businesses in three manners, i.e., direct investment in domestic stock, investment in Finnish venture capital funds, and investment in international venture capital funds, primarily in four industries, technology, life science, regional cooperation and small-sized & medium-sized starts-up. Meanwhile, it also invests in venture capital funds for high-tech industries actively. In addition to innovation technology companies, technical service providers are also its invested subjects[14]. 2. “Investment” Instrument Applied by Sitra to Boost Innovation Business The Starts-Up funding activity conducted by Sitra is named PreSeed Program, including INTRO investors’ mapping platform dedicated to mapping 450 angel investment funds and entrepreneurs, LIKSA engaged in working with Tekes to funding new companies no more than EUR40,000 for purchase of consultation services (a half thereof funded by Tekes, and the other half funded by Sitra in the form of loan convertible to shares), DIILI service[15] dedicated to providing entrepreneurs with professional sale consultation resources to integrate the innovation activity (product thereof) and the market to remedy the deficit in the new company’s ability to sell[16]. The investment subjects are stated as following. Sitra has three investment subjects, namely, corporate investments, fund investments and project funding. (1) Corporate investment Sitra will not “fund” enterprises directly or provide the enterprises with services without consideration (small-sized and medium-sized enterprises are aided by other competent authorities), but invest in the businesses which are held able to develop positive effects to the society, e.g., health promotion, social problem solutions, utilization of energy and effective utilization of natural resources. Notwithstanding, in order to seek fair rate of return, Sitra is dedicated to making the investment (in various enterprises) by its professional management and technology, products or competitiveness of services, and ranging from EUR300,000 to EUR1,000,000 to acquire 10-30% of the ownership of the enterprises, namely equity investment or convertible funding. Sitra requires its investees to value corporate social responsibility and actively participate in social activities. It usually holds the shares from 4 years to 10 years, during which period it will participate the corporate operation actively (e.g., appointment of directors)[17]. (2) Fund investments For fund investments[18], Sitra invests in more than 50 venture capital funds[19]. It invests in domestic venture capital fund market to promote the development of the market and help starts-up seek funding and create new business models, such as public-private partnerships. It invests in international venture capital funds to enhance the networking and solicit international funding, which may help Finnish enterprises access international trend information and adapt to the international market. (3) Project funding For project funding, Sitra provides the on-site information survey (supply of information and view critical to the program), analysis of business activities (analysis of future challenges and opportunities) and research & drafting of strategies (collection and integration of professional information and talents to help decision making), and commissioning of the program (to test new operating model by commissioning to deal with the challenge from social changes). Notwithstanding, please note that Sitra does not invest in academic study programs, research papers or business R&D programs[20]. (4) DIILI Investment Model Integrated With Investment Absorption A Start-Up usually will not lack technologies (usually, it starts business by virtue of some advanced technology) or foresighted philosophy when it is founded initially, while it often lacks the key to success, the marketing ability. Sitra DIILI is dedicated to providing the professional international marketing service to help starts-up gain profit successfully. Owing to the fact that starts-up are usually founded by R&D personnel or research-oriented technicians, who are not specialized in marketing and usually retains no sufficient fund to employ marketing professionals, DILLI is engaged in providing dedicated marketing talents. Now, it employs about 85 marketing professionals and seeks to become a start-up partner by investing technical services. Notwithstanding, in light of the characteristics of Sitra’s operation and profitability, some people indicate that it is more similar to a developer of an innovation system, rather than a neutral operator. Therefore, it is not unlikely to hinder some work development which might be less profitable (e.g., establishment of platform). Further, Sitra is used to developing some new investment projects or areas and then founding spin-off companies after developing the projects successfully. The way in which it operates seems to be non-compatible with the development of some industries which require permanent support from the public sector. The other issues, such as INTRO lacking transparency and Sitra's control over investment objectives likely to result in adverse choice, all arise from Sitra’s consideration to its own investment opportunities and profit at the same time of mapping. Therefore, some people consider that it should be necessary to move forward toward a more transparent structure or a non-income-oriented funding structure[21] . Given this, the influence of Sitra’s own income over upgrading of the national innovation ability when Sitra boosts starts-up to engage in innovation activities is always a concern remaining disputable in the Finnish innovation system. 3. Boosting of Balance in Regional Development and R&D Activities In order to fulfill the objectives under Lisbon Treaty and to enable EU to become the most competitive region in the world, European Commission claims technical R&D as one of its main policies. Among other things, under the circumstance that the entire R&D competitiveness upgrading policy is always progressing sluggishly, Finland, a country with a population of 5,300,000, accounting for 1.1% of the population of 27 EU member states, was identified as the country with the No. 1 innovation R&D ability in the world by World Economic Forum in 2005. Therefore, the way in which it promotes innovation R&D policies catches the public eyes. Some studies also found that the close relationship between R&D and regional development policies of Finland resulted in the integration of regional policies and innovation policies, which were separated from each other initially, after 1990[22]. Finland has clearly defined the plan to exploit the domestic natural resources and human resources in a balanced and effective manner after World War II. At the very beginning, it expanded the balance of human resources to low-developed regions, in consideration of the geographical politics, but in turn, it achieved national balanced development by meeting the needs for a welfare society and mitigation of the rural-urban divide as time went by. The Finnish innovation policies which may resort to technical policies retroactively initially drove the R&D in the manners including upgrading of education degree, founding of Science and Technology Policy Council and Sitra, establishment of Academy of Finland (1970) and establishment of the technical policy scheme, et al.. Among other things, people saw the role played by Sitra in Finland’s knowledge-intensive society policy again. From 1991 to 1995, the Finnish Government officially included the regional competitiveness into the important policies. The National Industrial Policy for Finland in 1993 adopted the strategy focusing on the development based on competitive strength in the regional industrial communities[23]. Also, some studies indicated that in consideration of Finland’s poor financial and natural resources, its national innovation system should concentrate the resources on the R&D objectives which meet the requirements about scale and essence. Therefore, the “Social Innovation, Social and Economic Energy Re-building Learning Society” program boosted by Sitra as the primary promoter in 2002 defined the social innovation as “the reform and action plan to enhance the regulations of social functions (law and administration), politics and organizational structure”, namely reform of the mentality and cultural ability via social structural changes that results in social economic changes ultimately. Notwithstanding, the productivity innovation activity still relies on the interaction between the enterprises and society. Irrelevant with the Finnish Government’s powerful direction in technical R&D activities, in fact, more than two-thirds (69.1%) of the R&D investment was launched by private enterprises and even one-thirds launched by a single enterprise (i.e., Nokia) in Finland. At the very beginning of 2000, due to the impact of globalization to Finland’s innovation and regional policies, a lot of R&D activities were emigrated to the territories outside Finland[24]. Multiple disadvantageous factors initiated the launch of national resources to R&D again. The most successful example about the integration of regional and innovation policies in Finland is the Centres of Expertise Programme (CEP) boosted by it as of 1990. Until 1994, there have been 22 centres of expertise distributed throughout Finland. The centres were dedicated to integrating local universities, research institutions and enterprise for co-growth. The program to be implemented from 2007 to 2013 planned 21 centres of expertise (13 groups), aiming to promote the corporate sectors’ cooperation and innovation activities. CEP integrated local, regional and national resources and then focused on the businesses designated to be developed[25]. [1] Sitra, http://www.sitra.fi/en (last visited Mar. 10, 2013). [2] Jari Hyvärinen & Anna-Maija Rautiainen, Measuring additionality and systemic impacts of public research and development funding – the case of TEKES, FINLAND, RESEARCH EVALUATION, 16(3), 205, 208 (2007). [3] id. at 206-214. [4] Charles Edquist, Tterttu Luukkonen & Markku Sotarauta, Broad-Based Innovation Policy, in EVALUATION OF THE FINNISH NATIONAL INNOVATION SYSTEM – FULL REPORT 11, 25 (Reinhilde Veugelers st al. eds., 2009). [5] id. [6] id. [7] Finnvera is a company specialized in funding Start-Ups, and its business lines include loaning, guarantee, venture capital investment and export credit guarantee, etc. It is a state-run enterprise and Export Credit Agency (ECA) in Finland. Finnvera, http://annualreport2012.finnvera.fi/en/about-finnvera/finnvera-in-brief/ (last visited Mar. 10, 2013). [8] Markku Maula, Gordon Murray & Mikko Jääskeläinen, MINISTRY OF TRADE AND INDUSTRY, Public Financing of Young Innovation Companies in Finland 32 (2006). [9] id. at 33. [10] id. at 41. [11] Sitra, http://www.sitra.fi/en (last visited Mar. 10, 2013). [12] Sitra, http://www.sitra.fi/en (last visited Mar. 10, 2013). [13] The other two were engaged in boosting the regional R&D center and industrial-academy cooperative center programs. Please see Gabriela von Blankenfeld-Enkvist, Malin Brännback, Riitta Söderlund & Marin Petrov, ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT [OECD],OECD Case Study on Innovation: The Finnish Biotechnology Innovation System 15 (2004). [14] id. at20. [15] DIILI service provides sales expertise for SMEs, Sitra, http://www.sitra.fi/en/articles/2005/diili-service-provides-sales-expertise-smes-0 (last visited Mar. 10, 2013). [16] Maula, Murray & Jääskeläinen, supra note 8 at 41-42. [17] Corporate investments, Sitra, http://www.sitra.fi/en/corporate-investments (last visited Mar. 10, 2013). [18] Fund investments, Sitra, http://www.sitra.fi/en/fund-investments (last visited Mar. 10, 2013). [19] The venture capital funds referred to herein mean the pooled investment made by the owners of venture capital, while whether it exists in the form of fund or others is not discussed herein. [20] Project funding, Sitra, http://www.sitra.fi/en/project-funding (last visited Mar. 10, 2013). [21] Maula, Murray & Jääskeläinen, supra note 8 at 42. [22] Jussi S. Jauhiainen, Regional and Innovation Policies in Finland – Towards Convergence and/or Mismatch? REGIONAL STUDIES, 42(7), 1031, 1032-1033 (2008). [23] id. at 1036. [24] id. at 1038. [25] id. at 1038-1039.

Executive Yuan roll-out The Policy of “The Free Economic Pilot Zones”Executive Yuan roll-out The Policy of “The Free Economic Pilot Zones”1.Executive Yuan approved a Bill titled “The Free Economic Pilot Zones Special Act”The “Free Economic Demonstration Zones” (hereinafter as FEDZs) is a critical part to improve the liberalization and internationalization of the economy of Republic of China (R.O.C). By deregulation, FEDZs was conceived as trial zones. Once the results of the program were promising, it would be expanded to the entire country. In order to engage in the regional economic and trade integration, the Executive Yuan approved a Bill titled “The Free Economic Pilot Zones Special Act” (hereinafter as Bill) on April 26th, 2013.On Mar 6th, 2014, the Joint Economic, Internal Administration , and Finance Committee of the Legislation Yuan (the Congress) discussed the Bill for reports and questions. By the end of the March, 2014, the Congress will hold five public hearings. Not until the discussion of the Bill item by item and the passage in the Congress, the second stage of the FEDZ program would not be initiated. There are five main points, including the treatments on foreigners and people from mainland China, tax incentives for Taiwanese businessman, foreign professionals and foreign companies, regulations on untaxed goods and labor, regulations on industrial development, such as the agriculture and the medical, and certain new items on education and professional services.For the reason that the government considered the need of human resources to sustain the operation of the industries, the Executive Yuan is trying to promote innovative education in FEPZs. Since the education requirements for both of public and private universities are unified in local, colleges and universities were restrained and missed some great opportunities to discover their own niches in education. Hence, innovative education in FEPZs is trying to help higher education system to introduce foreign education resources and foresight concepts, and to attract more international students. The innovative educational projects within FEPZs will also facilitate the cooperations among domestic and foreign universities, and set up experimental branch campuses, colleges, degree programs or professional courses. Besides, the financial service sector is also included. Since FEDZs is an important pusher for R.O.C to move forward in regional economic integration, accordingly, the most significant liberate item for the financial industry in the FEPZs is to allow offshore banking units and offshore security units to provide financial products and service (e.g. OSU and OBU). Meanwhile, the financial industry is predicted to receive an NTD$140 billion or more in revenues over the next five year.In summary, FEPZs is regarded as a engine propelling liberalization and internationalization. To gain the international competitiveness, the government will continue to promote policies and measures. By establishing the free economic demonstration zone, it is expected to create innovative effects into the education system and to create more job opportunities.2.Legislation Yuan has reviewd “The Free Ecomonic Pilot Zones Special Act”The Republic of China (R.O.C) have been carried out “free economic” recent years, by promoting “Free Economic Pilot Zone” (hereinafter as FEPZs) to encourage every industrial and foreign investment. Besides, FEPZs will not only keep talents and technologies in R.O.C but also liberalize and internationalize our economic.The Executive Yuan had approved a Bill titled “The Free Economic Pilot Zones Special Act” (hereinafter as the Bill) on Dec. 26th, 2013. At the end of May, the Joint Economic, Internal Administration, and Finance Committee of the Legislation Yuan (the Congress) have taken five public hearings for the Bill, and amended the Bill according to the advices proposed by specialists. Not until the deliberation of the Bill item by item and its passage in the Congress, the second stage of the FEDZ program would not be initiated. There are five main points, including the treatments on foreigners, tax incentives for R.O.C businessman, foreign professionals and foreign companies, regulations on untaxed goods and labor, regulations on industrial development, such as the agriculture and the medical service, and certain new items on education and professional services.The government considers that there have to be enough human resource to sustain the opened industries, so Executive Yuan is trying to promote innovative education in FEPZs. The core concept of FEPZs is foresight, liberalization and internationalization, the premier said, and the higher education systems belong to high-end service and have much more marketability and variability compared to other education systems. Through innovative and efficient way to manage the school could let University being much more liberalized. Furthermore, the higher education systems in R.O.C. have to connect with international education to avoid being marginalized. Our first stage of education innovation will promote to set up “degree programs” and “professional courses”. The first phase for the Ministry of Education is going to found “degree programs” or “professional courses” through collaboration way. The Ministry of Education will also draw up related regulations or guidance on standards for school cooperation, co-regulation, setup conditions, supervision, enrolling new student, and recruiting staff.? Once the Bills pass, The Ministry of Education plans to establish “branch school” and “independence campus” helping R.O.C. higher education goes internationalized.On the other hand, Our medical service also has strong international competitiveness. R.O.C is engage in developing international medical and health industry. The premier said, the Ministry of Health and Welfare have proposed some measures, such as limitation to the number of medical centre, medical personnel working hours, and NHI is not allow to use in the zones.The premier added, on the extemporaneous sittings, “The Free Economic Pilot Zones Special Act” will be the priority bills and be deliberated in the end of June By establishing the free economic demonstration zone, it is expected to propel R.O.C take part in Trans-Pacific Partnership (TPP) and the Regional Comprehensive Economic Partnership (RCEP).3.Executive Yuan’s rapid roll-out of “The Free Economic Pilot Zones”, and has published a report concerning the legal and economic implications of its the BillThe “Free Economic Pilot Zones” (hereinafter as FEPZs) plays a pivotal role in promoting market liberalization, especially at an international level. Premier of the Executive Yuan, Mr. Jiang Yi-Hua has stated that the “market economy” and “innovation economy” allows for tremendous economic prosperity to be embraced by the Republic of China (hereinafter as R.O.C). The seizing of such opportunity has been the goal of government efforts, which can be attested by the recent proposal of the “The Free Economic Pilot Zones Special Act” (hereinafter as the Bill), currently undergoing review and consultation proceedings. The Premier further stressed that the national economy should not be left excluded from international commerce, on the other hand, it is imperative that closer economic bonds with other nations are forged, therefore allowing itself open up to wider scope of opportunities for growth. The key in rendering this possible is through the enactment of laws. At a time, when Trans-Pacific nations, including the United States of America, Japan and countries from Southeast Asia, are working towards regional economic cooperation, if R.O.C. is to be left out, it is feared that its position in the global market would further be marginalized.The core innovative strengths of the FEPZs include “Smart Logistics”, “International healthcare services”, “Value added agriculture”, “Financial Services”, “Education Innovation”, all of which are implemented by employing R.O.C.’s finest workforce, knowledge, information and communications technology (ICT), geographical position and cross-strait relationship advantages, leading way for an advantageous basis for pioneering economic development. The first stage of development will be based on 6 locations proximal to the sea (including Keelung Port, Taipei Port, Kaohsiung Port, Suao Harbor, Anping Port, Taichung Port) and Taoyuan Aerotropolis and Pingtung Agricultural Biotech Park. The second stage of development would only commence after the Bill have been approved by the legislative Yuan, which would attract much capital investment, hence boosting high employment rates. Presently, besides the aforementioned regions opened up for the FEPZs, other cities and industrial sites (including those from offshore islands), are striving to gain membership of the FEPZs, or applying for empirical research of the FEPZs.The Executive Yuan has published a report concerning the legal and economic implications of its the Bill on May 2014. The report largely consists of assessments made by varying governing bodies, such as Ministry of Home Affairs, Financial Supervisory Commission etc., on the implications of the draft concerning real estate, employment, fiscal income, logistics, conditions for medical care, agriculture, higher education, social environment and social wealth redistribution etc.Furthermore, international attention has been closely centered on the progress of FEPZs. During the “The third review of the trade policies and practices of Chinese Taipei” after R.O.C accession to the World Trade Organization (WTO) held on the 17th of September 2014 in Geneva, each member state has demonstrated expectations arising out of the direction and planning undertaken for the FEPZs. National economic and international commercial reforms are under way and have seen much progress in further promoting the overall strength of the economic system, in an effort to respond to the rapid global political and economic developments, for example, through the signing of Economic Cooperation Framework Agreement (ECFA), and the implementation of FEPZs policies. In the future, it will be expected that R.O.C. will strive for a more integral international commercial system, allowing much capital investment inflows as well as the cultivating of high-caliber human resources.To promote more liberal and internationalized development of Taiwan economy, government of Republic of China (R.O.C) approved the “Free Economic Pilot Zone (FEPZ) Plan,” which the Bill is currently censored in Legislation Yuan and the measures would be implemented in two phases. The first phase of FEPZs would be initiated within six free trade ports, Taoyuan airport free trade zone, and Pingtung Agricultural Biotechnology Park; other industries that match up with the idea of liberalization, internationalization and foresight can all be incorporated into FEPZ through continuing examination under Execution Yuan. After this special legislation is passed, the set-ups of demonstration zones can be applied by authorities either of central or of local government and the related promotion works of the second phase will be unfolded immediately.Heading to the target of becoming Kin-Xiao (Kinmen and Xiaomen) Free Trade Zone, Kinmen government planned to apply to be one of the FEPZs and thus cooperated with Taiwan Institute of Economic Research (TIER) on December 11, for a commissioned research (which was later released on the conference of accelerating Kin-Xia FTZ on December 19) on evaluating if Kinmen is qualified for an application of FEPZs. Kinmen’s critical location and the featured industries have composed a perfect environment complying with the ideas such as value-added agriculture, international healthcare and innovative education for FEPZ. For instance, the white liquor industry in Kinmen represents the international management and promotion of agricultural products, and is the best example for value-added agriculture. “Long-term Healthcare Village in Kinmen,” which is currently developing in Kinmen, would also be a drive for international healthcare industry. Based on the Taiwan-featured culture, “International Education City” could be developed with a liberal and innovative atmosphere, which would attract famous schools in world to set up their branch school in Kinmen. Above all, Kinmen County vice Mayor, Wu Yo-Chin, indicated that Kinmen would be the first choice for FEPZ and would hold the key to open a new gate for the Cross-Strait. The vice Mayor emphasized that Kinmen government has well budgeting and financial management, which needn’t the extra aids from central government, yet Kinmen was excluded in the first phase of FEPZs. Although Kinmen would apply to be a FEPZ in the second phase after the special legislation passed, Kinmen still strived for taking part in the first phase of FEPZs due to the uncertain schedule for implementation of regulations on FEPZs.National Development Council (NDC), however, gave an opinion on issue of Kinmen applying to be in the first phase of FEPZs, which declared again the original plan for the first phase only included six free trade ports, Taoyuan airport free trade zone, and Pingtung Agricultural Biotechnology Park. NDC also suggested Kinmen could still follow after the first phase and apply to be a FEPZ in the second phase.

Taiwan Announced the Biobanks Regulations and Management PracticesTaiwan Has Passed “Statute of Human Biobank Management” to Maintain Privacy and Improve Medicine Industries Due to lack of regulations, divergent opinions abounded about the establishment of Biobanks and collection of human biological specimen. For example, a researcher in an academic research organization and a hospital-based physician collected biospecimens from native Taiwanese. Although they insisted that the collections were for research only, human rights groups, ethics researchers, and groups for natives´ benefits condemned the collections as an invasion of human rights. Consequently, the Taiwanese government recognized the need for Biobanks regulation. To investigate the relationship between disease and multiple factors and to proceed with possible prevention, The Legislative Yuan Social Welfare and Healthy Environment Committee has passed "the draft statute of human biobank management" through primary reviewing process on December 30, 2009 and subsequently passed through entire three-reading procedure on January 7, 2010. Therefore, the medical and research institute not only can set up optimal gene database for particular disease curing, but also can collect blood sample for database establishment, legally. However, the use of sample collections will be excluded from the use of judiciary purpose. In the light of to establish large scale biobank is going to face the fundamental human right issue, from the viewpoint of biobank management, it is essential not only to set up the strict ethics regulation for operational standard, but also to make the legal environment more complete. For instance, the Department of Health, Executive Yuan had committed the earlier planning of Taiwan biobank establishment to the Academic Sinica in 2006, and planned to collect bio-specimen by recruiting volunteers. However, it has been criticized by all circles that it might be considered violating the Constitution article 8 provision 1 front paragraph, and article 22 rules; moreover, it might also infringe the personal liberty or body information privacy. Therefore, the Executive Yuan has passed the draft statute of human biobank management which was drafted and reviewed by Department of Health during the 3152nd meeting, on July 16, 2009, to achieve the goal of protecting our nation’s privacy and promoting the development of medical science by management biomedical research affairs in more effective ways. Currently, the draft statute has been passed through the primary review procedure by the Legislative Yuan. About the draft statute, there are several important points as following: (1) Sample Definition: Types of collected sample include human somatic cell, tissues, body fluids, or other derivatives; (2) Biobank Establishment: It requires not only to be qualified and permitted, but also to set up the ethical reviewing mechanism to strengthen its management and application; (3)Sample Collection and Participant Protection: In accordance with the draft statute, bio-specimen collecting should respect the living ethics during the time and refer to the "Medical Law" article 64 provision 1; before sample collection, all related points of attention should be kept in written form , the participant should be notified accordingly, and samples can only be collected with the participant’s consent. Furthermore, regarding the restrained read right and setting up participants’ sample process way if there were death or lost of their capacity; (4) Biobank Management: The safety regulation, obligation of active notification, free to retreat, data destruction, confidentiality and obligation, and termination of operation handling are stipulated; and (5) Biobank Application: According to the new draft statute, that the biological data can’t be used for other purposes, for example, the use of inquisition result for the "Civil law", article 1063, provision 2, prosecution for denying the parent-child relationship law suit", or according to the "Criminal law", article 213, provision 6. This rule not only protects the participants’ body information and their privacy right, but also clearly defines application limits, as well as to set up the mechanism for inner control and avoid conflict of interests to prevent unnecessary disputes. Finally, the Department of Health noted that, as many medical researches has shown that the occurrence of diseases are mostly co-effected by various factors such as multiple genes and their living environment, rather than one single gene, developed countries have actively devoted to human biological sample collection for their national biobank establishment. The construction and usage of a large-scale human bank may bring up the critical issue such as privacy protection and ethical problems; however, to meet the equilibrium biomedical research promotion and citizen privacy issue will highly depend on the cooperation and trust between the public and private sectors. Taiwan Department of Health Announced the Human Biobanks Information Security Regulation The field of human biobanks will be governed by the Act of Human Biobanks (“Biobanks Act”) after its promulgation on February 3, 2010 in Taiwan. According to Article 13 of the Biobanks Act, a biobank owner should establish its directive rules based on the regulation of information security of biobanks announced by the competent authority. Thus the Department of Health announced the draft of the Human Biobanks Information Security Regulation (“Regulation”) for the due process requirement. According to the Biobanks Act, only the government institutes, medical institutes, academic institutes, and research institutes are competent to establish biobanks (Article 4). In terms of the collecting of organisms, the participants should be informed of the relevant matters by reasonable patterns, and the collecting of organisms may be conducted after obtaining the written consent of the participants (Article 6). The relative information including the organisms and its derivatives are not allowed to be used except for biological and medical research. After all the protection of biobanks relative information above, the most important thing is the safety regulations and directive rules of the database administration lest all the restrictions of biobanks owners and the use be in vain. The draft Regulation aims to strengthen the safety of biobanks database and assure the data, the systems, the equipments, and the web circumstances are safe for the sake of the participants’ rights. The significant aspects of the draft are described as below. At first, the regulation should refer to the ISO27001, ISO27002 and other official rules. Concerning the personnel management, the security assessment is required and the database management personnel and researchers may not serve concurrently. In case some tasks are outsourced, the contractor should be responsible for the information security; the nondisclosure agreement and auditing mechanism are required. The application system should update periodically including the anti-virus and firewall programs. The biobanks database should be separated physically form internet connection, including the prohibition of information transforming by email or any other patterns through internet. The authorizing protocol of access to the biobanks should be established and all log files should be preserved in a period. The system establishment and maintenance should avoid remote control. In case the database system is physically out of the owner’s control, the authorization of the officer in charge is required. If an information security accident occurred, the bionbanks owner should contact the competent authority immediately and inform the participants by adequate tunnel. The biobanks owner should establish annual security auditing program and the project auditing will be conducted subject to the necessity. To sum up, while the biobanks database security regulation is fully established, the biobanks owners will have the sufficient guidance in connection with the biobank information security to comply with in the future.

Review of Taiwan's Existing Regulations on the Access to Bioloical ResourcesThe activities of accessing to Taiwan's biological resources can be governed within certain extent described as follows. 1 、 Certain Biological Resources Controlled by Regulations Taiwan's existing regulation empowers the government to control the access to biological resources within certain areas or specific species. The National Park Law, the Forestry Act, and the Cultural Heritage Preservation Act indicate that the management authority can control the access of animals and plants inside the National Park, the National Park Control Area, the recreational area, the historical monuments, special scenic area, or ecological protection area; forbid the logging of plants and resources within the necessary control area for logging and preserved forestry, or control the biological resources inside the natural preserved area. In terms of the scope of controlled resources, according to the guidance of the Wildlife Conservation Act and the Cultural Heritage Preservation Act, governmental management authority is entitled to forbid the public to access the general and protected wild animals and the plant and biological resources that are classified as natural monuments. To analyse the regulation from another viewpoint, any access to resources in areas and of species other than the listed, such as wild plants or microorganism, is not regulated. Therefore, in terms of scope, Taiwan's management of the access to biological resources has not covered the whole scope. 2 、 Access Permit and Entrance Permit Taiwan's current management of biological resources adopts two kinds of schemes: access permit scheme and entrance permit in specific areas. The permit allows management authority to have the power to grant and reject the collection, hunting, or other activities to access resources by people. This scheme is similar to the international standard. The current management system for the access to biological resources promoted by many countries and international organizations does not usually cover the guidance of entrance in specific areas. This is resulting from that the scope of the regulation about access applies for the whole nation. However, since Taiwan has not developed regulations specifically for the access of bio-research resources, the import/export regulations in the existing Wildlife Conservation Act, National Park Law, Forestry Act, and Cultural Heritage Preservation Act may provide certain help if these regulations be properly connected with the principle of access and benefit sharing model, so that they will help to urge people to share the research interests. 3 、 Special Treatments for Academic Research Purpose and Aborigines Comparing to the access for the purpose of business operation, Taiwan's regulations favour the research and development that contains collection and hunting for the purpose of academic researches. The regulation gives permits to the access to biological resources for the activities with nature of academic researches. For instance, the Wildlife Conservation Act, National Park Law, and theCultural Heritage Preservation Act allow the access of regulated biological resources, if the academic research unit obtains the permit, or simply inform the management authority. In addition, the access by the aborigines is also protected by the Forestry Act, Cultural Heritage Preservation Act, and the Aboriginal Basic Act. The aborigines have the right to freely access to biological resources such as plants, animals and fungi. 4 、 The Application of Prior Informed Consent (PIC) In topics of the access to and benefit sharing of biological resources, the PIC between parties of interests has been the focus of international regulation. Similarly, when Taiwan was establishing theAboriginal Basic Act, this regulation was included to protect the aborigines' rights to be consulted, to agree, to participate and to share the interests. This conforms to the objective of access and benefit sharing system. 5 、 To Research and Propose the Draft of Genetic Resources Act The existing Wildlife Conservation Act, National Park Law, Forestry Act,Cultural Heritage Preservation Act, Aboriginal Basic Act provide the regulation guidance to the management of the access to biological resources within certain scope. Comparing to the international system of access and benefit sharing, Taiwan's regulation covers only part of the international guidance. For instance, Taiwan has no regulation for the management of wild plants and micro-organism, so there is no regulation to confine the access to wild plants and microorganism. To enlarge the scope of management in terms of the access to Taiwan's biological resources, the government authority has authorize the related scholars to prepare the draft of Genetic Resources Act. The aim of the Genetic Resources Act is to establish the guidance of the access of genetic resources and the sharing of interests in order to preserve the genetic resources. The draft regulates that the bio-prospecting activity should be classified into business and academic, with the premise of not interfering the traditional usages. After classification, application of the permit should be conducted via either general or express process. During the permit application, the prospector, the management authority, and the owner of the prospected land should conclude an agreement jointly. In the event that the prospector wishes to apply for intellectual property rights, the prospector should disclose the origin of the genetic resources and provide the legally effective documents of obtaining these resources. In addition, a Biodiversity Fund should be established to manage the profits derived from genetic resources. The import/export of genetic resources should also be regulated. Violators should be fined.

- Impact of Government Organizational Reform to Scientific Research Legal System and Response Thereto (1) – For Example, The Finnish Innovation Fund (“SITRA”)

- The Demand of Intellectual Property Management for Taiwanese Enterprises

- Blockchain in Intellectual Property Protection

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System

- Recent Federal Decisions and Emerging Trends in U.S. Defend Trade Secrets Act Litigation

- The effective and innovative way to use the spectrum: focus on the development of the "interleaved/white space"

- Copyright Ownership for Outputs by Artificial Intelligence

- Impact of Government Organizational Reform to Research Legal System and Response Thereto (2) – Observation of the Swiss Research Innovation System